Picking the best day trading platform is probably the single most important decision you'll make. It’s not just about charts and buy buttons; it’s about your execution speed, your ability to act on a strategy, and ultimately, your profitability. Since 2014, Trading Made Easy has been dedicated to a single mission: to cut through the market noise and equip traders with technology that delivers a real, tangible edge. This guide isn't another generic feature comparison. It’s a real-world breakdown of what matters, helping you find a platform that fits your style, whether you're scalping for tiny profits or setting up longer swing trades.

Key Features of Our Automated Day Trading Software

Your platform is either your greatest asset or your biggest handicap. Our focus is on giving you a tangible advantage with automated day trading software designed to execute your strategies with mechanical precision. By letting the system run your pre-programmed rules, it can execute trades up to 1,000 times faster than you ever could by hand. More importantly, it takes emotional guesswork out of the equation—which is where most traders go wrong. We built advanced risk management right into the software to protect your capital and enforce the discipline needed for long-term success.

Success Stories: Real Results from Our Traders

We built advanced risk-management right into the software to protect your capital. Take John Carter, a retired Green Beret who came to us after getting burned out by the stress of manual trading. Once he switched to our automated system, he started hitting a consistent success rate of up to 95%. He could finally trade with confidence without being chained to his monitor.

Another one of our traders, a busy professional, uses the platform to run her strategy perfectly while she's at her day job. That’s something you just can’t do when you're clicking the mouse yourself. If you want to dig deeper into what makes a platform tick, check out our guide on understanding trading platforms.

The right platform doesn't just give you tools; it forces you to be disciplined. Automation is how you remove emotion and execute your plan with mechanical precision, day in and day out.

At the end of the day, the best platform lets you trade smarter, not harder. As we compare the top options out there, you'll see how our automated approach gives traders a serious advantage by executing with a level of precision that’s simply not possible manually.

When you're picking day trading software, you need to cut through the marketing noise and look at the features that actually make a difference in your P&L. A platform’s real worth is measured by how it helps you trade faster, more accurately, and with unshakable discipline. The best software does this with a powerful mix of proprietary algorithms, smart risk management tools, and solid automation.

Think of these algorithms as the engine under the hood. They churn through massive amounts of market data—price, volume, volatility—at a speed no human could ever match. By crunching these numbers in real-time, they spot high-probability setups based on the strategies you define, moving you from simply reacting to the market to proactively trading with a data-backed edge.

The Power of Algorithmic Precision

The whole point of an algorithm is to execute your trading plan flawlessly, without hesitation. A human trader might get shaky and second-guess an entry, but an automated system is purely mechanical. It acts with total consistency, so you never miss a good setup because of a moment's doubt. In markets that move in a blink, those few seconds can be the difference between a winning trade and a losing one.

For instance, our software here at Trading Made Easy can place a trade up to 1,000 times faster than you can click a mouse. This isn't just for scalpers chasing tiny moves; that speed helps every trader get the best possible price, which means less slippage and more profit in your pocket.

Advanced Risk Management Tools

Let's be blunt: without solid risk management, you won't survive as a trader. It’s that simple. The best day trading platforms build in automated tools designed to protect your capital and keep you disciplined, even when you step away from the screen. These aren't just nice-to-haves; they're essential.

Look for these key risk management features:

- Automated Stop-Loss Orders: These are your safety net. They automatically close a losing trade at a price you set beforehand, protecting you from a sudden market crash.

- Take-Profit Orders: This tool locks in your winnings by closing a trade once it hits your profit target. It's the perfect antidote to greed.

- Daily Loss Limits: This is a huge one. It shuts down your trading for the day if you hit a certain loss amount, stopping you from spiraling into "revenge trading."

Automation enforces the trading rules you know you should follow but might emotionally override in the heat of the moment. It is your built-in discipline partner.

