In the fast-paced world of day trading, your software is your most crucial asset. The right platform acts as your command center, delivering the speed, data, and analytical tools necessary to capitalize on fleeting market opportunities. A slow, clunky, or feature-poor interface can be the difference between profit and loss. This guide is designed to cut through the marketing clutter and provide a clear, in-depth comparison of the best day trading software available today.

We will dissect the top platforms, from industry giants like thinkorswim and Trader Workstation to specialized tools like NinjaTrader and TradingView. Each review provides a detailed breakdown of features, pricing, and performance, complete with screenshots and direct links to help you make an informed decision.

Since 2014, Trading Made Easy has been a pioneer in the trading industry, driven by a mission to simplify the markets and empower traders through powerful, accessible automation. This comprehensive overview will explore how innovators like them are providing unique solutions. Whether you're a beginner seeking guided tools or a veteran optimizing your workflow, this resource will help you find the software that fits your strategy, budget, and trading style perfectly.

1. Trading Made Easy: Automated Precision Since 2014

Trading Made Easy carves out a distinct niche in the competitive landscape of day trading software by centering its platform on a singular, powerful mission: to democratize trading through sophisticated, AI-driven automation. Launched in 2014, it was engineered to neutralize the two most significant hurdles for traders: emotional decision-making and slow execution speeds. By automating pre-set strategies for futures markets, the platform provides a disciplined, high-speed trading framework that is accessible to both novice and veteran traders, making it a top contender for the best day trading software.

Key Features: How Our Software Benefits Traders

Our automated day trading software is built on unique features designed to give traders a distinct advantage. Its patented automation executes trades up to 1,000 times faster than manual clicking, a critical speed differential that allows traders to capitalize on micro-second price fluctuations that are impossible to catch by hand.

- Patented AI-Driven Automation: Instead of simply placing orders, our AI analyzes market conditions against your strategy parameters to execute with precision. This removes emotional bias and is ideal for traders who want to implement proven strategies without being glued to their screens all day.

- Integrated Risk Management: A key differentiator is the built-in safeguards. Before a trade is even placed, the system ensures your pre-defined risk parameters (like stop-losses and profit targets) are in place, effectively preventing emotion-driven mistakes like holding a losing position for too long.

- Continuous Education & Community: Since its inception, Trading Made Easy has offered free weekly live trading webinars. This provides invaluable real-time market analysis and helps users refine their approach, a feature that many competitors charge a premium for. New users can get up to speed by exploring resources covering day trading strategies for beginners.

Success Stories: Real-World Impact

Our software has empowered traders from diverse backgrounds to achieve their financial goals. For example, a retired professional with no prior trading experience used our system to generate consistent returns, allowing him to supplement his retirement income while spending more time with his family. Another user, a busy working mother, leveraged the platform’s "set-and-forget" automation to participate in the markets without disrupting her demanding schedule, turning a long-held interest into a successful side venture. These stories highlight how our technology helps real people succeed by providing a disciplined, automated, and accessible path to trading.

Website: https://tradingmadeasy.com

2. Interactive Brokers – Trader Workstation (TWS)

Interactive Brokers (IBKR) offers Trader Workstation (TWS), a professional-grade platform that stands as a top contender for the best day trading software due to its institutional-level tools and direct market access. Geared toward serious, active traders, TWS provides sophisticated algorithmic order types and its proprietary IB SmartRouting technology, which seeks the best possible price by scanning competing market centers. This focus on execution quality and speed gives experienced traders a significant competitive edge.

The platform’s main draw is its ultra-low cost structure, particularly the tiered pricing model that rewards high-volume traders with minimal commissions. It also provides unparalleled global reach, allowing users to trade stocks, options, futures, forex, and more across 160 markets from a single account.

However, the immense power of TWS comes at a cost. The user interface has a steep learning curve that can intimidate beginners. Additionally, while the platform is free with an IBKR account, comprehensive real-time market data requires paid monthly subscriptions, which can add up. It is best suited for seasoned professionals who need its advanced features and can navigate its complex environment.

- Best For: Experienced, high-volume, and global multi-asset traders.

- Pricing: IBKR Pro offers tiered or fixed commissions; IBKR Lite offers $0 commissions for U.S. stocks/ETFs. Market data fees are extra.

- Unique Feature: Direct access to an extensive range of international markets and advanced order routing.

3. Charles Schwab – thinkorswim platform suite

The thinkorswim platform suite from Charles Schwab is a powerhouse for day traders, offering an elite set of tools without platform fees, making it one of the best day trading software options available. It is renowned for its sophisticated options analytics, futures trading capabilities, and extensive charting tools that cater to both technical and fundamental analysts. The platform's professional-level features are accessible across desktop, web, and mobile, ensuring traders can monitor markets and manage positions from anywhere.

A key differentiator for thinkorswim is its proprietary scripting language, thinkScript, which allows traders to build and backtest their own custom automated strategies and indicators. This feature, combined with a robust paper trading mode, lets users refine their approach risk-free. The platform is seamlessly integrated with Schwab’s commission-free U.S. stock and ETF trading, providing exceptional value.

While the platform itself is free, the heavy desktop application performs best on modern hardware, which may be a consideration for some users. Additionally, futures trading involves standard contract and exchange fees. Its comprehensive feature set and strong educational resources make it an ideal choice for serious traders who want advanced functionality without the high cost.

- Best For: Active stock, options, and futures traders seeking advanced analytical and automation tools without platform fees.

- Pricing: Free with a Charles Schwab account; $0 commissions on U.S. stocks/ETFs. Standard fees apply to options and futures contracts.

- Unique Feature: Custom strategy creation and backtesting with its proprietary thinkScript language.

