Thinking about jumping into day trading? Since 2014, Trading Made Easy has been dedicated to a simple mission: demystifying the trading industry and empowering individuals with the tools for success. It’s a path that requires a clear head and the right tools. You'll need to get a solid grip on market fundamentals, pick a platform you can trust, map out a strategy, and definitely get your feet wet with a demo account before putting real money on the line. It's a discipline, for sure, but with a structured game plan, it’s completely within reach.

Your Introduction to Day Trading with Trading Made Easy

Since we started back in 2014, our mission at Trading Made Easy has been simple: pull back the curtain on the world of trading and make it accessible to everyone. We've always believed that with the right tech and a good support system, anyone can learn to navigate the markets. This guide is my direct answer to the question I hear all the time—"how do I start day trading?"—by laying out a practical roadmap.

The journey from hopeful beginner to confident trader is full of challenges. Let's be honest, day trading is demanding. It calls for quick thinking, solid emotional control, and a real feel for how the markets breathe. This is exactly where our approach, which we've been honing for a decade, gives you a serious leg up.

A Modern Approach to Trading

We bring together powerful technology, ongoing education, and a strong community to create a complete ecosystem for our traders. Our goal isn't just to hand you some software; it's to arm you with the confidence and the know-how to actually execute your strategy when it counts.

The hard truth is that most new traders stumble because they don't have a disciplined framework. Emotions like fear and greed are notorious for clouding judgment, which leads straight to impulsive moves and unnecessary losses.

Day trading is one of the best and most expensive self-development programs you will ever enroll in. To succeed, you need good control of your emotions and discipline, forcing you to look inward and analyze your personality flaws.

This is the very problem we built our platform to solve. We provide tools designed to automatically enforce your trading rules, taking the emotional guesswork right out of the picture.

Key Features That Empower Traders

Our automated day trading software is the core of our platform, designed to give you a decisive edge by handling the complex, repetitive tasks that are crucial for success. Here’s a look at the unique features that benefit our traders:

- Algorithmic Analysis: Our software uses advanced algorithms to tirelessly scan markets, identifying high-probability opportunities that align with your specific strategy, doing the heavy lifting for you.

- Precision Execution: Trades are executed with microsecond speed and accuracy, capitalizing on fleeting market movements that are impossible to catch manually.

- Integrated Risk Management: Protect your capital with built-in safety nets. Simply set your risk parameters, and the software will enforce them, preventing catastrophic losses from a single bad trade.

- Emotional Detachment: By automating execution, our system ensures you stick to your trading plan, which is essential for avoiding the emotional rollercoaster that derails so many traders.

Real Success Stories from Our Community

The true measure of our software's impact is the success of our users. We've seen countless traders transform their results by integrating our automated system into their approach. For instance, a busy professional who struggled to find time for manual trading used our software to remain active in the market and achieve consistent results without being tied to their screen. Another trader, who had a habit of letting losses run, utilized our risk management tools to enforce strict stop-losses, a simple change that protected their capital and allowed for steady profit growth. These success stories highlight a common theme: the right tools can make all the difference in a trader's journey.

Picking Your Market and Gearing Up for Trading

Before you ever think about placing a trade, you need to lay some groundwork. This isn't the exciting part, I know, but getting it right is crucial. It all comes down to two big decisions: where you’ll trade and what tools you’ll use. These choices shape everything—your daily schedule, the strategies that work, and ultimately, your chances of coming out ahead.

Choosing between markets like forex, stocks, or commodities is a personal call. It really depends on your personality, how much risk you're comfortable with, and the capital you have to work with. Each market has its own vibe, with different trading hours, volatility, and startup costs.

For example, if you're someone who enjoys fast-paced action and you're starting with a smaller account, the forex market might be a good fit. But if you prefer digging into company performance and have more capital to meet the higher requirements, you might lean toward stocks.

Finding Your Place in the Major Day Trading Markets

You have to understand the personality of each market. We're talking about things like liquidity (how easily you can get in and out of a position) and volume (how many people are trading). For day traders, these aren't just buzzwords; they're everything. You need to be able to execute your trades instantly and at the price you want.

