Ever since we started Trading Made Easy back in 2014, our mission has been to demystify the complexities of the market and provide traders with powerful, intuitive tools. This guide is all about delta, one of the most critical concepts you need to get right if you're serious about options. We're going to skip the dense, academic theory and show you exactly how to calculate delta and, more importantly, how to use it to make smarter trades.

Why Mastering Delta Is a Game Changer for Traders

Look, delta isn't just another Greek letter on your screen. Think of it as your roadmap to an option's risk and potential reward. If you want to move beyond just buying and selling calls and puts, you absolutely have to get a handle on delta. It gives you a hard number that tells you exactly how much an option's price should move for every dollar the underlying stock moves.

This guide is designed to make that idea real. We'll break down the calculation step-by-step, making sure you understand every input and the logic behind the formula. But knowing how to do the math is only half the story. The real edge comes from knowing how to apply that knowledge to your live trades.

The Power of Instant Calculation

Knowing the theory is great, but the market doesn't wait. By the time you’ve punched all the numbers into a calculator, the trade you were looking at is probably gone. Our automated day trading software was built to solve this exact problem. It features real-time calculation of all option Greeks, including delta, so you can make decisions instantly. Our platform also includes one-click trade execution, advanced charting tools, and customizable alerts, ensuring you never miss an opportunity because you were busy with manual calculations.

By the time you’ve manually calculated an option’s delta, the market conditions that influenced it have likely already changed. Instant, automated calculations are essential for making timely and informed decisions.

For instance, one of our clients, a part-time trader named Sarah, used to struggle with managing her covered call positions. By using our software's real-time delta alerts, she was able to proactively roll her positions when the delta indicated a high probability of her shares being called away. This simple, automated insight helped her increase her portfolio income by over 15% in her first six months.

What Delta Actually Tells You About Your Trades

Before we get into the nitty-gritty of how to calculate delta, you need to build a real gut feel for what this number means for your trades. Think of it as the speedometer for your options contract. It’s a live, dynamic number that tells you how your option is going to react when the market makes a move.

At its heart, delta really does two critical jobs for a trader. The first, and most common use, is predicting how much an option's premium will change for every $1 shift in the underlying stock's price. This is its most direct function and helps you see how your position's value will ebb and flow with the market.

Decoding the Numbers

Delta is shown as a value between 0 and 1 for call options and 0 and -1 for put options. That positive or negative sign is your first big hint about which way the option is betting.

- Call Options: Calls have a positive delta. Simple enough—their value goes up when the stock price goes up. So, a call with a delta of 0.70 is expected to gain about $0.70 for every $1 the stock climbs.

- Put Options: Puts have a negative delta because they profit when the stock price goes down. A put with a delta of -0.40 should gain around $0.40 in value for every $1 the stock drops.

This relationship is a cornerstone of options trading. Delta gives you a hard number for how much an option's price should move for every dollar the stock moves, giving you a clear handle on your directional risk. If you want to dive deeper into this principle, this detailed guide from Analyst Prep is a great resource.

But that’s not all. Delta’s second job is to act as a quick-and-dirty probability gauge.

While it's not a crystal ball, an option's delta gives you a rough, at-a-glance estimate of the odds that it will expire in-the-money (ITM).

So, if you're looking at an option with a 0.30 delta, you can loosely interpret that as having a 30% chance of finishing in the money. A deep in-the-money call with a 0.95 delta? It has a very high, roughly 95% chance, of expiring with real value. This is a game-changer for setting up trades and managing your own expectations.

Interpreting Delta Values at a Glance

Getting a feel for where an option’s delta sits on the scale tells you a ton about its personality. The higher the absolute value—meaning, the closer it is to 1 or -1—the more it will mimic the underlying stock's movements.

Deltas near 1 (for calls) or -1 (for puts) mean the option moves almost dollar-for-dollar with the stock. On the flip side, deltas close to zero are far less sensitive to small price swings.