In the United States, 2025 data shows a few regulated platforms really stand out for active traders. They offer broad market access and the compliance needed to protect investors while delivering top-tier performance. For example, Interactive Brokers requires no minimum deposit and gives you access to everything from stocks and options to futures and forex. They offer leverage up to 1:50 and have a powerful suite of tools, including their Trader Workstation (TWS). To get a better sense of the options out there, you can see how different platforms stack up by checking out the latest analysis of leading US brokers at DayTrading.com.

How Automation Empowers Traders

At the end of the day, it's the fusion of algorithms and automated risk management that separates the good platforms from the great ones. Automation isn't here to replace you; it's here to help you perform at your best. It takes emotion—like the fear and greed that cause most trading mistakes—out of the equation entirely. By forcing you to stick to your proven strategy, the software ensures you apply it consistently, day in and day out.

This level of consistency also frees you up. You can capture opportunities in markets around the globe without being chained to your desk. Whether you're just starting or have been trading for years, having the right tools to apply your knowledge is what counts. You can get a better handle on the fundamentals by reading our guide on these foundational day trading strategies for beginners.

Comparing the Leading Day Trading Platforms

https://www.youtube.com/embed/OCwwo_VgRUU

Choosing the right day trading platform isn't about finding a single "best" option. It's really about matching the software to your specific trading style and what you need it to do.

Think about it: the demands of a high-frequency scalper are worlds apart from a methodical swing trader who might hold a position for a few hours. To really figure out which platform will work for you, we need to get into the weeds—execution speed, charting tools, and how the commissions are structured. That’s where you see which platforms genuinely shine.

Instead of just listing features, let’s break down the leading platforms by looking at how they perform in real-world trading scenarios. This way, you can see which software will be a powerful ally for your strategy and which might just get in your way.

The Scalper’s Need for Speed

For a scalper, every single millisecond is money. This style of trading means you're jumping in and out of dozens, sometimes hundreds, of trades a day, trying to catch tiny price moves. To make that work, you absolutely need two things: ultra-low latency and minimal transaction costs. Commissions, even small ones, can chew through your profits in a hurry.

A platform built for scalping has to offer direct market access (DMA) and lightning-fast order execution. A delay of even a few hundred milliseconds can cause significant slippage, which can instantly flip a winning trade into a losing one. That’s why platforms that live and breathe futures, like NinjaTrader or Tradovate, are usually the top picks here. Their entire infrastructure is optimized for raw speed.

Imagine a scalper trading the E-mini S&P 500 futures. They’d need a platform that not only gives them Level II data to see market depth but also lets them place orders with a single click right from the chart or the DOM (Depth of Market). This kind of trader would gravitate toward a platform where commissions go down as their trading volume goes up, making that high-frequency activity sustainable.

A scalper’s success is a direct function of their platform's speed and cost-efficiency. Anything less than near-instantaneous execution and rock-bottom commissions is a non-starter.