The sheer size of these markets is mind-boggling. Take the forex market—it's the biggest in the world, with an average of $7.51 trillion changing hands every single day. The EUR/USD pair alone makes up 22.7% of that, which is about $1.71 trillion traded daily. This massive volume means you get tight spreads and fast execution, which is exactly what a day trader needs. For a deeper dive into these numbers, you can check out the latest reports from sources like Tradeweb.

A rookie mistake I see all the time is jumping into a market just because it's popular. Don't follow the hype. The real goal is to find the environment where your specific strategy can actually work. Discipline starts here, with picking the right playground.

To help you get a feel for the options, here's a quick comparison of some of the most popular markets for day traders.

Key Day Trading Market Comparison

| Market | Average Daily Volume | Best Trading Hours (EST) | Key Characteristics |

|---|---|---|---|

| Forex | $7.5 trillion | 24/5, peak at 8 AM – 12 PM | Highest liquidity, low capital entry, high leverage. |

| US Stocks | $400+ billion | 9:30 AM – 4 PM | Wide variety of assets, requires significant capital ($25k+). |

| Futures | $15+ trillion (notional) | Nearly 24/5, varies by asset | Leveraged, diverse (indices, commodities), centralized exchange. |

| Crypto | $100+ billion | 24/7 | High volatility, decentralized, less regulated. |

This table should give you a starting point. Think about which trading hours fit your schedule and which characteristics align with your risk tolerance.

Your Trading Command Center

Once you've picked a market, it's time to build your setup. This is more than just having a decent computer; it's about creating a reliable, professional-grade system that won’t fail you when money is on the line.

Think of it as your command center. You don't need to go crazy, but here's a solid baseline:

- A Reliable Computer: You'll want a modern processor (an Intel i7 or something similar) and at least 16GB of RAM. This will keep your trading platforms and charting software running smoothly without frustrating lags.

- High-Speed Internet: This is non-negotiable. A stable, wired connection is best. A delay of just a few seconds can turn a winning trade into a losing one.

- Multiple Monitors: You can start with one, but most serious traders eventually end up with at least two. It's incredibly helpful to have your trading platform on one screen and your charts, news, or our uncategorized trading resources on another for a full view of the market.

