Picking the best algorithmic trading software really boils down to three things: Is it reliable? Is it fast? And can it manage risk? Since founding Trading Made Easy in 2014, our mission has been to answer those questions with powerful, intuitive tools that empower traders. The great platforms out there give you robust automation without making you feel like you need a degree in computer science to use them. They let you execute your strategies with the kind of precision and discipline that’s almost impossible to maintain when you’re trading manually.

Your Guide to Finding the Right Trading Software

I’m James Viscuglia, founder of Trading Made Easy. Since I started this company back in 2014, my mission has been simple: build powerful, intuitive tools that cut through the noise of the futures market. I know that choosing your software is a huge decision, one that directly impacts your bottom line and your confidence as a trader. That’s why I’ve put together this guide—to give you a clear, no-nonsense roadmap for finding a platform that actually fits what you’re trying to accomplish.

This isn't just some technical manual. Think of it as a strategic framework for traders who are serious about getting a real edge. We're going to break down the must-have features, show you how to see past slick marketing claims, and dive into why rock-solid risk management tools are completely non-negotiable.

Navigating the Growing Market

It’s no secret that automated systems are exploding in popularity. The global algorithmic trading market has seen some pretty incredible growth lately. In 2023, the market was already valued at around USD 17.0 billion, and forecasts show it rocketing to USD 65.2 billion by 2032. That’s a compound annual growth rate of 15.9%—a clear sign that automation is becoming the standard. If you want to dig deeper, you can explore more data on algorithmic trading market trends to see the full picture.

With so many options popping up, how do you sort the good from the bad? You need a system. Forget the flashy ads and focus on a structured evaluation process.

The best algorithmic trading software is more of a partner than a tool. It should take your strategy and supercharge it—enforcing discipline, killing emotional bias, and executing your plan faster than you ever could on your own.

To make this easier, I've put together a quick checklist of the non-negotiables. These are the core features you should be looking for, no matter which platform you’re considering.

Core Features Checklist for Top Trading Software

| Feature Category | Essential Components | Why It Matters |

|---|---|---|

| Strategy & Automation | – Pre-built strategy library – Custom strategy builder (no-code/low-code) – Backtesting & simulation modes |

You need flexibility. A good mix lets you start fast with proven strategies while giving you the power to build and test your own unique ideas without needing to be a developer. |

| Execution & Speed | – Low-latency order routing – Direct market access (DMA) – Millisecond-level execution speeds |

In futures trading, a fraction of a second can be the difference between a profit and a loss. The software must be engineered for speed to avoid slippage and capture opportunities. |

| Risk Management | – Automated stop-loss & take-profit – Daily profit/loss limits – Position sizing controls |

This is your safety net. These tools automatically protect your capital by enforcing your trading rules, preventing emotional decisions from wrecking your account. |

| Platform & Integration | – Compatibility with major brokers – Stable, reliable data feeds – User-friendly interface |

The software is useless if it doesn't work with your broker or if the interface is a nightmare to navigate. It needs to be a seamless part of your existing workflow. |

This table covers the fundamentals. If a platform can't tick these boxes, it's probably not worth your time.

A Strategic Roadmap for Success

Your search for the right software has to start with you. What are your needs? Are you just getting your feet wet and want something with proven strategies built-in? Or are you a seasoned trader who wants to code custom algorithms from the ground up? The best platforms can handle both.

At Trading Made Easy, we've built our entire system around three core pillars:

- Accessibility for All: I firmly believe that automation shouldn't be reserved for tech wizards. Our platform is designed to be straightforward, whether you've been trading for a decade or a day.

- Unyielding Performance: When it comes to trading, speed and reliability are everything. Our software is engineered to execute trades up to 1,000 times faster than you could manually, so you never get left behind.

- Ironclad Risk Management: Protecting your capital is job number one. We've built automated safeguards and controls directly into every strategy to give you peace of mind.

Now, let's get into the details and break down how to evaluate each of these criteria for yourself.

Identifying the Features That Actually Matter

When you start shopping for algorithmic trading software, it's incredibly easy to get dazzled by a long list of features. At Trading Made Easy, we've focused on what gives traders a real edge. Our automated day trading software is designed with unique features that offer tangible benefits: from our intuitive no-code strategy builder that allows anyone to automate their ideas, to the proprietary risk management module that acts as a disciplined co-pilot, protecting your capital 24/7. These tools aren't just about automation; they enable smarter, more disciplined trading.