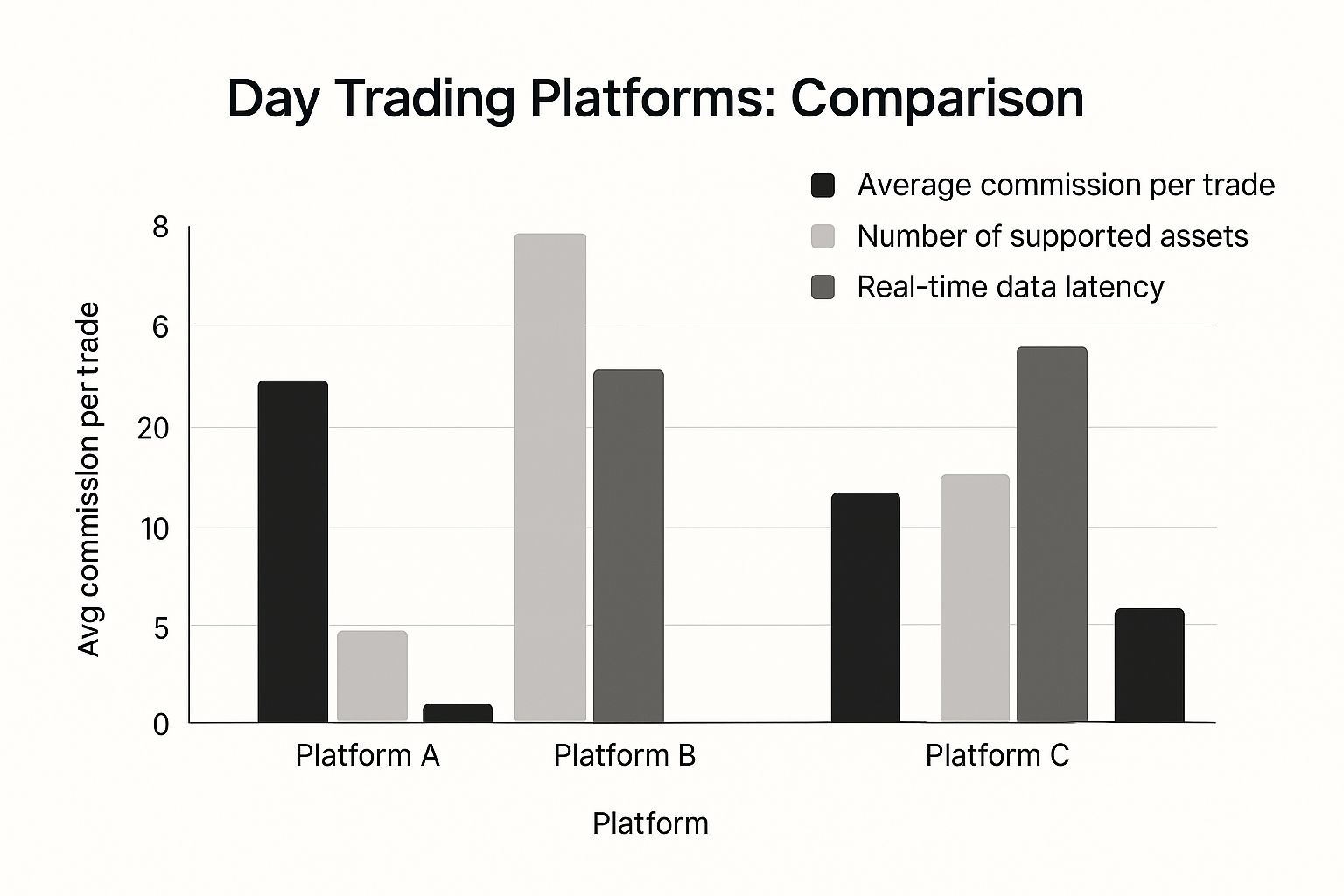

This chart breaks down a side-by-side comparison of three platforms, looking at average commission per trade, the number of supported assets, and real-time data latency.

As you can see, there are clear trade-offs. Some platforms give you lower costs but sacrifice a bit of speed, while others deliver top-tier performance for a higher commission. It hammers home the point that you have to align a platform’s strengths with your own trading strategy.

The Swing Trader’s Analytical Arsenal

On the flip side, a swing trader holding positions overnight or for a few days has a completely different set of priorities. Execution speed is still nice to have, but it’s nowhere near as critical as the platform’s analytical and charting tools. These traders are all about deep technical analysis, trying to identify trends and patterns over longer periods.

One of the most well-known and versatile platforms for this in 2025 is TradingView. It's famous for its incredible charting and analysis tools that work across stocks, crypto, and forex. It's packed with a massive library of technical indicators and drawing tools that work for both new traders and seasoned pros. TradingView also has a huge social community, giving traders a place to share ideas and strategies. You can check out more insights on 2025's best platforms on MindMathMoney.com.

A swing trader is going to be looking for a platform that delivers:

- Advanced Charting: The ability to stack dozens of indicators, use custom drawing tools, and have multiple chart layouts open at once is essential.

