Future Trading Markets are on Fire Cash in Now

Trading Made Easy

We Been in the Game

The Futures Market For 14 Years

And

Still Going !!

Why Trade Futures

Trading futures offers a range of potential advantages for traders, primarily focusing on speculation and hedging

.

Here are some key reasons why traders might choose to trade futures:

- Leverage:

- Futures trading allows you to control a large contract value with a relatively small amount of margin (an initial deposit), which can magnify both potential profits and losses.

- Diversification:

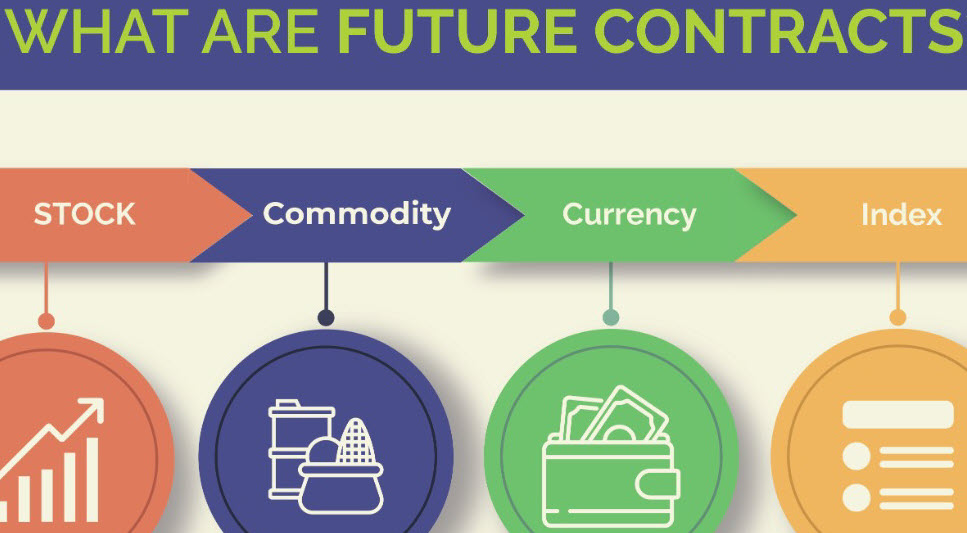

- Futures provide access to a wide variety of markets, including commodities (like oil and gold), indexes, currencies, and interest rates, allowing for potential portfolio diversification and risk management.

- Hedging:

- Futures contracts can be used to hedge against potential adverse price movements in the underlying asset, helping businesses lock in costs or sales prices.

- Liquidity:

- Many futures markets are highly liquid, meaning it’s easy to enter and exit positions, and potentially at lower transaction costs.

- 23-Hour Trading:

- Futures markets are often open nearly 23 hours a day, allowing traders to react to global market events and trade on their own schedule.

- No Pattern Day Trader Rules:

- Unlike stock trading, futures trading is not subject to the pattern day trader rule that requires a minimum account balance for active day trading.

- Ease of Shorting:

- Futures contracts can be easily shorted, allowing traders to profit from falling prices.

- Tax Advantages:

- In the U.S.

- profits from futures trading receive favorable tax treatment under Section 1256 of the Internal Revenue Code, where 60% of gains are taxed as long-term capital gains and 40% as short-term gains, regardless of holding period.

- Fair and Transparent Price Discovery:

- Futures markets are generally considered transparent, with all traders having access to the same price and volume data.

- Flexible Trade Sizing:

- Futures contracts come in various sizes, including Micro futures, which allow traders with smaller accounts to participate with reduced risk.

Important Considerations:

- High Risk:

- While leverage can amplify profits, it also magnifies losses, making futures trading potentially very risky.

- Margin Calls:

- Futures trading requires a margin account, and traders may face margin calls if their losses exceed their account balance.

- Complexity:

- Futures trading can be complex and requires a strong understanding of market dynamics and trading strategies.

- Volatility: Futures contracts can be sensitive to market fluctuations, which can lead to rapid price changes.

Discover the Advantages of Futures Trading

Learn how Trading Made Easy transforms futures trading with high liquidity, flexibility, and smart risk management.

High Market Liquidity

Access deep and active markets that ensure fast trade execution and minimal price slippage for all traders.

Flexible Trading Strategies

Tailor your approach with diverse futures contracts that allow you to capitalize on a variety of market movements.

Advanced Automation Tools

Utilize our platform’s automated features to enhance decision-making and manage risks effectively with ease.

Futures trading offers unparalleled liquidity and the chance to capitalize on market trends with precision.

NINJA https://ninjatrader.com/ TRADER

800-971-4160