4. TradeStation

TradeStation has earned its place as one of the best day trading software options by offering a powerful, institutional-grade suite of tools tailored for active traders. Its platform is renowned for its stability and speed, providing direct-market access and advanced order execution capabilities that serious traders demand. It excels in strategy automation, allowing users to design, backtest, and automate their own custom trading strategies using its proprietary EasyLanguage programming language, a feature that sets it apart.

The platform offers significant value, with free real-time market data for U.S. accounts and commission-free trading on stocks and ETFs under its TS Select plan. This cost-effective structure makes it accessible without sacrificing professional-level functionality. While its comprehensive tools may present a learning curve, its robust performance and analytical depth provide a solid foundation for traders aiming to refine their edge. For those new to such platforms, understanding the core features of TradeStation is a great first step.

While the pricing structure is competitive, traders should note that costs can vary by plan, and high-volume orders may incur per-share fees. Nevertheless, for traders focused on strategy development and reliable execution across stocks, options, and futures, TradeStation remains a top-tier choice that has stood the test of time.

- Best For: Active traders focused on strategy development and backtesting.

- Pricing: TS Select plan offers $0 commissions on stocks, ETFs, and options contracts. Other plans and products have varying fee structures.

- Unique Feature: Proprietary EasyLanguage for creating and automating custom trading strategies.

5. NinjaTrader

NinjaTrader has established itself as a premier destination for futures traders, making it one of the best day trading software options for this specific asset class. The platform is renowned for its high-performance charting, sophisticated order flow analysis, and market replay capabilities. This ecosystem is built to provide active futures traders with professional-grade tools, including a free, robust simulated trading environment to practice strategies without risking real capital.

The platform's appeal is amplified by its flexible licensing model, which includes a free version alongside monthly and lifetime options, catering to different commitment levels. NinjaTrader brokerage services offer attractive low intraday margin requirements, a crucial feature for day traders looking to maximize their capital. Its extensive third-party add-on market also allows for significant customization, from new indicators to fully automated trading systems.

However, users should be aware of the associated costs. While the platform can be used for free for charting and simulation, unlocking its full potential and connecting to a live brokerage account often involves additional fees for data, exchange access, and order routing. It is best suited for dedicated futures traders who will leverage its specialized toolset and can justify the a la carte pricing structure for data and execution.

- Best For: Dedicated futures traders seeking advanced charting and a customizable platform.

- Pricing: Free for simulation; Monthly ($99) or Lifetime ($1,499) license for advanced features and lower commissions. Exchange, data, and NFA fees are extra.

- Unique Feature: A rich ecosystem of third-party add-ons and a powerful, free simulation environment for strategy development.