- Powerful Scanners: They need tools that can scan the entire market for stocks or assets that meet very specific technical criteria, like breaking above a 50-day moving average on high volume.

- Backtesting Engines: This is a big one. The ability to test a trading strategy against historical data is key to validating its potential before risking a single dollar of real capital.

For instance, a swing trader who focuses on tech stocks might use a platform like TD Ameritrade's thinkorswim. They could spend hours poring over charts, running scans for bullish setups after the market closes, and setting complex conditional orders that only trigger when specific price and volume targets are hit. For them, it's not about raw speed—it's about strategic depth and analytical horsepower. If you're interested in making moves outside of normal market hours, we have a detailed guide on after-hours futures trading.

Evaluating Costs and Supported Markets

Of course, commission structures and market access are two other massive differentiators. Some platforms, like Webull, have made $0 commission trading on U.S. stocks and ETFs the new standard. This is a huge draw for beginners or traders with smaller accounts because it removes a major cost barrier.

But you have to read the fine print. These platforms often make money through payment for order flow (PFOF), which can sometimes mean you don't get the absolute best execution price compared to a direct-access broker.

For traders wanting to go beyond stocks, the range of supported markets is everything. A platform like Interactive Brokers gives you access to a whole world of assets—stocks, options, futures, forex, and bonds—all from one account. This is perfect for experienced traders who want to run diverse strategies across different asset classes without juggling multiple accounts.

Day Trading Platform Feature Comparison

Here’s a quick table to help you compare some of the top platforms and see how their features line up with different trading needs.

| Platform | Best For | Key Automation Features | Execution Speed | Commissions & Fees | Supported Markets |

|---|---|---|---|---|---|

| NinjaTrader | Active Futures & Forex Traders | Advanced Trade Management (ATM), C# Strategy Builder | Very Fast | Per-Side Commissions, Data Fees | Futures, Options, Forex, Stocks |

| TD Ameritrade | All-Around Traders, Options | thinkScript®, Advanced Order Types, Conditional Orders | Moderate | $0 Stocks/ETFs, Options Fees | Stocks, Options, Futures, Forex, ETFs |

| Interactive Brokers | Professional & Global Traders | API Access, Algos, Portfolio Automation | Very Fast | Low Per-Share or Fixed, Data Fees | Global Stocks, Options, Futures, Forex |

| TradingView | Chartists & Technical Analysts | Pine Script™, Strategy Tester, Alerts | Broker-Dependent | Varies by Integrated Broker | Stocks, Forex, Crypto (via broker) |

| Webull | Beginners & Mobile-First Stock Traders | Basic Conditional Orders, Alerts | Moderate (PFOF) | $0 Stocks/ETFs, Options Fees | Stocks, Options, ETFs, Crypto |

Ultimately, picking the best day trading platform comes down to knowing yourself as a trader. Once you’ve defined your strategy, risk tolerance, and the markets you want to trade, you can judge these platforms on the criteria that will actually impact your bottom line. That way, your software becomes a tool that empowers you, not a hurdle you have to overcome.

How Automation Gives You a Strategic Edge in Trading

Execution speed and fancy analytical tools are important, but the real game-changer in modern trading is automation. It’s where you gain a massive strategic advantage by blending mechanical precision with rock-solid risk management—two things you absolutely need to survive long-term. Automation takes the single biggest enemy of profitability out of the equation: your own emotions.

Since we started Trading Made Easy back in 2014, our mission has been to give traders a system that executes their strategies perfectly, without the emotional baggage that leads to disastrous mistakes. Fear, greed, and second-guessing have blown up more accounts than any bad strategy ever could. An automated system doesn't have those biases. It just follows the data-driven rules you give it, creating a level of consistency that’s nearly impossible to maintain by hand, especially when the market gets choppy.

Proving Your Strategy with Hard Data

Before you even think about putting real money on the line, you need to know if your strategy actually works. This is where backtesting is non-negotiable. The right platform lets you run your trading rules against months or even years of historical market data, spitting out a clear, unbiased report card on its performance.