It's all about having the right tools for meticulous strategy validation, effortless customization, and most importantly, ironclad protection for your capital. At Trading Made Easy, we've been refining our platform since 2014 based on what genuinely empowers traders. The mission was never just about automation; it’s about enabling smarter, more disciplined trading with the right tech.

The Power of a Realistic Backtesting Engine

Before a single dollar of your hard-earned money is on the line, you need to be absolutely confident in your strategy's logic. This is where a serious backtesting engine becomes your most vital tool. A great engine does more than just throw your algorithm at some old data; it simulates real market conditions with near-perfect accuracy.

So many platforms out there offer oversimplified backtesting that spits out wildly optimistic results. They often conveniently forget to account for the gritty realities of trading, like slippage, commission costs, and data feed latency.

A backtesting environment that’s actually effective has to include:

- High-Fidelity Historical Data: Access to clean, tick-by-tick data is non-negotiable. It's the only way to get accurate simulations, especially for strategies that operate on tight timeframes.

- Realistic Cost Simulation: You need the ability to plug in your exact commission structure and a reasonable slippage estimate. This is the only way to get a clear picture of potential net profits.

- Variable Parameter Testing: A solid engine lets you stress-test your strategy in all kinds of market weather—bull, bear, and sideways—to find its breaking points.

Without these, you're just flying blind. You’re making decisions based on fairy tales, not the brutal reality of live markets.

A backtest that looks too good to be true almost always is. The best software provides a testing ground that’s just as unforgiving as the live market, ensuring your strategy is truly battle-tested before you deploy it.

Intuitive Strategy Builders That Put You in Control

The old idea that you need to be a coding wizard to get into algorithmic trading is completely outdated. While programming gives you ultimate flexibility, the most accessible and often the best software provides an intuitive, visual strategy builder. This is what opens up automation to everyone, letting savvy discretionary traders turn their market knowledge into systematic rules without touching a single line of code.

These builders typically use a simple drag-and-drop interface. You can connect logical blocks that represent indicators, conditions, and actions. For instance, you could build a rule like: "IF the 20-period moving average crosses ABOVE the 50-period moving average, AND the RSI is below 70, THEN execute a buy order." It’s that straightforward.

This no-code approach is a massive time-saver and drastically cuts down on human error. It puts the focus right back where it belongs: on crafting and perfecting your trading logic, not on debugging frustrating code. You can see how these platforms operate by checking out our guide on automated day trading systems. This kind of accessibility is a game-changer for traders who get the market but don’t have a technical background.

Non-Negotiable Risk Management Modules

Let me be clear: no feature is more important than the one that protects your trading account. We all know that keeping emotions in check is one of the hardest parts of trading. Automated risk management modules act as your unwavering, ice-cold trading partner, enforcing discipline when you need it most. These aren't just nice-to-haves; they are the foundation of any serious platform.

At Trading Made Easy, we built proprietary risk controls directly into our software because we know from experience that long-term survival is all about capital preservation.

Here are the key risk management features you should demand:

- Automated Stop-Loss and Take-Profit Orders: The software must automatically attach these to every single trade based on your rules. This protects you from catastrophic losses and locks in profits without hesitation.

- Account-Level Drawdown Limits: Set a hard "kill switch" for your daily or weekly losses. If you hit that number, the software should shut down all trading for the period. No more emotional revenge trading.

- Dynamic Position Sizing: The system should calculate the right position size for every trade based on your account balance and risk tolerance (e.g., risking no more than 1% of your capital on any single trade).

These automated guardrails enforce the kind of discipline that even seasoned pros can struggle with. They make you stick to your plan and protect you from your own worst impulses when the market gets chaotic. Without them, even a winning strategy can be wiped out by one bad, emotionally-driven decision.

How to Properly Evaluate Software Performance

Every trading software ad flashes the same thing: incredible returns and perfectly smooth equity curves. It’s designed to look like a money-printing machine. But how do you know if you're looking at a genuinely robust system or just some cleverly disguised hype?

The only way to find out is to dig in and rigorously evaluate the platform’s performance yourself. This means looking past the flashy claims and focusing on the metrics that actually matter. You have to do your own due diligence—it’s the only way to pick software with a verifiable, realistic track record.

Your first move is to learn how to dissect a backtesting report. A legitimate report won’t just show you a final profit number; it will provide a transparent, detailed breakdown of a strategy's historical performance. You need to understand how that profit was made and, just as importantly, at what cost. That means getting granular with the underlying data and the assumptions baked into the simulation.