Visit NinjaTrader

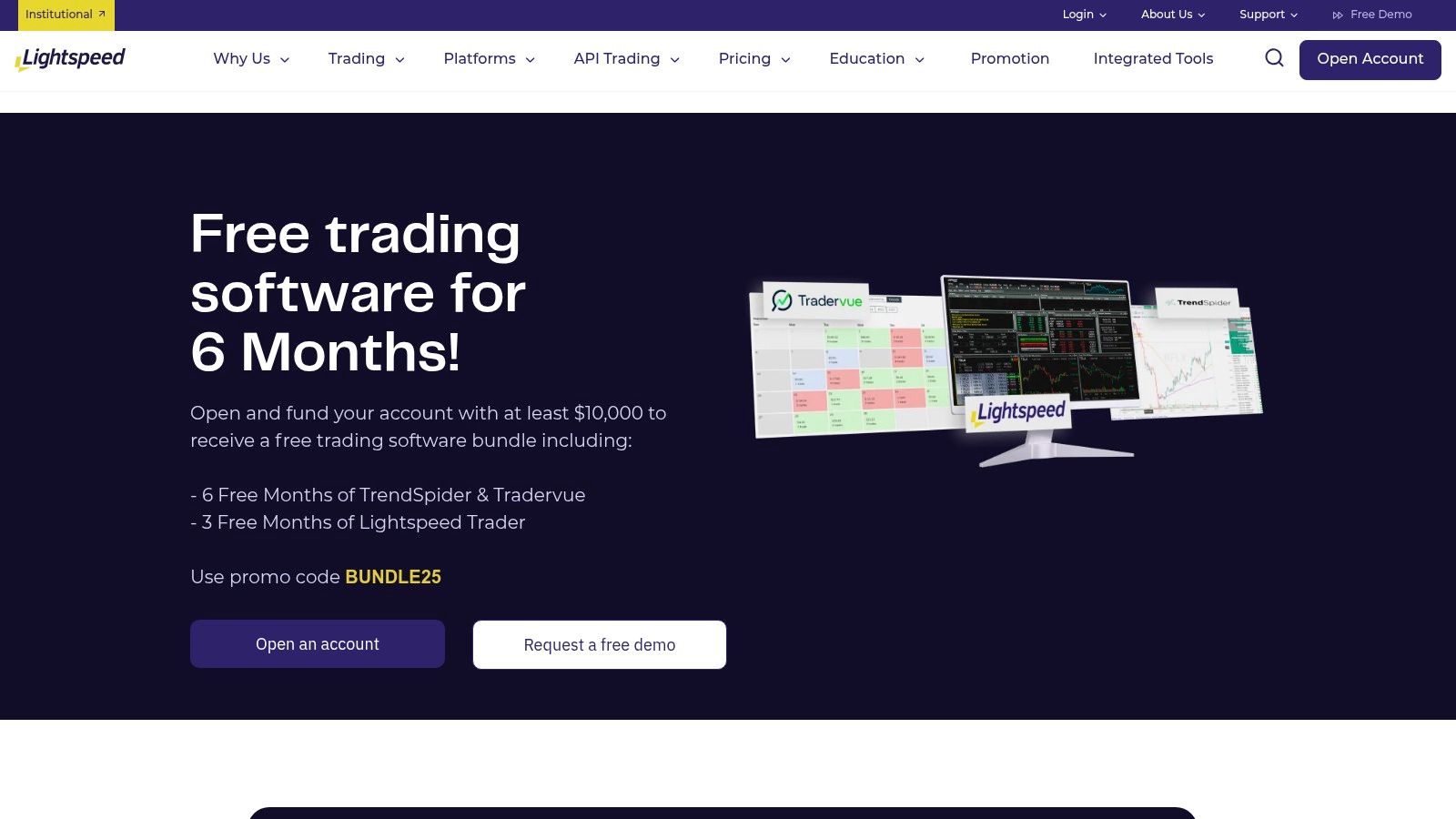

6. Lightspeed Trader (Lightspeed Financial)

Lightspeed Trader is a direct-access trading platform and broker engineered specifically for speed, making it a powerful contender for the best day trading software. It caters to active, professional traders who prioritize low-latency execution and deep customization. The platform's main advantage is its robust order routing system, giving users control over how their trades are executed to minimize slippage and improve fill times. This focus on rapid, precise execution is critical for scalpers and high-frequency traders.

The platform is renowned for its highly customizable interface, allowing traders to create layouts and hotkeys that perfectly match their workflow for near-instantaneous order placement. While its flexible commission structures, with per-share or per-trade options, are attractive, they are optimized for high-volume activity.

However, Lightspeed is not for the casual trader. The platform has a steep learning curve and carries monthly minimum activity fees and charges for market data, which can be prohibitive for those just starting. It is best suited for serious, well-capitalized traders who can leverage its institutional-grade speed and routing capabilities to gain a competitive edge in fast-moving markets.

- Best For: Professional, high-volume equity and options traders demanding low-latency execution.

- Pricing: Per-share or per-trade commissions with volume discounts. Monthly software fees and market data costs apply.

- Unique Feature: Multiple direct-access order routing options and extensive hotkey customization for maximum speed.

