Welcome to Trading Made Easy. We’ve been helping traders make sense of the markets with powerful, intuitive technology since 2014. Our mission has always been to simplify the trading industry, empowering traders with automated tools that provide discipline, consistency, and a strategic edge. This guide is all about after-hours futures trading—a world that might seem intimidating at first, but is absolutely packed with opportunity.

We'll break down exactly how these markets operate around the clock and show you why understanding them is so critical for any serious modern trader.

Why Trade After The Bell Rings

The classic 9-to-5 stock market hours just don't capture the full picture anymore. Major economic news, political shifts, and global events don't wait for the opening bell in New York. They happen 24/7, sending shockwaves across markets long before most people are even awake.

When you trade futures after hours, you're not just staying up late. You’re giving yourself the ability to react to these global developments the moment they happen. Instead of waking up to a massive price gap that you had no control over, you can actually get ahead of the curve and position yourself strategically.

The Evolution of the 24-Hour Market

The idea of a market that never sleeps really took off with the rise of electronic trading platforms back in the late 1990s. Today, it’s the standard. Futures on major indices and commodities trade nearly 24 hours a day on platforms like the CME Group's Globex system.

Think about it: some S&P 500 futures contracts trade for almost 23 hours a day, running from Sunday evening right through to Friday afternoon U.S. time. This constant activity allows traders to react instantly to news breaking in Asia or Europe while the U.S. is asleep.

It's not a niche activity, either. These after-hours sessions can see a huge chunk of the day's action—sometimes accounting for 30-40% of the total daily volume on certain contracts. This just goes to show how deeply interconnected the global markets have become. You can check out the latest data on trading volumes on the Cboe's website to see for yourself.

A Smarter Approach to After-Hours Futures Trading

Trading in a 24-hour market brings its own set of challenges, mainly dealing with volatility and the need to be constantly watching the charts. This is exactly why we built our automated trading software. Our unique systems are designed to provide:

- Disciplined Execution: Our software removes the emotion from trading. It strictly follows your pre-defined rules for entries, exits, and stop-losses, which is critical for navigating volatile overnight markets without making impulsive mistakes.

- Constant Monitoring: It acts as your tireless trading partner, scanning for opportunities 24/5. You can capitalize on market moves happening in different time zones without having to sacrifice sleep or be chained to your desk.

- Advanced Risk Management: Our platform comes with built-in safety features like automated stop-losses and daily loss limits. These tools protect your capital around the clock, giving you the peace of mind to engage in after-hours trading confidently.

Our goal is simple: to put you on the path to smarter, more controlled trading by turning the risks of a non-stop market into a structured, well-managed plan.

Understanding the 24-Hour Market Cycle

Think of the global financial market like a relay race that never stops. As traders in New York wrap up their day, they pass the baton to Tokyo. Tokyo then hands it off to London, who eventually brings it right back to New York to start all over again. This is the heart of after-hours futures trading—it's a market that truly never sleeps.

This constant, 24/5 cycle is powered by electronic trading platforms, with the CME Globex system being the major player. It links buyers and sellers across continents into one massive, unified marketplace that’s almost always open for business. The result? The market is always digesting new information, no matter the time of day.

The Global News Impact

Here's a critical truth: major market-moving news doesn't stick to a 9-to-5 schedule. An unexpected economic report out of China, a sudden interest rate decision from a European central bank, or geopolitical flare-ups in the Middle East can send prices flying long before the opening bell rings on Wall Street.

For instance, imagine an overnight announcement about new international tariffs. This could cause S&P 500 futures to drop like a rock while most U.S. traders are asleep. If you only trade during regular hours, you'd wake up to a big loss with zero chance to react or protect your position. This is precisely why being able to trade after hours isn't just a perk; for many, it's a strategic necessity for managing risk.