This process gives you the real story:

- Profitability Metrics: You'll see the strategy's potential net profit, profit factor, and the all-important average win versus average loss.

- Drawdown Analysis: It shows you the biggest dip your account would have taken, which helps you stomach the inevitable losing streaks.

- Win Rate vs. Risk/Reward: Backtesting reveals if your strategy is built on frequent small wins or less common but much larger ones.

By validating your ideas with historical data, you stop guessing and start planning. You can fine-tune your parameters and optimize your rules before a single dollar is at risk—a crucial step most manual traders foolishly skip.

The Power Couple: Automation and Risk Management

Maybe the most powerful thing about automation is how it forces you to be disciplined with risk. A human trader might get tempted to move a stop-loss on a losing trade, praying for a comeback. Or they might hold a winner too long, getting greedy. An automated system will never, ever break your rules.

An automated platform is like having a personal risk manager that enforces the discipline you need to protect your account. It automatically applies rules like maximum daily loss or position sizing, preventing the emotional decisions that wipe traders out.

For example, you can program a platform to enforce a strict 2% risk rule on every single trade. It will automatically calculate the right position size based on your account balance and where your stop is. You can also set a hard "kill switch," like a maximum daily loss of 5%. Hit that number, and the platform shuts down trading for the day. No questions asked. This single feature prevents revenge trading, where a trader digs themselves into a deeper and deeper hole trying to win back losses.

This mechanical enforcement of your risk rules is what keeps you in the game. It ensures no single trade or one bad day can knock you out for good, giving you the resilience you need for a long, profitable trading career. By letting the software handle execution and risk, you’re free to do what you do best: refining your strategies and analyzing the market. That's the synergy that turns a good trader into a great one.

Real-World Results from Our Trading Community

When we launched Trading Made Easy back in 2014, our goal was simple: build an automated trading platform that delivers real, tangible results. The true test of any system isn’t just a list of features, but the actual success of the traders who rely on it day in and day out. Our community is full of people from all walks of life who’ve found the consistency and confidence they were looking for through our software.

The following stories aren't hypotheticals. They show how our automated day trading software solves real-world problems and helps traders with very different goals find a new level of performance and discipline. This is the practical impact of letting a proven system do the heavy lifting.

The Part-Time Trader Juggling a Career

Take Sarah, a project manager with a seriously demanding full-time job. She loved trading but could never find the time during market hours to actually execute her strategy well. Missing the best entry and exit points because she was stuck in a meeting was a constant frustration.

By using our software, Sarah was able to code her specific trading rules directly into the system. The platform took over from there, executing her strategy flawlessly while she focused on her career. Trading went from being a source of stress to a streamlined, secondary income stream—all without her having to be glued to a screen.

Overcoming Emotional Hurdles as a Beginner

Then there's Mark, a new trader who knew the theory but kept getting tripped up by his own emotions. Sound familiar? He’d cut winning trades short out of fear, only to let losers run way too long, hoping for a turnaround. These classic beginner mistakes were eating away at his capital and his confidence.

Mark came to our platform specifically to enforce discipline. By automating his strategy, he took his own emotional interference completely out of the equation. The software mechanically applied his predefined stop-losses and take-profits, giving him the consistency he was missing. This freed him up to focus on refining his strategy instead of fighting his own psychology.

The greatest advantage of automation is its ability to act as your personal discipline coach. It executes your proven strategy with mechanical precision, removing the fear and greed that sabotage most traders.

Scaling Strategies for the Experienced Trader

Finally, let’s look at David, a veteran trader with more than a decade of experience under his belt. He had several profitable strategies but found it impossible to manage them all at once across different markets. He wanted to scale up without sacrificing precision or spending more time at his desk.

Our platform was the solution. David set up several automated strategies to run at the same time, each one tailored to specific market behaviors. This diversification allowed him to capture far more opportunities than he ever could by hand. The system’s ability to execute complex orders with zero hesitation helped him scale his trading volume while keeping tight risk controls across his entire portfolio.