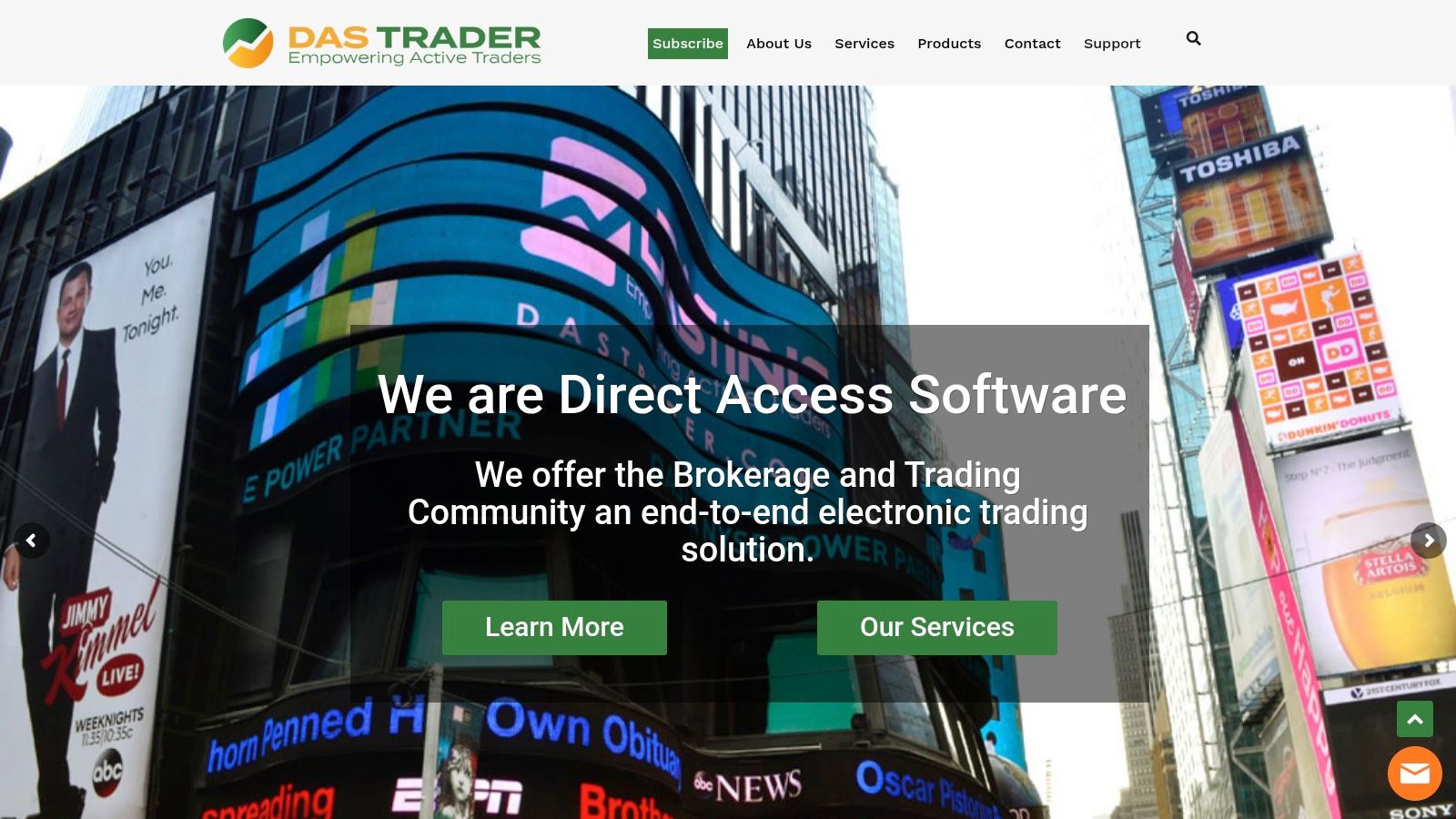

7. DAS Trader Pro

DAS Trader Pro is a premier direct-access trading platform renowned for its high-speed execution and robust market data, making it a favorite among serious day traders. The software provides a professional-grade front end for equities and options, focusing on delivering real-time Level II data and rapid order entry. Its main strength lies in its extensive customization, particularly the hotkey functionality that allows traders to execute complex orders with a single keystroke, a critical advantage in fast-moving markets.

The platform is not a brokerage itself but rather a software solution that connects to a supported broker. This separation allows traders to choose their preferred broker while using a consistent, powerful trading interface. Its flexible subscription model lets users select specific data feeds they need, such as NASDAQ TotalView, ensuring they only pay for what is necessary for their strategy.

However, the costs can accumulate. Users must pay a monthly software subscription fee directly to DAS Trader, plus separate fees for market data and any commissions charged by their chosen broker. This pricing model makes it less suitable for casual or beginner traders but ideal for dedicated professionals who require its specialized tools and can justify the expense through their trading volume and performance.

- Best For: Active equity and options traders who prioritize execution speed and deep market data.

- Pricing: Monthly software subscription (from ~$150/mo) plus separate fees for market data and broker commissions.

- Unique Feature: Advanced hotkey customization for lightning-fast order execution and direct-access routing.

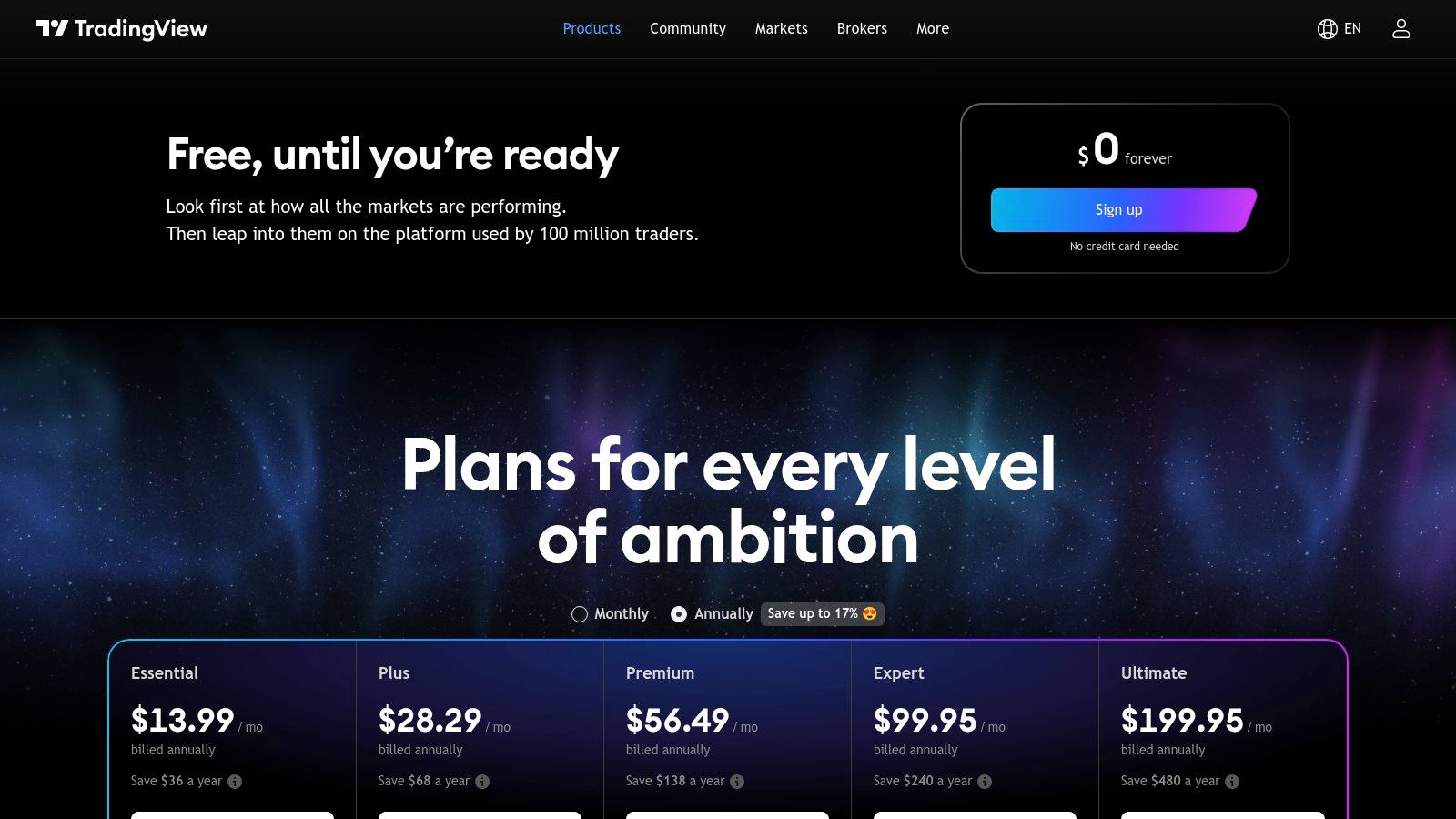

8. TradingView

TradingView has established itself as the premier cloud-based charting and social networking platform, making it a powerful contender for the best day trading software, especially for technical analysis. It excels by combining institutional-grade charting capabilities with an active community where traders share ideas, scripts, and strategies. Its web-based nature ensures a seamless and synchronized experience across all devices, from desktop to mobile, allowing traders to monitor markets and manage positions from anywhere.