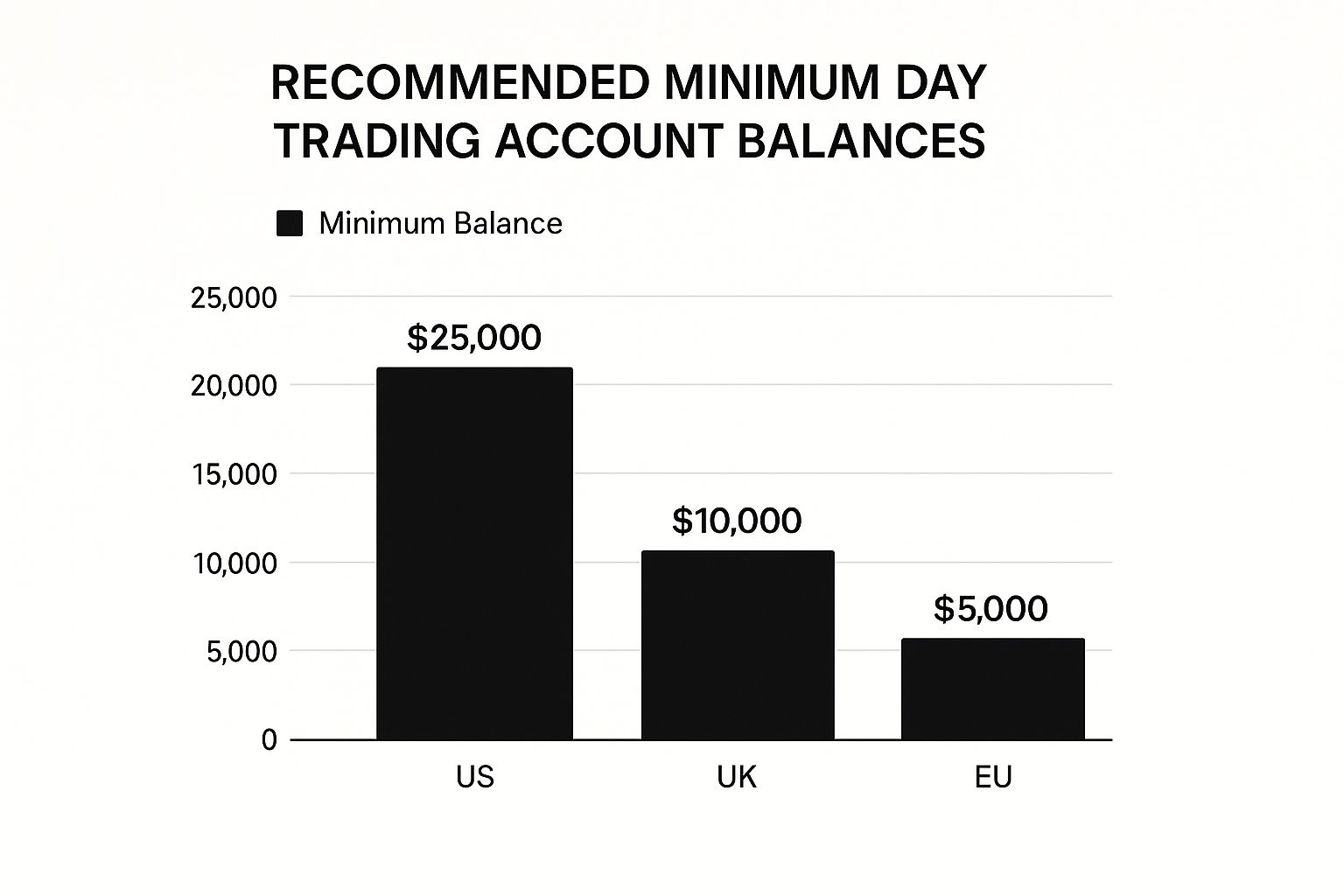

Capital requirements are another huge factor. The image below shows just how different the minimum account balances are depending on where you live.

As you can see, the U.S. has a strict $25,000 minimum for pattern day traders. It’s a perfect example of why you need to know the rules of the game before you start playing.

Finally, the most critical tool in your arsenal is your trading platform. This is your portal to the markets, and it has to be fast, dependable, and easy to use. With a platform like Trading Made Easy, our goal is to handle the complicated stuff for you, so you can focus on executing your strategy cleanly and confidently, no matter which market you've chosen. Building this solid foundation is the first real step on your journey.

Gaining an Edge with Automated Trading Software

When you step into the day trading arena, you're entering a world that moves at the speed of light, driven by massive amounts of data. I’ve seen countless traders struggle because success often comes down to how fast you can process information and act on it. This is where automated trading software, like the system we’ve perfected here at Trading Made Easy, becomes your most powerful ally.

If you're wondering how to start day trading without getting completely overwhelmed, automation is the key. It's built to level the playing field, giving you the kind of speed and discipline that used to be reserved for big-shot financial institutions. Our software becomes your tireless partner, executing your strategy with precision while you stay focused on the bigger picture.

Today's markets are a different beast entirely. They're complex, lightning-fast, and packed with competition. With trading volumes exploding—Cboe Global Markets, for instance, reported 31 million options contracts traded in a single month—you simply can't keep up without robust software. The entire market has shifted to electronic, algorithm-driven trading, which means you need a system that can analyze and execute in the blink of an eye. You can get a deeper sense of how these volumes shape the game by checking out these insights on modern trading complexities.

How Automation Pinpoints Opportunities

At the heart of our platform, you'll find proprietary algorithms built to do one thing: analyze market data relentlessly. Think of these algorithms as the engine of your trading strategy, constantly scanning for the exact conditions you’ve laid out for entering or exiting a trade. It’s a process that happens faster and more consistently than any human could ever hope to manage.

So, instead of being glued to your screen watching every single price tick, you can define your parameters and let the software handle the grunt work. This systematic approach means you never miss a prime opportunity just because you stepped away to grab a coffee. It’s all about swapping constant screen time for intelligent automation.