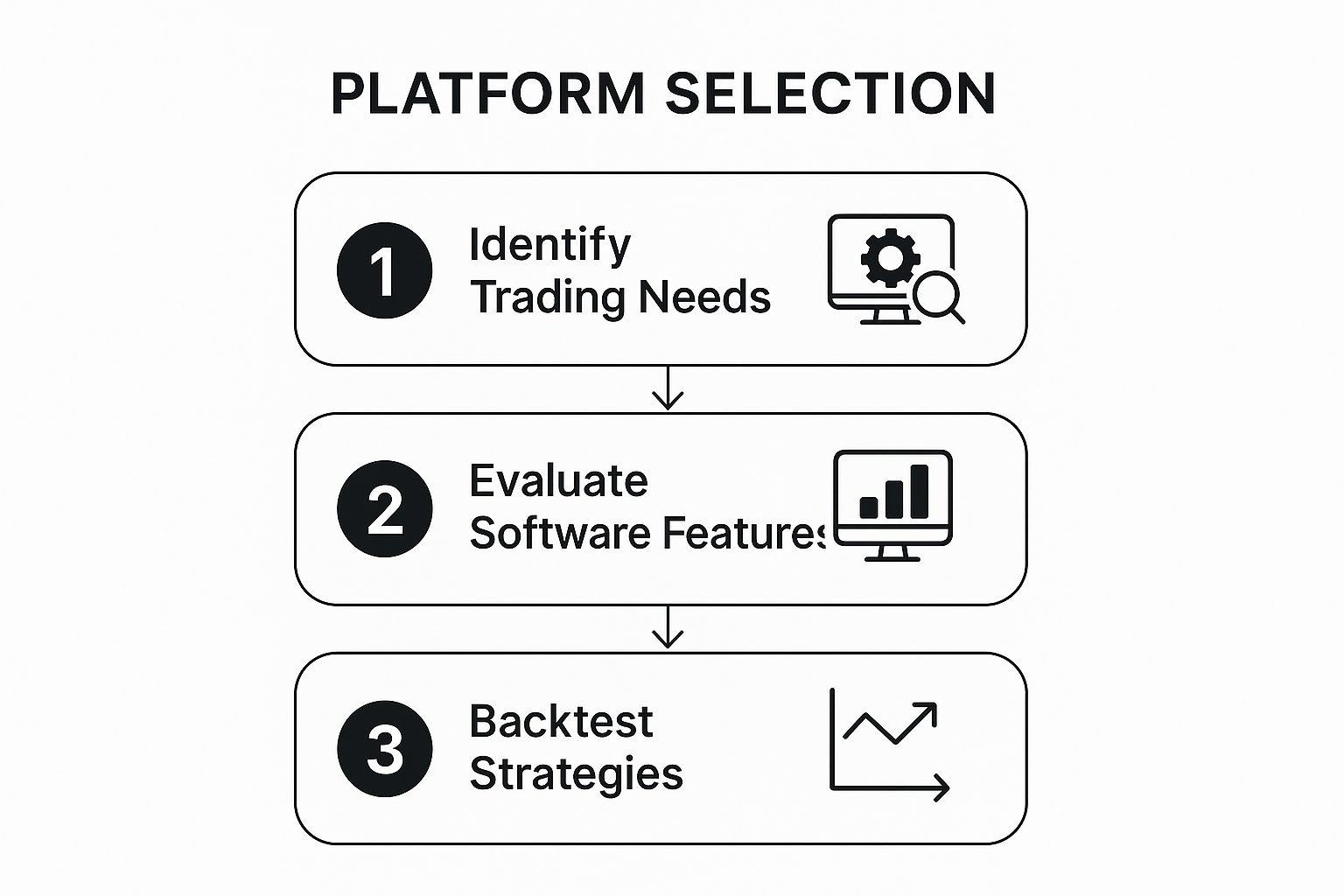

This workflow really just visualizes the common-sense path from figuring out what you need to actually validating that a platform can deliver.

Following this process ensures you don't waste time on software that can’t even meet your basic strategic needs, long before you get to the performance testing phase.

Key Performance Indicators to Scrutinize

When you’re staring at a backtest, some numbers tell a much clearer story than the total profit. These are the Key Performance Indicators (KPIs) that reveal the real risk, consistency, and potential durability of an algorithm.

Here are the non-negotiable metrics you should always hunt for:

- Maximum Drawdown: I’d argue this is the most critical risk metric, period. It measures the biggest drop your account took from its peak value during the test. A max drawdown of 50% means your account was literally cut in half at one point. You have to be comfortable with this number, because it’s a real reflection of the pain you might have to endure.