To make it even simpler, here’s a quick reference table.

| Delta Value | Call Option Meaning | Put Option Meaning | Approximate ITM Probability |

|---|---|---|---|

| 0.0 – 0.2 | Far out-of-the-money; low sensitivity to stock price changes. | Far out-of-the-money; low sensitivity to stock price changes. | 0% – 20% |

| 0.4 – 0.6 | At-the-money; highly sensitive to all factors. | At-the-money; highly sensitive to all factors. | 40% – 60% |

| 0.8 – 1.0 | Deep in-the-money; behaves almost exactly like the stock. | Deep in-the-money; behaves almost exactly like the stock. | 80% – 100% |

As you can see, this one number is incredibly powerful. It shapes everything from how you size your positions to your hedging strategy, which is why it’s a metric no serious options trader can afford to ignore.

The Key Inputs for an Accurate Delta Calculation

If you really want to get a handle on how to calculate delta, you first need to know the ingredients. Delta isn't just some random number that pops up on your screen; it's the output of a complex financial recipe where several key variables are constantly interacting. These inputs are the bedrock of classic options pricing models, like the famous Black-Scholes.

Think about it like this: if you build a house on a shaky foundation, the whole thing is compromised. The same exact principle applies to delta. One bad input will spit out a useless number, and that’s how bad trading decisions are made.

So, let's break down each piece of the puzzle.

The Core Components of the Delta Formula

To get an accurate delta, you absolutely have to get these five inputs right. Each one plays a unique role in telling the story of an option's sensitivity.

-

Underlying Stock Price: This one’s the most obvious. It’s simply the current market price of the stock the option is tied to. As the stock ticks up or down, the delta shifts right along with it.

-

Strike Price: This is the locked-in price where you can buy (for a call) or sell (for a put) the underlying stock. The gap between the stock price and the strike price is what tells you if an option is in-the-money, at-the-money, or out-of-the-money.

-

Time to Expiration: How much runway is left before the option expires? This variable, usually measured in years, is critical. The more time on the clock, the more opportunity the stock has to make a big move, which directly influences the option's delta.

As an option gets closer to its expiration date, its delta begins a race to the finish line. For an in-the-money call, it will sprint toward 1.0, while an out-of-the-money option’s delta will crawl toward 0. This is the power of time decay (theta) at work, constantly eroding value and changing the dynamics.

Understanding Volatility and Interest Rates

The first three inputs are pretty easy to find, but the last two—implied volatility and the risk-free rate—are a little more abstract. They bring the market’s mood and the broader economic environment into the calculation.

Implied Volatility (IV)

This is, without a doubt, the most important and trickiest input. Implied volatility is the market’s best guess about how much a stock’s price will swing in the future. It’s a forward-looking metric, which is why it’s so much more valuable for calculating delta than historical volatility, which just tells you what already happened.

A higher IV means the market is expecting more drama. That translates to higher option premiums and can cause wild swings in delta, since there's a greater perceived chance of a big price move.

The Risk-Free Interest Rate

This input is the theoretical return you’d get from a completely risk-free investment. For practical purposes, traders just use the current yield on short-term U.S. Treasury bills. While it has the smallest effect of all the inputs, a proper pricing model still needs it for accuracy.

It's also worth remembering that your trading profits can have tax consequences, and a solid strategy accounts for that. For a deeper dive, check out our guide on day trading tax implications.

Once you get a feel for how all these variables work together, you’re no longer just looking at a number—you're seeing the full story behind it.

Alright, let’s roll up our sleeves and walk through how to actually calculate delta. The theory is great, but nothing clicks quite like seeing it done with real numbers. We're going to take a call option on a big tech stock and break down the whole process, step-by-step.

For this example, we’re not going to get lost in the weeds of the complex calculus that makes the Black-Scholes model tick. Instead, we’ll focus on the single most important output for our purpose: the N(d1) value. For a standard call option, the delta is simply equal to N(d1). My goal here is to show you how to get to that number without needing a Ph.D. in math.