Executing Trades with Unwavering Precision

Once our system identifies a valid trading setup, speed is everything. A delay of just a fraction of a second can be the difference between a winning trade and a missed chance. Our automated execution function was engineered for this exact scenario, placing trades with microsecond accuracy.

This level of precision completely removes the hesitation and "analysis paralysis" that I see cripple so many manual traders. There’s no more second-guessing or fumbling with the order entry screen. The software executes the trade exactly as your strategy dictates, getting you in and out of the market at the most optimal moment.

The greatest challenge in day trading isn't finding a good strategy; it's executing that strategy flawlessly, over and over again, without letting fear or greed interfere. Automation is the ultimate tool for achieving that consistency.

This mechanical discipline is what truly separates consistently profitable traders from everyone else. The software doesn’t get tired, distracted, or emotional. It just follows the rules you give it.

Fortifying Your Capital with Integrated Risk Management

This might be the most important function of our software: integrated risk management. Every single successful trader I know will tell you that protecting your capital is job number one. Our platform has built-in safeguards that automatically enforce your personal risk rules on every trade, without exception.

This means you can set your maximum loss per trade, your daily loss limit, and other key risk metrics ahead of time. Once those rules are in place, the software will not break them.

- Automatic Stop-Losses: The system instantly places a stop-loss order the moment your trade is opened, protecting your position from an unexpected market turn.

- Position Sizing: It calculates the correct position size for you based on your account balance and risk percentage, which keeps you from accidentally over-leveraging on a single trade.

- Daily Loss Limits: If your account hits a predetermined loss amount for the day, the software can automatically stop trading to prevent any further damage. This is a lifesaver.

These aren't just fancy features; they are your financial safety net. They enforce the kind of discipline that is incredibly difficult to maintain on your own, especially during a losing streak when the urge to "revenge trade" is strongest. By taking the emotional component out of risk management and embedding it into the system, you’re free to trade with a clearer, more objective mind. For anyone serious about how to start day trading for the long haul, this is absolutely foundational.

Real Success Stories From Our Trading Community

It’s one thing to talk about how software works, but nothing hits home like seeing real-world results. We’ve been at this since 2014, and in that time, we've had a front-row seat to some incredible trading journeys. These stories from the Trading Made Easy community aren't just about making money—they're about genuine transformation.

Most people get into day trading chasing financial freedom. What they often find is a much tougher road than they expected. Let's be honest about the numbers: day trading has a notoriously high failure rate.

Research published on MoneyZine.com shows that about 97% of day traders lose money in their first year. Only a tiny fraction, around 12%, manage to stay profitable. It’s a tough gig, with about 85% of traders quitting within three years because of mounting losses.

Those stats are exactly why we built our system—to give traders a real, sustainable edge against those odds.

Taking Emotion Out of the Equation

One of the biggest hurdles we see traders face, time and time again, is letting their emotions get the best of them. We worked with a trader—we’ll call him Alex—who knew his technical analysis inside and out. The problem? He was his own worst enemy, constantly sabotaging his own trades. He’d anxiously cut his winning trades short and let his losers run, praying for a miraculous turnaround.

It’s a classic, account-draining mistake.

After he started using our automated software, everything changed. Alex began setting his profit targets and stop-losses before he even entered a trade. The system took over from there, executing his plan perfectly without a hint of fear or greed.

The difference was immediate. By removing his own emotional interference, he finally found the consistency that had been just out of his reach. His story is a powerful example of how automation can instill the discipline every trader needs.

Turning Market Volatility Into an Advantage

Another great story comes from a trader named Sarah, who used our software to handle a major market-moving news event. In the past, those volatile moments were a source of pure anxiety and big losses for her. The market just moved too fast to keep up with manually, which led to panicked, costly decisions.

This time, she used Trading Made Easy to set up a strategy that reacted to specific volatility triggers. When the news broke, the software went to work, executing several quick, small trades based on her pre-set rules. It capitalized on the rapid price swings.

In a situation where she would have normally frozen up or taken a substantial loss, the system performed flawlessly on her behalf. It demonstrated how automation turns volatile, high-risk scenarios into manageable opportunities.