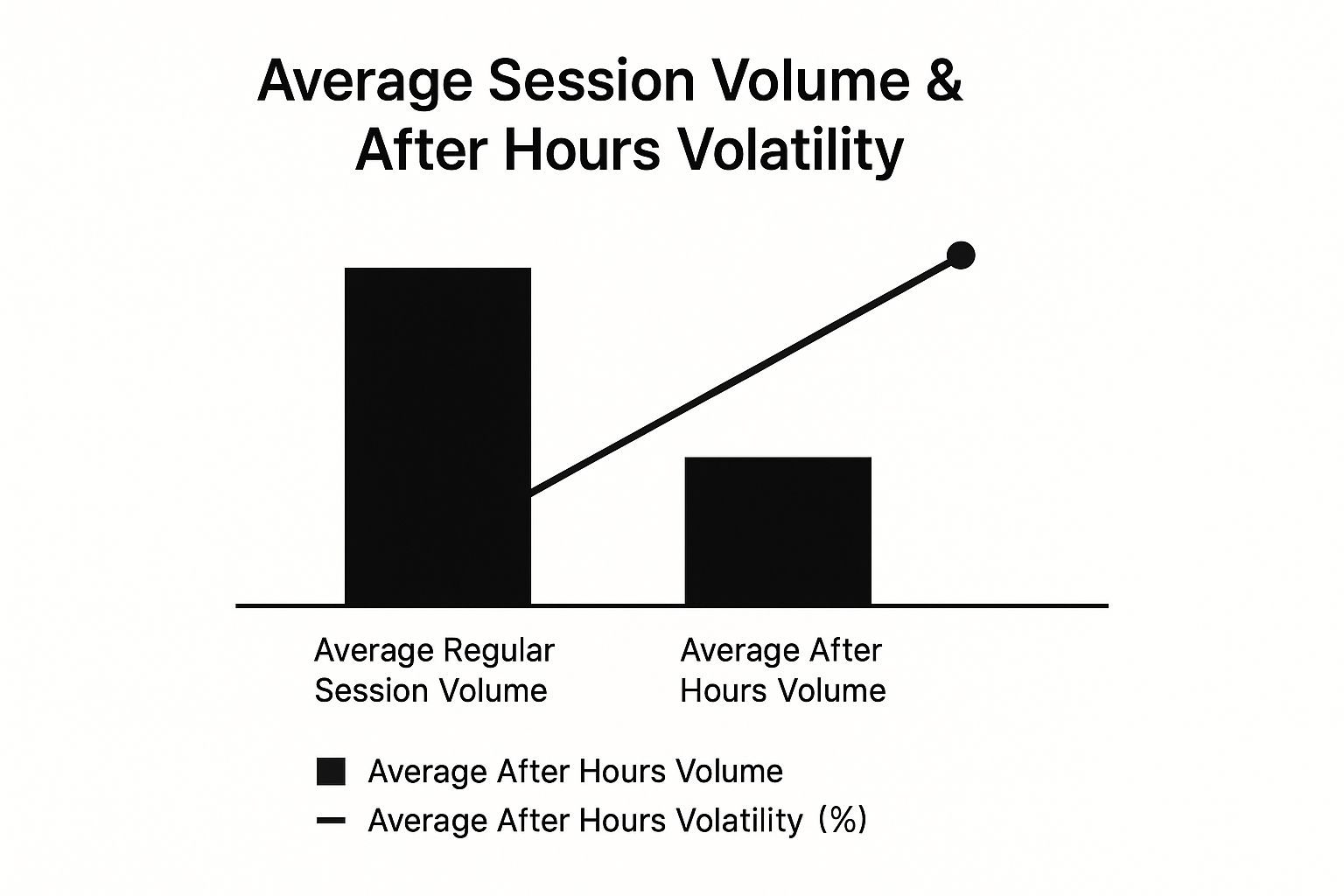

The image below shows you exactly what this looks like, comparing the trading volume and volatility between regular and after-hours sessions.

You can see that even though the trading volume is lower after hours, the volatility can still be significant. It's a clear illustration of how big price moves can happen on a smaller number of trades.

Mapping the Market's Rhythm

Getting a feel for this continuous rhythm is fundamental. It isn't about pulling all-nighters. It's about recognizing how interconnected global events are and how they directly ripple through the assets you trade.

To give you a better sense of how the trading baton gets passed around the world, I've put together a simple table. It shows the near-constant trading activity by translating the major market hours into a single time zone.

Global Futures Market Operating Hours Example

| Market/Region | Typical Trading Session (EST) | Key Contracts Traded |

|---|---|---|

| Asia | 7:00 PM – 4:00 AM | Nikkei 225, Hang Seng |

| Europe | 2:00 AM – 11:00 AM | DAX, FTSE 100, Euro Stoxx 50 |

| North America | 8:00 AM – 5:00 PM | E-mini S&P 500, Nasdaq 100, Crude Oil |

Note: These are generalized hours and can vary based on specific contracts and daylight saving time changes.

Notice the constant overlap in the table. The European session is well underway before the U.S. even wakes up, creating a crucial window where news from that part of the world gets priced into global futures.

By getting involved in after-hours futures trading, you get a much fuller picture of the market. You can react to global news as it happens, hedge your positions against overnight surprises, and spot unique trading opportunities that just don't exist during standard hours. It shifts you from being a passive bystander to an active participant in the global market.

How Automation Transforms Overnight Trading

Let's be honest, the biggest opportunity in overnight trading is also its biggest challenge: you need to sleep. This is where automation stops being a "nice to have" and becomes your most valuable partner for after hours futures trading. It turns what could be a grueling, sleep-deprived marathon into a smart, manageable part of your overall strategy.