The platform’s standout feature is its vast library of community-built indicators and strategies developed using its proprietary Pine Script language. While not a standalone broker, TradingView integrates with numerous popular brokers like TradeStation and Interactive Brokers, allowing users to execute trades directly from its superior charts. This combination provides traders with top-tier analytical tools and the flexibility to choose their preferred brokerage for execution.

However, its trading capabilities are entirely dependent on the quality of its broker integration, which can sometimes lack support for more complex order types. While a robust free version is available, serious day traders will need a paid subscription to unlock essential features like multiple charts per layout, more indicators per chart, and faster real-time data.

- Best For: Technical analysts and traders who prioritize charting and community collaboration.

- Pricing: Tiers range from a free Basic plan to paid Pro, Pro+, and Premium plans with increasing features. Brokerage commissions are separate.

- Unique Feature: An extensive, open-source library of community-created indicators and strategies via Pine Script.

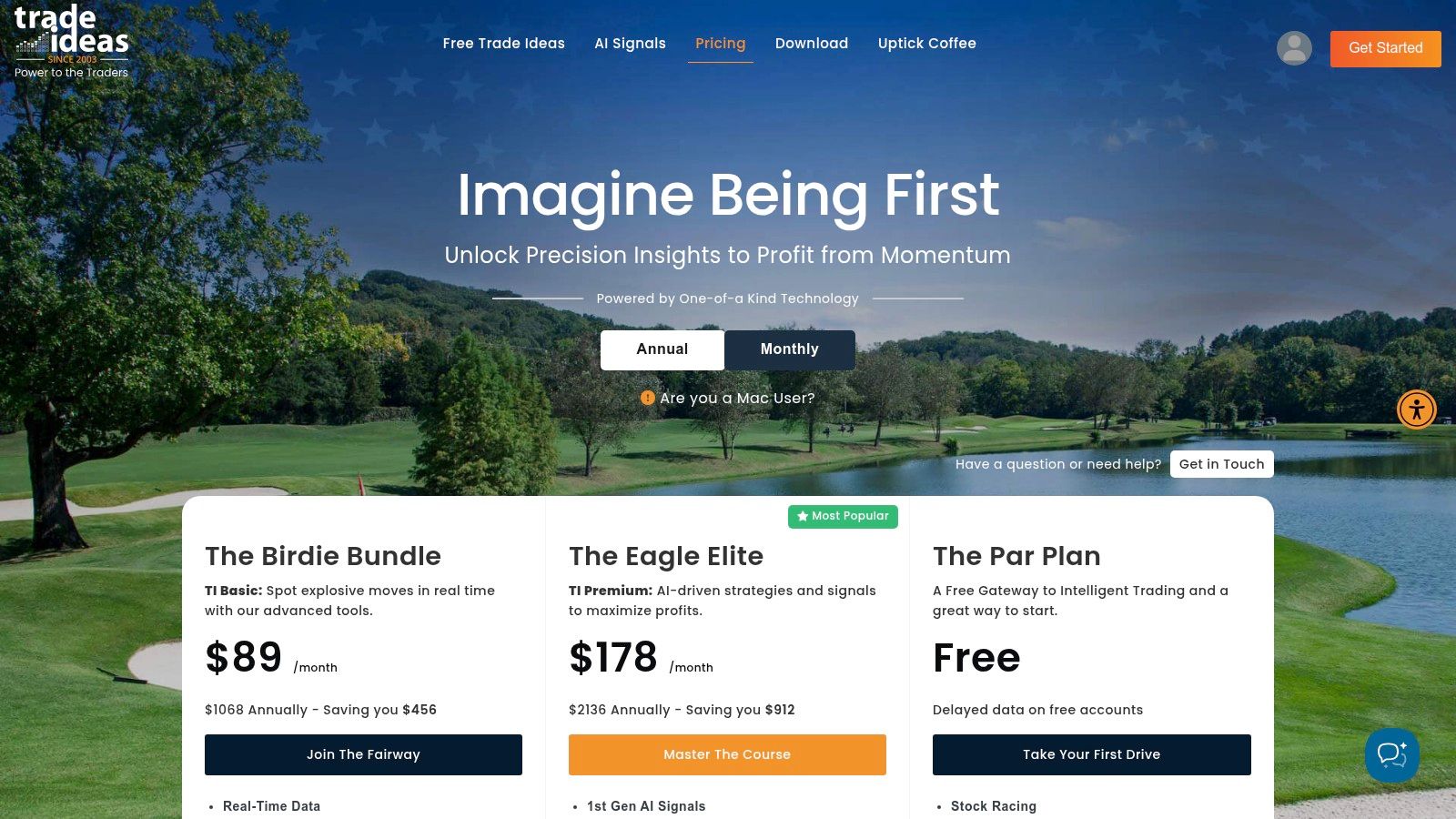

9. Trade Ideas

Trade Ideas is a powerful AI-driven stock scanning platform that serves as an idea-generation engine rather than a traditional brokerage. It excels at identifying real-time trading opportunities using its advanced artificial intelligence, Holly, which runs millions of simulations overnight to find high-probability setups. This makes it one of the best day trading software options for traders who rely on momentum and statistical analysis to find their next move before the rest of the market does.