Setting the Stage with a Real-World Scenario

Let's imagine you're eyeing a call option for a hypothetical tech giant we'll call "Innovate Corp." (INVC). To make this practical, we need some realistic inputs:

- Current Stock Price (S): $150.00

- Strike Price (K): $155.00 (This option is slightly out-of-the-money)

- Time to Expiration (t): 30 days (or about 0.082 years, which is how the models see it)

- Implied Volatility (σ): 25% (or 0.25)

- Risk-Free Interest Rate (r): 4.5% (or 0.045)

With these variables in hand, we have everything we need to use a standard options pricing calculator or a spreadsheet function built for the Black-Scholes model. These tools do the heavy lifting to compute the d1 variable, which is the key to finding our N(d1).

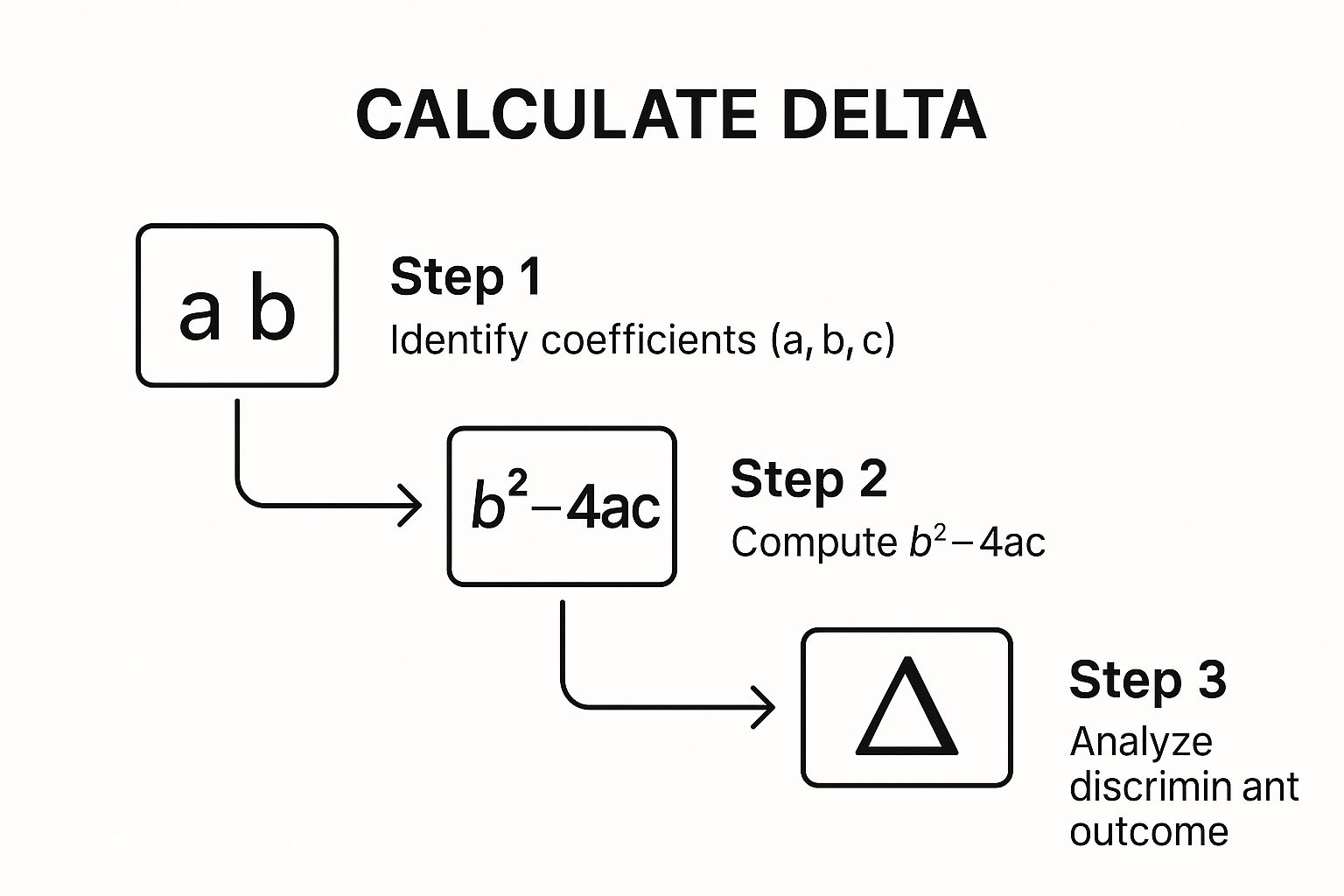

The image below gives you a good sense of the logic these pricing models use to get to an outcome.