With an automated system running, your trading desk is never really closed. Your strategies keep humming along, scanning the markets and executing trades based on the rules you’ve laid out, even while you’re fast asleep. It’s how you can finally jump on major news coming out of Asia or Europe without wrecking your personal life or your health.

Maintaining Discipline When Volatility Spikes

Overnight markets have a reputation for being thin, and that lower liquidity can spark some pretty sharp, sudden price moves. In those moments, emotion is a trader’s worst enemy. It only takes one bad decision, driven by a jolt of fear or a rush of greed, to wipe out your gains or dig a deeper hole.

Automation is the ultimate fix because it brings stone-cold discipline to the table. It just follows your plan—no emotion, no second-guessing. It hits the entry, exit, and stop-loss levels you’ve already decided on.

An automated platform doesn’t get rattled by a sudden price drop or get greedy after a quick win. It simply executes the logic you gave it, which is absolutely vital for surviving the wild swings of after-hours sessions.

That kind of mechanical consistency is a total game-changer. It smooths out the emotional rollercoaster that so often throws manual traders off their game during these low-liquidity periods.

Advanced Risk Management Around the Clock

Maybe the single most important thing automation does is manage your risk when you can't be there. If you're trading manually overnight, part of your brain is always worrying about your open positions. What happens if some surprise headline sends the market screaming in the wrong direction?

Automated systems like Trading Made Easy have sophisticated risk protocols baked right in, acting like your own personal risk manager 24/7. These aren't just bells and whistles; they're your safety net.

- Automated Stop-Loss Orders: The second a trade is opened, a stop-loss is placed right alongside it, shielding your capital from a sudden reversal.

- Trailing Stops: This is a fantastic tool for locking in profits. As a trade moves your way, the stop automatically moves with it.

- Daily Loss Limits: This feature is your circuit breaker. It prevents a bad day from turning into a disaster by automatically shutting down trading if you hit a preset loss limit.

These features give you the confidence and peace of mind to actually engage in after hours futures trading without constantly looking over your shoulder. If you want to get into the nuts and bolts of setting this up, you can dig deeper in our guide on building an automated trading system.

Actionable Strategies for After Hours Trading

Alright, so you’ve got a handle on how the market works around the clock and the tools you need. Now for the fun part: putting that knowledge to work with real, actionable strategies designed for the unique landscape of after hours futures trading.

The after-hours session is its own beast. Lower liquidity and the potential for sudden, sharp moves mean you can’t just use the same playbook you would during the day. Certain approaches just work better here.

These aren't just abstract ideas, either. We’re talking about tangible game plans you can program directly into an automated system like Trading Made Easy. This helps you execute a logical, systematic strategy that hunts for real opportunities instead of just chasing random market noise.

Trading News-Driven Breakouts

A classic after-hours play is trading breakouts that happen right after major economic news drops in Europe or Asia. Think about it: a surprise interest rate decision from a major central bank or a hot inflation report can send related futures—like currencies or stock indices—screaming in one direction.

The entire goal is to ride that initial wave of momentum. Because these events unfold outside of regular U.S. trading hours, the market’s first reaction can be incredibly powerful as everyone rushes to reprice assets based on the new reality.

Here’s a practical look at how it might play out:

- Step 1: Pinpoint the Event. You see the European Central Bank (ECB) has a policy announcement scheduled for 3:00 AM EST. This is a red-alert event for anything tied to the Euro.

- Step 2: Set Your Boundaries. Using a platform like Trading Made Easy, you can draw a virtual box—a pre-set range—around the current price right before the news hits.

- Step 3: Define the Breakout. You then tell the system: if the price smashes through the top of that box, go long. If it crashes below the bottom, go short. Simple as that.

- Step 4: Let Automation Do the Work. At 3:00 AM EST, the ECB news comes out hotter than anyone expected. Euro futures rocket upward. Your system sees the breakout and fires off a long trade instantly, far faster than any human could click a mouse.

This approach turns a scheduled event into a crystal-clear trading signal, using automation to pounce on the volatility the second it appears.

Mean Reversion in Quieter Times

On the flip side, we have the mean-reversion strategy. This one shines during the lulls of after hours futures trading when there isn't a big news story pushing things around. In these low-volume environments, prices have a funny habit of drifting away from their recent average (the "mean") only to snap right back to it.

I like to think of it as a rubber band. The further you stretch it from its center without a good reason, the more likely it is to snap back.

This strategy is all about capitalizing on the market's tendency to overreact on low volume. It finds those temporary, statistically-driven price stretches and bets on a return to normal—a pattern that plays out all the time in less liquid sessions.