The platform’s strength lies in its customizable real-time scanners and pre-configured channels that stream potential trades throughout the day. The Premium tier includes access to AI-powered strategies, backtesting capabilities, and simulated trading to test ideas without risking capital. While it’s not a direct brokerage, its Brokerage Plus module integrates with platforms like E-TRADE and Interactive Brokers, allowing users to execute trades directly from the Trade Ideas interface. Many consider it a top choice among the best AI trading software.

The main drawback is its high subscription cost, which may be prohibitive for new traders. The free version offers only delayed data, limiting its usefulness for active day trading. Trade Ideas is best for serious traders who understand that paying for a premium idea-generation tool can provide a significant analytical edge and are willing to invest in high-quality market intelligence.

- Best For: Momentum and active day traders who need sophisticated, AI-driven idea generation.

- Pricing: Standard plan starts at $84/month (billed annually); Premium plan is $167/month (billed annually). A free, delayed-data version is also available.

- Unique Feature: The "Holly" AI analyst, which provides statistically weighted, AI-curated trade signals.

10. eSignal

eSignal is a veteran in the trading software space, offering a robust, Windows-based charting and analytics platform favored by discretionary day traders. It stands out for its institutional-grade data feeds and a comprehensive suite of technical analysis tools that have been refined over decades. The platform is designed for serious traders who require reliable, real-time data and advanced charting capabilities to make informed decisions without the clutter of brokerage-integrated features.

The platform’s strength lies in its powerful charting tools, including its proprietary Advanced GET studies, market profile, and extensive volume-based indicators. With various subscription tiers, users can scale their access to features and data based on their needs, from delayed data for beginners to full real-time access for professionals. eSignal also connects to a wide array of brokers, allowing traders to execute directly from its charts.

However, eSignal's maturity comes with some drawbacks. The platform is exclusive to Windows, and its higher-tier subscriptions can be costly, especially when factoring in additional exchange data fees. It is best for traders who prioritize deep analytical capabilities and data integrity over a modern user interface or low-cost structure, making it a solid choice for dedicated technical analysts.

- Best For: Discretionary traders who need advanced charting and reliable data.

- Pricing: Tiered monthly subscriptions (Classic, Signature, Elite) starting around $62/month, with additional fees for real-time exchange data.

- Unique Feature: Advanced GET proprietary indicators and a highly reputable data infrastructure.