Think of it like this: the model takes your specific inputs, runs the calculation, and uses that result to make a final determination—just like how we get to N(d1).

Finding N(d1) and What It Tells Us

When we feed our numbers into an online Black-Scholes calculator, the first thing it spits out is the value for d1. In our INVC scenario, the result for d1 comes out to roughly -0.27.

Now what? The next move is to find the N(d1) value, which is a concept from statistics representing the cumulative distribution function for a standard normal distribution. Don't worry, it's easier than it sounds. You can find this value in a couple of ways:

- A Z-Table: If you’re old school, you can look up the value -0.27 on a standard normal distribution table.

- Spreadsheet Magic: A much faster way is to use a function like

NORMSDIST()in Excel or Google Sheets.

Plugging -0.27 into the function gives us an N(d1) value of about 0.3936.

Since the delta of a call option is N(d1), the delta for our INVC call option is 0.39. What this means in plain English is that for every $1 the stock price moves up, the option's premium should increase by about $0.39.

This number also doubles as a rough probability gauge. It suggests our option has approximately a 39% chance of expiring in-the-money. Pretty handy, right?

The Big Challenge: Finding Delta's Ghost in the Past

Calculating delta for today is simple with modern tools. But looking backward? That's a whole different story.

If you’ve ever tried backtesting a strategy, you know that getting historical delta values is a massive headache. Data availability is the main culprit. In fact, major financial data providers like Refinitiv only started collecting time series delta data for US stock options on October 12, 2020.

Trying to analyze data before that date means you have to reconstruct delta values yourself using historical prices and volatility—a seriously complex task. You can get a better sense of this data puzzle from discussions in the Refinitiv developer community. This limitation really highlights why having real-time calculation tools for looking forward is so invaluable for traders today.

How Traders Use Delta to Manage Risk and Find Opportunities

Knowing how to calculate delta is one thing. Actually using it in a live market to make money? That’s what separates the pros from the crowd. The real power of delta isn’t just knowing the number; it’s about understanding what that number is telling you about your risk and where the next opportunity might be.

Once you have instant access to delta, you can stop making simple "up or down" bets and start deploying more sophisticated strategies. This is where the theory ends and delta becomes a practical, profit-generating tool that can completely change your trading game.

Practical Application: Delta Hedging

One of the most powerful ways professionals use delta is through delta hedging. The entire goal is to build a "delta-neutral" portfolio—one where the value doesn't really budge when the underlying stock makes small moves. Why on earth would you want that? Because it lets you profit from other factors, like time decay (theta) or shifts in implied volatility (vega), without having to sweat the stock's direction.

A trader might sell an option to collect the premium, then immediately turn around and buy or sell shares of the stock to perfectly offset that option's delta.

- You sell a call option with a 0.60 delta. You are now effectively short 60 deltas for every 100-share contract.

- To hedge, you buy 60 shares of the stock. Since each share has a delta of 1.0, you just added 60 positive deltas to your position.

- The result? A net delta of zero. Now, as the stock wiggles up and down, the loss on your shares should be canceled out by the gain on your short call (and vice versa). Your position is now insulated, allowing you to focus on profiting from other variables.

This is a cornerstone strategy for market makers and hedge funds, but automated delta calculations bring it within reach for everyone. You can stop fumbling with a calculator and just see your portfolio’s real-time delta, adjusting on the fly like a pro.