To put this into action with Trading Made Easy, you'd set up rules that spot when an asset has moved a certain statistical distance from its recent average price. Once the price hits that pre-defined threshold, the system can automatically place a trade in the opposite direction, positioning you for the snap-back. It's a surprisingly effective way to find solid opportunities even when the market looks like it's just wandering aimlessly.

Real Stories of After Hours Success

It’s one thing to talk about strategies, but what really matters is seeing how automation helps real traders succeed. At Trading Made Easy, we've had a front-row seat to watch our software completely change the game for people navigating the tricky world of after hours futures trading.

For example, a West Coast trader named Mark was constantly missing out on market-moving news from Europe because it happened while he was asleep. By implementing our software, he was able to automate his breakout strategy on EUR/USD futures. Now, his system automatically executes trades around scheduled ECB press conferences, allowing him to capitalize on powerful moves without sacrificing his sleep.

Another trader, Sarah, struggled with the emotional discipline required for overnight trading. The low liquidity and sharp price spikes often led her to make impulsive decisions. By using Trading Made Easy, she took the emotion out of the equation.

"The overnight market was my biggest weakness. My emotions would get the best of me every time there was a sudden spike. Automation took me out of the equation and forced the discipline I was missing."

Sarah now runs a successful mean-reversion strategy that the software executes with precision. These stories highlight how our software provides a tangible solution, helping traders overcome common hurdles like time zone differences and emotional decision-making to achieve greater consistency and peace of mind.

Your Path to Smarter 24-Hour Trading

Diving into after-hours futures trading opens up a world of opportunity, but succeeding in this 24-hour environment requires the right game plan and the right tools. We've walked through how the market operates around the clock, laid out specific strategies, and highlighted why automation is the key to unlocking its full potential. Your journey to becoming a sharper, more confident trader starts with discipline and the right technology.

Since 2014, Trading Made Easy has been dedicated to giving traders exactly that. Our mission is to simplify complex markets by providing automated solutions that execute trades with precision and manage risk around the clock. We’ve seen firsthand that when you remove emotion and add the power of automation, any trader can learn to master the after-hours game.

The core features of Trading Made Easy—disciplined execution, 24/5 monitoring, and robust risk management—are what transform the challenges of the non-stop market into tangible opportunities for success.

We invite you to take the next step. If you're ready to get a handle on the global market and trade with more confidence, explore our automated trading services to see how our platform can help you achieve your goals.

A Few Lingering Questions About After-Hours Futures

Even after you've got a handle on the basics, stepping into the after-hours futures arena can feel a bit different. Let’s tackle some of the most common questions and clear up any confusion you might have about trading when most of the world is asleep.

Is After-Hours Futures Trading Safe for Beginners?

The short answer is: it can be, but you have to be smart about it. After-hours futures trading isn't some exclusive club for seasoned pros, but it's not the shallow end of the pool, either.

The environment is just plain different. Lower liquidity and a tendency for sharper price swings can turn a small mistake into a big one, fast. For anyone new to this, risk management isn't just a good idea—it's everything.

My advice? Start incredibly small. Get your feet wet on a trading simulator until you feel comfortable. An automated tool can be a massive help here, too, because it takes the emotion out of it and sticks to your risk rules, which is often the biggest hurdle for newcomers.

What Are the Biggest Risks of Trading Futures Overnight?

It really boils down to two things: thin liquidity and high volatility.

When fewer people are trading, the gap between the buy price (bid) and sell price (ask) gets wider. Think of it as a higher built-in cost for every trade. This also leads to "slippage," where the price you get is different—and often worse—than the price you clicked.

Then there’s the volatility. A surprise news event overnight can send prices flying on very little volume. We’ve seen it happen time and again with things like unexpected tariff announcements. You also face "gap risk"—the market could open the next morning at a completely different price than where it closed overnight, leaving you with a major loss right from the bell.

How Does Automated Software Specifically Help With After-Hours Trading?

This is where automation really shines. For starters, it lets your strategy work for you 24/5 without you needing to lose sleep glued to a screen. You set the rules, and the software executes them perfectly, day or night.

Second, and this is huge, it acts as your emotion-free trading partner. An automated system doesn't panic when a sudden news headline causes a price spike. It just follows the plan you laid out, which is the key to consistent results.

Finally, it can process information from multiple markets and indicators faster than any human possibly could. In a low-liquidity environment where prices can move in the blink of an eye, that speed is a serious edge. Making sure the system uses the right order for the job is crucial, too. For a deeper dive, check out our guide on market orders vs. limit orders.

At Trading Made Easy, we build the tools that give you the confidence to navigate the 24-hour market. Take a look at our patented, AI-driven platform and see how our tech can help you hit your trading goals. Learn more at Trading Made Easy.

Leave a Reply