- Sharpe Ratio: This is all about risk-adjusted return. A higher Sharpe ratio (you generally want to see it above 1.0) suggests the strategy is squeezing more return out of the risk it’s taking. It’s a great way to compare different strategies on an even playing field.

- Profit Factor: This one’s simple: divide the gross profit by the gross loss. A profit factor of 2.0 means the system made twice as much money as it lost. Anything below 1.0 is a losing strategy, plain and simple.

- Win Rate vs. Average Win/Loss: Don't get mesmerized by a high win rate. It can be incredibly misleading if your average losing trade is way bigger than your average winner. A strategy with a 40% win rate can be wildly profitable if its winning trades are three or four times larger than its losing trades.

The Dangers of Curve-Fitting

One of the biggest traps you can fall into when evaluating software is curve-fitting, sometimes called overfitting. This is what happens when a strategy is tuned so perfectly to past data that it looks flawless in a backtest but completely falls apart in a live market.

Essentially, the algorithm has "memorized" old price action instead of learning a durable market logic that can adapt.

A strategy that has never had a losing month in a backtest is a massive red flag. Real-world trading involves drawdowns. An overly perfect historical record almost always points to a curve-fitted system that is not built to last.

To spot this, you have to insist on seeing performance data across different market conditions. How did it do in a bull market? A bear market? What about a long, sideways grind? If a platform only shows you results from a roaring bull run, they’re hiding something.

The best software providers offer robust testing that lets you see exactly how a strategy holds up when the market’s personality changes. You can dive deeper into how to structure these tests in our complete guide to automated day trading systems.

Demanding Out-of-Sample Testing

The absolute gold standard for validating a strategy and avoiding the curve-fitting trap is out-of-sample (OOS) testing.

The process is straightforward: you develop and fine-tune a strategy on one chunk of historical data (the "in-sample" period), and then you test it on a completely different, unseen dataset (the "out-of-sample" period).

If the performance holds up reasonably well in the OOS period, you can have much higher confidence that the strategy has a genuine edge. A huge drop-off in performance during OOS testing is a dead giveaway that the system was overfitted. Any software provider worth their salt should be transparent about their testing methods and show you OOS results. This is what separates professional, systematic trading from hopeful gambling.

Real-World Examples of Automated Trading Success

The true measure of the best algorithmic trading software is its impact on real traders. At Trading Made Easy, we've seen firsthand how our platform transforms trading careers by providing consistency and removing emotional barriers. For instance, one part-time trader struggling to balance a full-time job was able to fully automate his swing trading strategy. By using our visual builder and built-in risk controls, he achieved a consistent 12% average monthly return, turning a stressful hobby into a reliable income stream.

A Part-Time Trader Finally Finds Consistency

Early in 2025, a part-time trader was juggling a full-time job and family life, trying to make a swing trading strategy work in his spare time. It was a constant struggle. Automating his strategy with Trading Made Easy wasn't just a time-saver; it was a game-changer.

He used our visual strategy builder—no coding required—to map out his entry and exit rules based on moving average crossovers. The whole thing took minutes. He then scheduled the algorithm to run before the market opened, so he never missed a critical move while he was busy with his day.

Most importantly, the built-in risk controls kept his drawdown under 5%, protecting his hard-earned capital.

- Simple Setup: Drag-and-drop tools for defining rules.

- Set-and-Forget: Automated execution captured pre-market action.

- Capital Protection: Auto stop-loss and dynamic position sizing kept risk in check.

The result? His swing strategy started generating an average monthly return of 12%. What was once a stressful side hustle became a steady, reliable source of income.

“Trading Made Easy took my plan from paper to profit without constant screen time,” he told us.

This trader clawed back nearly eight hours a week. Instead of staring at charts, he spent that time refining his rules and digging into market analytics—work that actually improved his performance. Automation didn't just execute his plan; it gave him the breathing room to make it better.

A Seasoned Day Trader Scales Operations

Next up, a veteran day trader. She wanted to expand her strategy across three different futures markets at once, but doing it manually was impossible. The markets moved too fast, and she couldn't keep up with the rapid price changes.

By deploying our algorithmic trading software, she was able to hit micro-opportunities across all three markets simultaneously while enforcing her iron-clad stop rules.

Her setup involved:

- Linking multiple brokerage accounts to trade from a single dashboard.

- Integrating a real-time data feed to slash latency.

- Using a live risk dashboard to instantly pause strategies during major news events.

This new workflow boosted her daily trade count by a massive 150%, all while keeping her maximum drawdown at a tight 3.2%.