She was able to profit from the market’s chaos without the emotional whiplash that usually came with it. That’s a game-changer, especially for new traders who need a system that can handle the pressure.

Finding a Way to Trade as a Busy Professional

A lot of our members are busy professionals, just like David, a full-time engineer. He was passionate about trading but just didn't have the time to be glued to charts all day. For a long time, he couldn't figure out how to stay active in the market without it compromising his career.

He found his solution by automating his futures trading strategy on our platform. Now, he spends about an hour each evening reviewing the market and setting up his parameters for the next day. The software handles the rest.

This setup allows him to participate in the markets and grow his account, all without being chained to a desk. His success proves you don’t have to quit your day job to trade—you just need the right tools to do it efficiently. For anyone in a similar boat, we have specialized training for beginner traders that dives deep into this approach.

All of these stories share a common theme: when used the right way, technology gives traders the power to overcome the biggest obstacles and finally build lasting consistency.

Your Next Steps With Trading Made Easy

Since we started Trading Made Easy back in 2014, our mission has stayed the same: to cut through the noise and make the world of trading genuinely accessible. I've seen firsthand that with the right tools and straightforward guidance, anyone can learn to navigate the markets with more confidence.

We've covered a lot in this guide, from market basics to the serious advantages of our automated trading software. Now it’s time to pull it all together so you know exactly what to do next.

The path to becoming a successful day trader is tough. There's no sugarcoating it. But it's also one of the most rewarding things you can do, forcing you to grow not just as a trader, but as a person. The real-world success stories we share aren't just about the money; they're about people who finally mastered discipline, got a handle on risk, and completely changed their results. It shows you what’s truly possible when a good strategy meets powerful automation.

How Our Software Actually Helps You

Look, the biggest edge our automated software gives you is simple: it executes your plan without getting sidetracked by emotion. It follows the rules you set with speed and precision, helping you dodge the classic mental traps—fear and greed—that knock so many traders out of the game. That kind of systematic approach is what builds consistency over the long haul.

Here's what the platform handles for you:

- Algorithmic Analysis: It does the heavy lifting, scanning markets 24/7 for opportunities that fit your exact criteria.

- Automated Execution: Your trades get placed with precision, helping you catch moves you'd almost certainly miss if you were trying to do it all by hand.

- Built-in Risk Management: It protects your capital with automated stop-losses and position sizing, forcing discipline on every single trade.

"The real test of any trading system isn't just finding winners. It's about protecting you from the kind of losses that can wipe you out. We built our software with risk management at its very core to give you the foundation you need to survive and thrive long-term."

Take Your First Real Step Today

We've laid out the "how-to," but knowledge is just potential until you put it into action. This is that moment—the time to go from just reading to actually doing. I genuinely encourage you to explore everything Trading Made Easy has to offer.

To see our system work in a live environment and get your questions answered by experts in real-time, the best next step is to join one of our free live webinars held daily. It's the perfect place to see how the platform works and connect with our trading community. This is your chance to turn what you've learned into your first solid step toward becoming a more confident, strategic trader. Don't wait to build a better trading future.

Your Top Day Trading Questions, Answered

Jumping into the world of day trading always brings up a ton of questions. I get it. When you're starting out, everything feels a bit uncertain. We've heard just about every question in the book from new traders, so I've put together some straight-shooting answers to the most common ones.

The goal here is to clear up the confusion and give you the practical, real-world advice you need to get started on the right foot.

How Much Money Do I Really Need to Get Started?

This is always the first question, and for good reason. The honest answer? It really depends on where you live and what you want to trade.

If you’ve got your eye on U.S. stocks, you'll immediately bump into something called the Pattern Day Trader (PDT) rule. It’s a regulation that says you need to keep a minimum balance of $25,000 in your account if you make four or more day trades in a five-day span. That’s a steep entry fee for most people.

That's why many traders I know got their start in other markets like futures or forex, which have much more forgiving capital requirements. You can realistically get into the futures market with an account between $2,500 and $5,000. The most important thing is to only fund your account with money you are truly prepared to risk—capital that won't disrupt your life if you lose it.