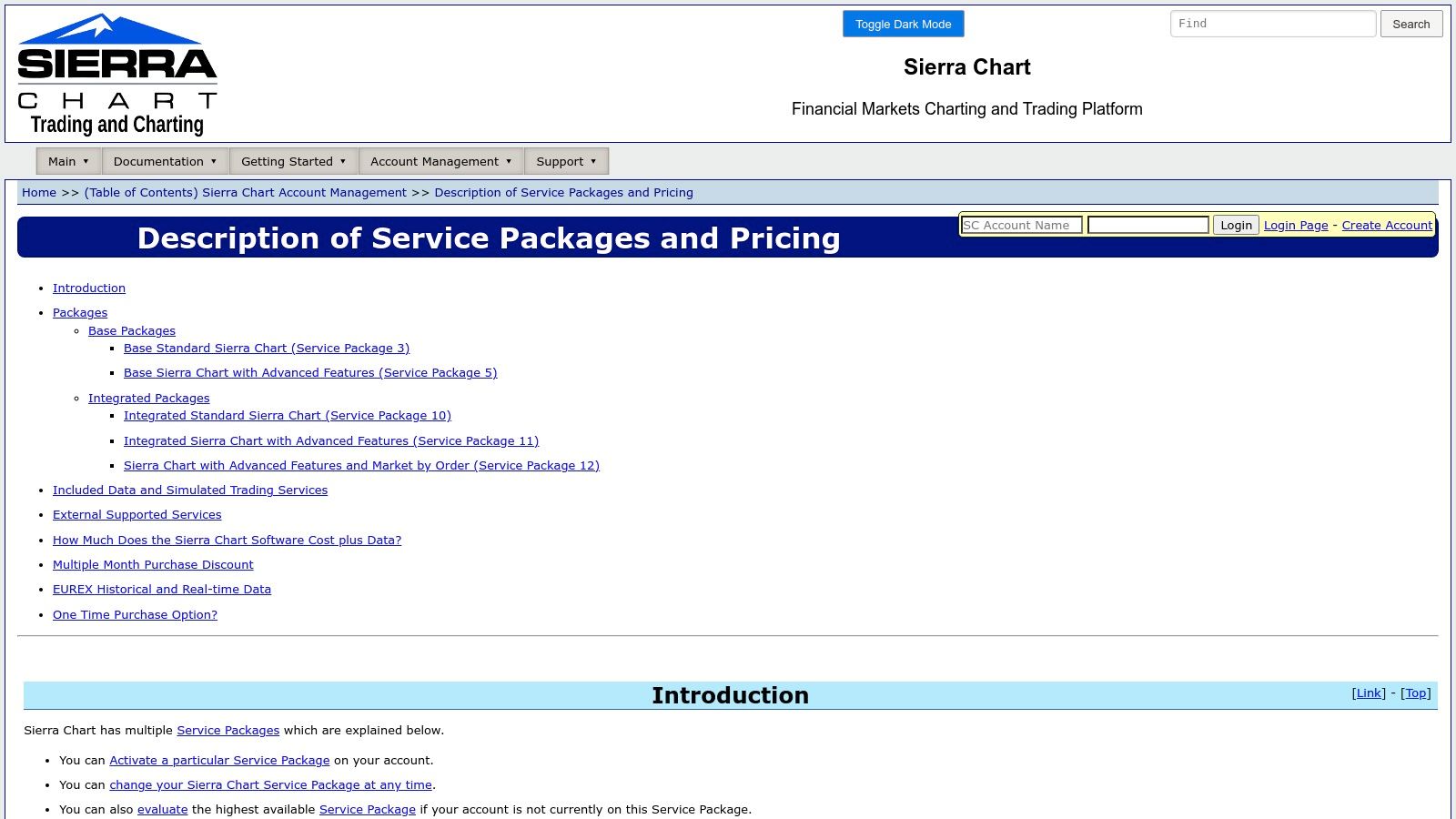

11. Sierra Chart

Sierra Chart is a professional, high-performance desktop trading platform renowned for its exceptional speed, stability, and advanced charting capabilities. It is particularly favored by serious futures traders who require deep market analysis tools, such as order flow and footprint charts (known as Numbers Bars). The platform's direct C++ coding ensures low latency and efficient resource usage, making it a powerful contender for the best day trading software for those who prioritize raw performance and data visualization.

The platform stands out with its affordable, tiered service packages and direct integration with reliable data feeds like the Denali Exchange Data Feed and Teton order routing. This provides traders with direct CME/CBOT/NYMEX/COMEX futures data at a competitive price, bypassing the need for more expensive broker-provided solutions. Its ultra-configurability allows users to build a trading environment tailored precisely to their strategy.

However, Sierra Chart's immense power and flexibility come with a notoriously steep learning curve. Its user interface is functional rather than visually modern, and its dense documentation can be intimidating for newcomers. It is best suited for experienced futures specialists who are willing to invest time in mastering its complex environment to leverage its superior analytical tools and execution speed.

- Best For: Professional futures traders and order flow specialists who need advanced charting.

- Pricing: Multiple monthly service packages starting from around $26/month. Exchange data and broker connectivity are separate fees.

- Unique Feature: Advanced order flow visualization (Numbers Bars) and highly reliable, low-cost proprietary data feeds.

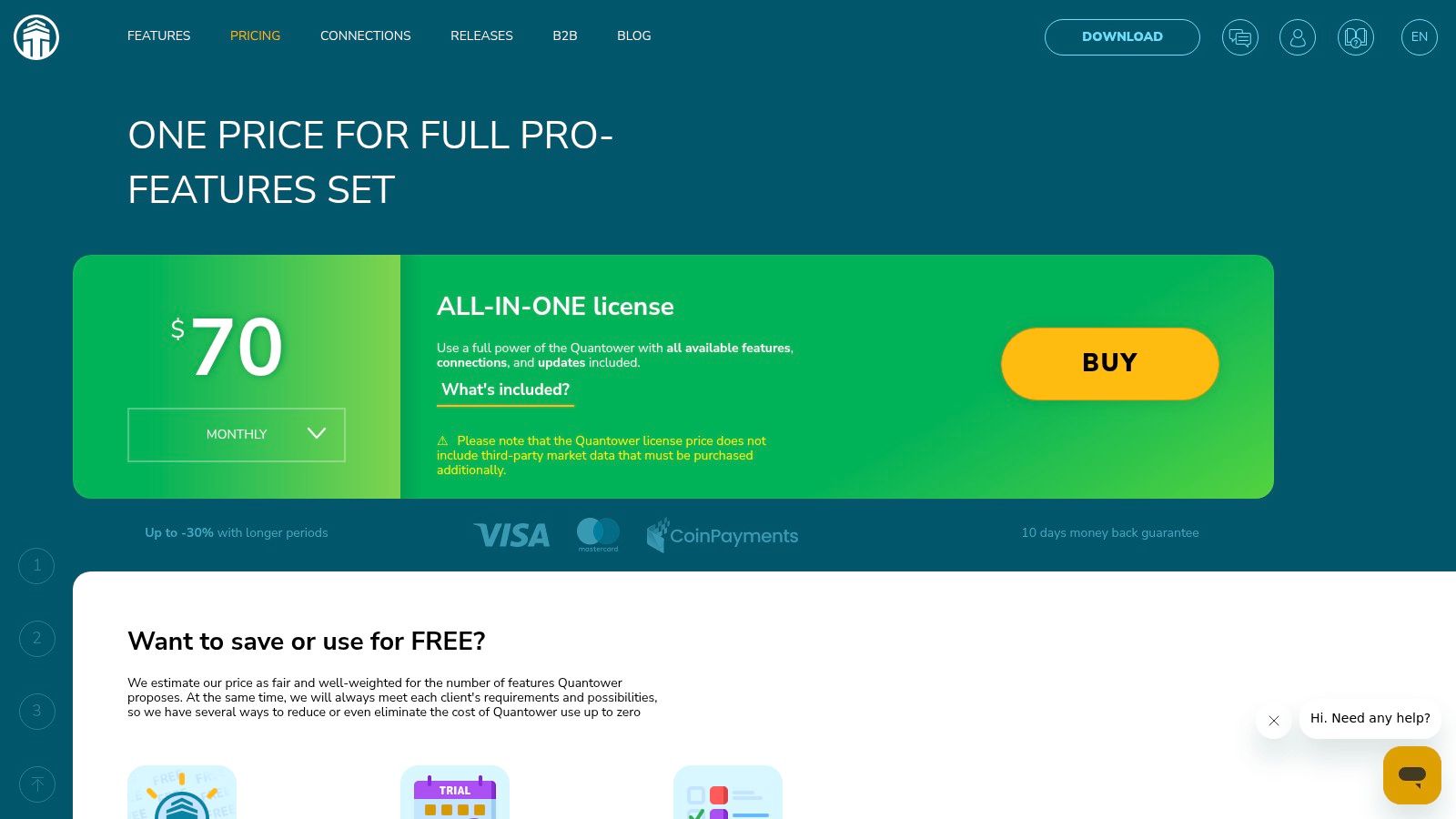

12. Quantower

Quantower is a modern, broker-agnostic trading terminal that stands out for its flexibility and powerful analytical tools, making it a strong candidate for the best day trading software. Designed as a multi-asset platform, it allows traders to connect to numerous brokers and data feeds for futures, stocks, forex, and cryptocurrencies from a single, highly customizable interface. Its strength lies in its modular design, empowering users to build a workspace tailored specifically to their strategy with advanced features like DOM Surface, TPO Profile Charts, and a versatile Options Desk.