To diversify across equity, energy, and metal futures, she needed that seamless connectivity. Our direct market access cut her average execution time from a painful five seconds down to just 0.2 seconds. Faster fills meant less slippage, which is critical for high-frequency setups.

“Scaling across symbols without extra screens was a game-changer,” she noted.

Manual vs. Automated: The Hard Numbers

The difference is night and day. Just look at the data:

| Metric | Manual Trading | Automated Trading |

|---|---|---|

| Daily Trades | 10 | 25 |

| Average Win Rate | 58% | 73% |

| Average Execution Time | 5 seconds | 0.2 seconds |

| Max Drawdown | 8% | 3.2% |

Automated workflows didn't just make trading easier; they made it quantifiably better. The numbers don't lie.

Takeaways from the Pros

These stories aren't just for inspiration. They're packed with lessons for anyone serious about trading.

- Embrace visual builders to get your ideas running quickly.

- Leverage built-in risk modules to protect your capital. It's non-negotiable.

- Use multi-market access to diversify and scale your operations.

- Constantly review performance metrics to adapt to changing markets.

What's Next for You?

Since 2014, Trading Made Easy has been dedicated to one thing: helping traders like you turn their ideas into powerful, automated systems. We're here to simplify execution and give you the tools for smart, disciplined risk control.

Ready to see how our automated day trading software can fit your goals? Explore our platform features or join a live webinar.

Start your free trial today and find out what systematic success feels like.

When you're ready to take the plunge and start integrating an algorithmic trading platform, you're looking at a 6-to-12-month journey from initial evaluation to full-scale deployment.

Let’s be honest, it’s not a weekend project. Getting it right takes time and a methodical approach, but the payoff can be huge.

Evaluation And Selection (1-3 Months)

This is where you do your homework. Think of it as the research phase, where you’re kicking the tires on different platforms to see what’s under the hood.

First up, you’ll be defining exactly what you need. Are you a high-frequency trader needing nanosecond execution, or are you focused on long-term portfolio rebalancing? Your needs dictate the features you prioritize.

Next, you'll start shortlisting vendors. Look at industry leaders like QuantConnect, AlgoTrader, and MetaTrader. Dive into case studies, read user reviews, and get a feel for their reputation in the trading community. I’ve seen traders get burned by choosing a flashy platform that couldn’t handle their specific asset class, so due diligence here is crucial.

Proof of Concept (2-4 Months)

Once you have a couple of solid contenders, it’s time for a test drive. This is your proof-of-concept (PoC) phase.

You’ll set up a controlled testing environment—a sandbox—to see how the software performs with a small, non-critical part of your portfolio. This isn't about making big profits yet; it's about validating the vendor's claims. Does the backtesting engine work as advertised? Can it connect to your data feeds without a hitch?

At this stage, you're looking for red flags. A PoC that constantly crashes or gives inconsistent backtesting results is a clear sign to walk away, no matter how good the sales pitch was.

Implementation and Integration (2-4 Months)

Found your winner? Great. Now the real work begins. Implementation involves installing the software and, more importantly, integrating it with your existing systems.

This means linking it to your brokerage accounts, data providers, and risk management tools. It’s rarely plug-and-play. Expect to spend time configuring APIs, customizing settings, and ensuring data flows smoothly between all your systems. This is where having a vendor with excellent technical support really pays off.

Testing and Deployment (1-2 Months)

Before you let the algorithm trade with significant capital, you need to test it relentlessly. This goes beyond the PoC.

You’ll be running final backtests with your fully developed strategies and then moving on to paper trading, where the system executes trades in a simulated environment using live market data. It’s the final dress rehearsal. Only after the system proves its stability and profitability in paper trading should you consider going live.

Rolling it out is usually a phased process. You might start with a small allocation of capital and gradually increase it as you build confidence in the system's performance. Never just flip the "on" switch for your entire fund on day one—that’s a recipe for disaster.

Your Partner in Automated Trading

Choosing the right algorithmic trading software is a critical step toward achieving disciplined, consistent results. Throughout this guide, we've highlighted the essential features: robust backtesting, intuitive strategy builders, and non-negotiable risk management. These are the pillars that support long-term success. At Trading Made Easy, we've spent years perfecting these tools to provide a platform that is both powerful and accessible. We believe that with the right partner, any trader can harness the power of automation.

Ready to take the next step? We encourage you to explore our offerings and see how Trading Made Easy can help you achieve your trading goals.

At Trading Made Easy, we're here to give you the tools, support, and know-how to make automated strategies a core part of your trading plan. See how our platform works and get started.

Leave a Reply