One of the biggest mistakes a new trader can make is being undercapitalized. Starting with too little cash puts an insane amount of pressure on every single trade. It forces you into bad habits, like risking too much on one position just to try and make a meaningful profit. It's a recipe for blowing up your account.

Can I Day Trade While Working a Full-Time Job?

Absolutely. In fact, most successful traders I know started out exactly this way, balancing their trading ambitions with a 9-to-5 career. You just have to be smart about it and pick the right tools and markets.

Find a Market That Fits Your Life: The forex market never sleeps, running 24 hours a day, five days a week. This gives you incredible flexibility to trade before or after your day job. Futures markets also offer extended hours outside the typical stock market session.

Let Technology Do the Heavy Lifting: This is where automation becomes your best friend. A platform like Trading Made Easy lets you build your strategy, set your rules, and then let the software execute trades for you. You can be at work, in a meeting, or away from your desk, and your strategy keeps running.

This hybrid approach allows you to build your trading skills and account without giving up the security of your main income. It's the most practical path forward for a reason.

How Long Until I'm Actually Profitable?

There's no single answer here, and anyone who gives you a specific timeline is selling you something. The learning curve is steep. For some people, things click in a few months. For others, it takes a couple of years of dedicated effort.

Trading is a professional skill, just like becoming a doctor or an engineer. It’s not a lottery ticket. It demands patience, screen time, and a genuine commitment to learning from your wins and your losses.

So many new traders fall into the Dunning-Kruger trap—a psychological bias where a little bit of knowledge leads to a lot of overconfidence. They'll string together a few winning trades and think they've cracked the code, only to be brutally humbled by the market a week later. True, lasting profitability comes from surviving those lessons and building real expertise over time.

Is Automated Trading Software Actually Any Good?

When it’s used the right way, it’s more than good—it’s an absolute game-changer. Automation directly tackles the two biggest demons that haunt every trader: emotion and hesitation.

Fear of losing money and greed for bigger profits cause traders to break their own rules. Think about it: you exit a winning trade too early or hold onto a loser way too long, hoping it will turn around. That’s emotion talking. An automated system executes your pre-defined strategy with zero emotion, keeping you disciplined.

On top of that, it’s lightning-fast. By the time you see an opportunity, click your mouse, and confirm the order, the price may have already moved against you. Software places orders in milliseconds, capturing small, fleeting movements that are impossible for a human to catch manually. It’s about replacing emotional, inconsistent actions with pure, disciplined execution.

What’s the Single Most Important Skill for a New Trader?

If you forced me to pick just one, it’s risk management. Hands down.

You could have the most brilliant, back-tested trading strategy in history, but if you don't know how to protect your capital, you will eventually go broke. It's a mathematical certainty.

Your primary job as a new trader isn't to hit home runs; it's to stay in the game. That means mastering position sizing, knowing exactly where to place your stop-loss before you enter a trade, and having the discipline to walk away when your daily loss limit is hit.

Embrace this defense-first mindset from day one. It's the foundation that every single successful trading career is built on.

We've covered a lot of the common questions that come up when you're just getting started. Here's a quick summary table for easy reference.

| Question | Answer |

|---|---|

| How much capital do I need? | For US stocks, you'll need $25,000 due to the PDT rule. Futures and forex markets are more accessible, often starting around $2,500 – $5,000. |

| Can I trade with a full-time job? | Yes. Choose a market with flexible hours (like forex or futures) and use automated software to execute trades when you're busy. |

| When will I be profitable? | It varies for everyone, from months to years. Focus on learning and skill development, not on a specific timeline. Profitability is a result of discipline and experience. |

| Is automation effective? | Yes, it eliminates emotional decision-making and executes trades faster than any human can, providing a crucial edge in consistency and discipline. |

| What's the most important skill? | Risk management. Your first goal is to protect your capital. Master this, and you'll survive long enough to become profitable. |

These are the core truths of trading. Understanding them puts you miles ahead of most people who are just starting their journey.

Ready to stop just learning and start doing? Trading Made Easy gives you the automated tools to apply these principles with confidence and discipline.

Discover how Trading Made Easy can execute your strategy with precision.

Article created using Outrank

Leave a Reply