Managing Positions with Real-Time Delta

Let's look at a more common scenario: managing a simple covered call. You own 100 shares of a stock and sell a call option against it to bring in some extra income. At the start, you might sell an out-of-the-money call with a delta of 0.30.

But then the stock starts to rally. As it climbs, that call option's delta might shoot up to 0.60, then 0.80. Our software’s real-time delta tracker makes this change impossible to miss. Seeing the delta jump that high is a blaring signal that your risk has changed. The odds of your shares being called away are now much, much higher.

By monitoring delta in real time, a trader can make proactive decisions. They might choose to roll the option up and out to a higher strike price and later expiration, locking in some profit while keeping the income strategy alive.

This kind of active management turns a "set-it-and-forget-it" position into a dynamic one, giving you the power to maximize income while keeping a lid on risk. These advanced tactics are just a few of the many day trading strategies for beginners and seasoned pros that open up when you have instant, accurate data. Without it, you're always trading in the rearview mirror.

Putting Your Trading Strategy on Autopilot

Knowing the math behind delta is one thing, but actually doing it by hand in the middle of a trading day? Forget it. The futures market moves way too fast for that. By the time you’ve plugged everything into a formula, the exact opportunity you were eyeing is long gone.

This is where the rubber meets the road—where theory gets a much-needed technology upgrade.

At Trading Made Easy, we've been tackling this exact problem since 2014. Our goal has always been to build tools that let traders focus on their strategy, not on becoming human calculators. Our automated day trading software is built to do all the heavy lifting for you.

Making Instant Risk Assessments

Instead of getting lost in a spreadsheet, our software puts delta—and the other key Greeks like gamma, theta, and vega—right on your screen in real-time. For any option you’re watching, you get an immediate, crystal-clear snapshot of its risk profile.

At a glance, you can see just how sensitive your position is to a shift in the market. That’s how you start making smarter, faster decisions.

This is especially critical for more advanced strategies. Trying to set up a delta-neutral trade, for instance, becomes a simple exercise. The platform shows you the net delta of your entire portfolio, so you can perfectly balance your positions with a few clicks instead of a headache.

The real win with automation isn't just about speed; it's about mental clarity. You're freed up to hunt for great setups instead of being buried in the mechanics.

From Calculation to Confident Execution

Making that leap from manual grunt work to automated insight changes everything.

Picture this: a stock you're holding starts moving hard, and you need to hedge your position right now. With real-time delta tracking, you know the exact number of shares to buy or sell to get your directional risk back to zero. No guesswork. No crossing your fingers. Just precise, data-backed action. That’s the edge.

This powerful mix of deep analytics and clean design is what empowers traders, whether they're just starting out or have been at it for years. To see more on how this all works under the hood, check out our guide on what is automated trading.

When you put your strategy on autopilot, you're not just trading faster. You’re trading with a level of precision and confidence that you simply can't achieve by hand.

So, Where Do You Go from Here?

Since we launched Trading Made Easy in 2014, our mission has been to empower traders with technology that simplifies complex strategies. We've covered the what, why, and how of calculating delta. The key takeaway is that mastering this metric shifts you from reactive guessing to proactive, data-driven trading. By instantly understanding an option's risk and potential movement, you gain a decisive edge in any market.

Turning Knowledge into Action

Knowing the math is one thing. Being able to use that information in the heat of the moment is what really gives you an edge. This is exactly why a solid platform is so critical. Instead of fumbling with a calculator, you can stay focused on your strategy and pull the trigger when the time is right.

The goal isn’t to become a human calculator. It’s to become an agile, informed trader. The right technology lets you apply a complex idea like delta instantly and confidently, turning a stream of market data into a clear plan.

Our automated day trading software was built to do just that—to completely change how you approach the market. We encourage you to explore our platform and see how instant access to critical metrics like delta can elevate your trading strategy.

Ready to take the next step? It's time to see what having the right tools in your corner can do for your trading. Having instant access to these kinds of critical metrics really does make all the difference.

Explore how Trading Made Easy can simplify your strategy and accelerate your trading. Visit us to learn more.

Leave a Reply