Of course, the cost-effectiveness of a platform is also a key factor. Research from 2025 shows a major shift toward commission-free platforms like Webull and Fidelity, which offer $0 per trade fees on U.S. stocks and ETFs. This trend significantly lowers the barrier to entry for traders, especially those just starting out. You can discover more about how trading costs are changing for day traders at NerdWallet.

Choosing the Right Platform for You

So, what’s the verdict? We’ve laid out the critical factors—speed, cost, tools, and the game-changing power of automation. The truth is, the "best day trading platform" doesn't exist. The right one, however, is the one that fits your strategy and goals like a glove. The right software does more than just feed you data; it builds discipline right into your process.

Since 2014, that’s exactly what we at Trading Made Easy have been obsessed with building. Our automated day trading software was engineered from the ground up to give traders that critical edge. It takes your proven strategies and executes them with mechanical precision, removing the emotional guesswork that sinks so many accounts. We’ve seen it help traders from all backgrounds achieve new levels of consistency.

Your success as a trader boils down to finding a platform that executes your strategy flawlessly. Automation is what connects a solid plan to consistent results.

Now, it’s your turn. We invite you to explore our automated solutions and watch a live demo. See for yourself how the Trading Made Easy platform can be the decisive tool you need to trade with more confidence and precision than ever before.

Frequently Asked Questions

Jumping into the world of day trading platforms is bound to bring up some questions, especially when you're trying to nail down the right fit for your strategy. Let's tackle some of the most common things traders ask so you can move forward with confidence.

What Is a Realistic Amount of Capital to Start Day Trading?

This is a big one, and the answer really depends on what you're trading. For anyone looking to trade U.S. stocks, you can't ignore the Pattern Day Trader (PDT) rule, which requires you to maintain a $25,000 minimum account balance.

However, if you're trading futures or forex, that rule doesn't apply. You can often get started with a much smaller stake. Just remember the golden rule: only trade with capital you can truly afford to lose. Most experienced traders would suggest starting with at least $2,000 to $5,000 in non-stock markets. This gives you enough runway to manage risk properly and survive the learning curve without one or two bad trades wiping you out.

Is Automated Trading Software a Good Choice for Beginners?

Without a doubt. In fact, it might be one of the best tools a beginner can have. Why? Because it forces you to be disciplined from your very first trade. The biggest battle new traders face isn't with the market; it's with their own emotions—like the fear of missing out or the temptation to let a losing trade run.

An automated system strips that emotion out of the equation. It makes you define your strategy with clear-cut rules for when to get in, when to get out, and how much to risk. That process alone builds the kind of solid habits that lead to consistency. We actually designed our platform at Trading Made Easy around this very principle: helping new traders execute a plan with mechanical precision.

Automation acts as your built-in risk manager. It ensures you stick to a proven plan, which is the cornerstone of long-term trading success.

How Do I Pick a Platform That Matches My Trading Style?

The secret is finding a platform whose strengths perfectly align with what your strategy demands. Your needs will change dramatically based on how you trade:

- Scalpers: You live and die by speed. You need a platform with lightning-fast, direct market access and the lowest possible commissions. Platforms built specifically for futures trading are often your best bet.

- News Traders: Your game is all about reacting to volatility. You need a platform that delivers a real-time news feed right to your screen and lets you place complex orders in a split second.

- Swing Traders: You're looking at the bigger picture. Your must-haves are top-tier charting tools, powerful market scanners to find opportunities, and solid backtesting features to validate your ideas over longer timeframes.

Ultimately, the best day trading platform isn't a one-size-fits-all solution. It's the one that gives you the exact tools you need to execute your unique strategy, day in and day out.

At Trading Made Easy, we provide the automated tools and support to help you achieve your trading goals with confidence. Explore how our software can enhance your strategy by visiting Trading Made Easy.

Leave a Reply