The platform’s broker-independent nature is its main appeal, freeing traders from being locked into a single ecosystem. You can start with a feature-rich free version and add premium modules as needed, ensuring you only pay for the tools you use. This model provides an accessible entry point for new traders while offering the sophisticated functionality demanded by professionals.

However, its independence means that market data and broker connectivity are separate expenses. Users must subscribe to a data feed like Rithmic or CQG and maintain their brokerage account, which can add complexity and cost. The platform is best for traders who value deep market analysis and the freedom to switch between different brokers and asset classes without changing their primary charting and execution software.

- Best For: Multi-asset traders who want a broker-independent platform with advanced analytical tools.

- Pricing: Free version with limited features; All-in-One license available monthly, annually, or as a lifetime purchase. Data feed and broker subscriptions are extra.

- Unique Feature: A modular, broker-agnostic design with professional-grade volume analysis and order flow tools.

Key Features Comparison of 12 Day Trading Platforms

| Platform | Core Features / Automation ✨ | User Experience / Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| Trading Made Easy 🏆 | AI-driven automation, 1,000x faster trades, risk management | Intuitive UI, U.S.-based support, weekly live free webinars | Leasing from $299 💰 | Beginners to seasoned futures traders 👥 | Patented AI tech, emotional bias removal, social impact ✨ |

| Interactive Brokers TWS | SmartRouting, 160+ markets, advanced orders | Multi-device, robust but steep learning curve | Ultra-low commissions 💰 | Active global traders 👥 | Broad market access, very low costs |

| Charles Schwab thinkorswim | thinkScript automation, extensive charting | Powerful tools, free with Schwab account | No platform fees 💰 | Options & futures traders 👥 | Custom scripting, paper trading |

| TradeStation | Strategy backtesting, free real-time data | Stable, reliable execution | $0 commissions on many products 💰 | Active traders in stocks, options, futures 👥 | Institutional-grade tools |

| NinjaTrader | Licensing tiers, intraday margin, add-ons | 24/5 support, free simulated trading | Free to $1,499 lifetime 💰 | Futures day traders 👥 | Multiple licensing, low margin requirements |

| Lightspeed Trader | Hotkey customization, direct-access routing | Very fast execution, pro-grade tools | Monthly minimums apply 💰 | High volume equity/options day traders 👥 | Low latency, customizable hotkeys |

| DAS Trader Pro | Real-time Level II data, advanced charting | Fast hotkey order entry | High monthly fees 💰 | Intraday equity/options traders 👥 | Real-time Level II, simulator available |

| TradingView | Cloud-based charts, broker integration | Excellent cross-device, social community | Free to professional plans 💰 | All trader levels 👥 | Script library, social features |

| Trade Ideas | AI-powered scanning, backtesting | Real-time alerts, simulated trading | Premium pricing 💰 | Momentum & day stock traders 👥 | Advanced AI scanning |

| eSignal | Market profile, volume indicators | Mature tools, Windows only platform | Higher pro-tier fees 💰 | Discretionary day traders 👥 | Advanced GET tools, market profile |

| Sierra Chart | Order flow visualization, Denali feed | Highly customizable, low latency | Affordable software fees 💰 | Futures specialists 👥 | Deep order flow tools |

| Quantower | Broker-agnostic, modular, multi-asset | Flexible workflow, free trial | Modular paid licenses 💰 | Multi-market traders 👥 | Broker/data feed flexibility |

Making Your Final Decision: Empowering Your Trading Strategy

Navigating the landscape of the best day trading software can feel overwhelming, but clarity emerges when you align a platform’s strengths with your personal trading philosophy. We have journeyed through a comprehensive list of the industry's top contenders, from the institutional-grade power of Interactive Brokers' TWS and Lightspeed to the unparalleled charting capabilities of TradingView and Sierra Chart. Each tool presents a unique value proposition designed for a specific type of trader.

Your ideal platform is not necessarily the one with the most features, but the one with the right features for your strategy, risk tolerance, and lifestyle. The key is to move beyond marketing claims and focus on the practical application of these tools.

The Automation Advantage

This brings us to a crucial consideration: the role of automation. For traders struggling with emotional discipline, time constraints, or the sheer complexity of manual analysis, automated systems offer a powerful solution. Trading Made Easy has carved a unique niche by focusing exclusively on this. Our system is engineered to execute predefined, tested strategies with robotic precision, effectively removing fear and greed from the equation. This is particularly compelling for busy professionals, veterans, and anyone seeking a more systematic approach to the markets.

Ultimately, selecting the best day trading software is an investment in your trading career. The key points to remember are the importance of patented AI-driven automation, integrated risk management, and continuous education. These elements empower you to trade with confidence, precision, and a clear strategic edge.

Ready to explore our offerings? Discover how a decade of refinement in automated trading can transform your approach. Explore our patented technology and see the system in action at Trading Made Easy.

Leave a Reply