Since 2014, Trading Made Easy has been on a singular mission: to simplify the complex world of trading and empower individuals to execute their strategies with precision and discipline. We believe that successful trading shouldn't require you to be chained to a screen, reacting to every market fluctuation. It should be about having a solid plan and the right tools to execute it flawlessly. This guide will show you how to leverage a cornerstone of technical analysis—the moving averages trading strategy—using our powerful automated day trading software.

Essentially, a moving average filters out the day-to-day market chaos, smoothing out price data to reveal the underlying trend. It's how traders spot potential entry and exit points, and with automation, it becomes a hands-off, disciplined system.

Building Your Automated Trading Foundation

The theory behind moving averages is simple, but turning that theory into consistent profit is where most traders struggle. This is where our automated day trading software creates a significant advantage. We built our platform to translate your trading ideas into perfectly executed actions, removing emotion and human error from the equation.

Our unique software offers several key features designed for serious traders:

- Hands-Free Execution: Define your moving average crossover rules once, and our system will monitor the markets 24/7, executing trades the instant your conditions are met. No hesitation, no second-guessing.

- Advanced Risk Management: Automatically attach dynamic stop-loss and take-profit orders to every trade. You can set a stop-loss that trails a specific moving average, protecting your capital with intelligent, adaptive rules.

- Powerful Backtesting Engine: Before you risk a single dollar, you can test your moving average strategy against years of historical data. Our platform provides detailed performance reports, including profit/loss, maximum drawdown, and win rate, so you can trade with data-backed confidence.

The core benefit is shifting from being a reactive trader to a proactive one. Instead of waiting to spot a signal, you build a system that anticipates and acts for you, ensuring you never miss an opportunity.

This guide will walk you through setting all of this up. You’ll learn how to configure different moving averages, define your exact entry and exit rules, and finally start trading with the confidence that only data-driven decisions can bring.

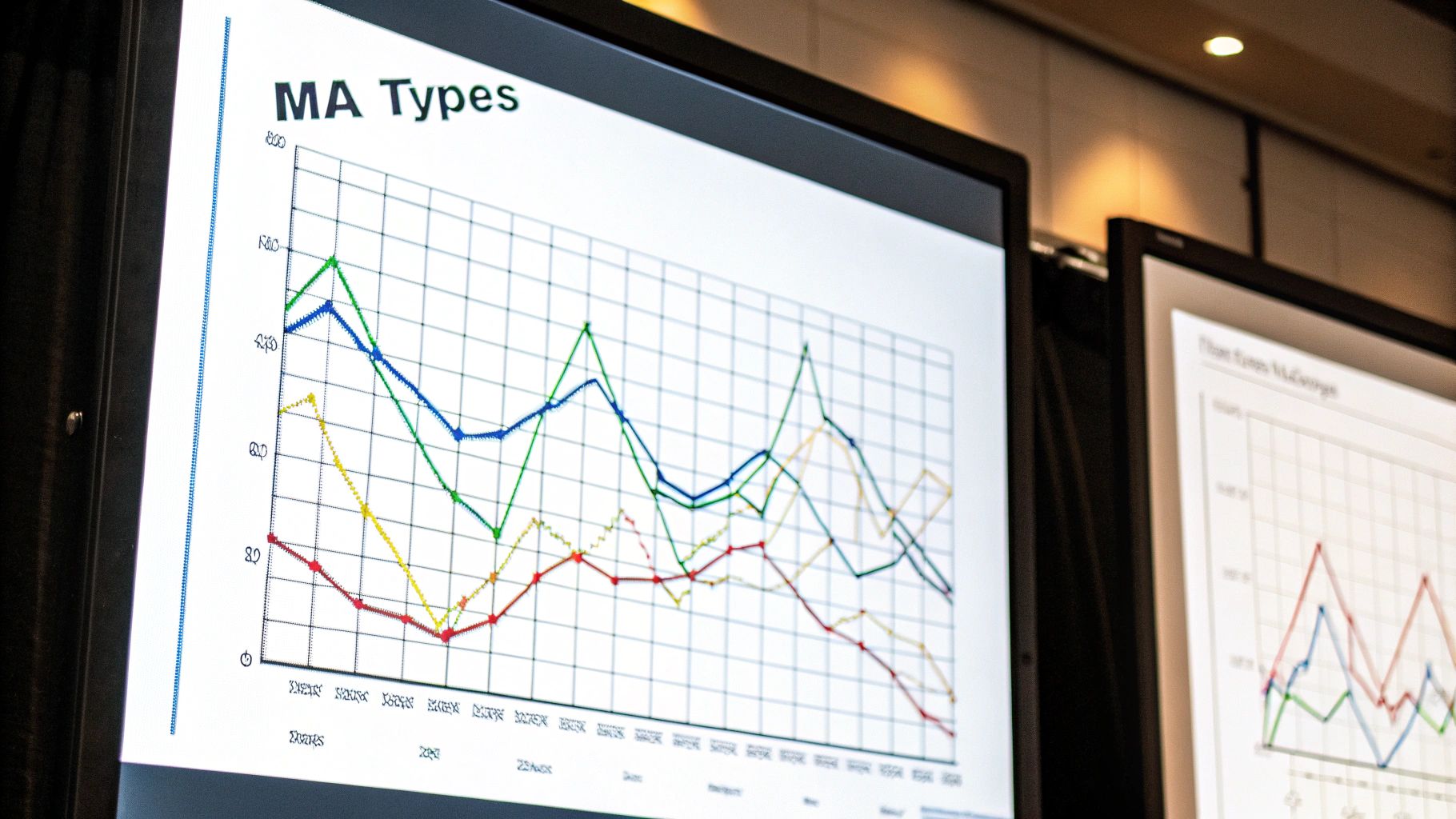

Choosing the Right Moving Average for Your Goal

Not all moving averages are created equal. The one you choose depends entirely on your trading style and what you're trying to accomplish. Some are built for speed to catch quick momentum shifts, while others are designed to give you a smoother, long-term view.

The table below breaks down the essential moving average types and shows you how to apply them within our software for different market conditions.

| Moving Average Type | Calculation Method | Best For | Software Application |

|---|---|---|---|

| Simple Moving Average (SMA) | Averages prices over a set period. | Identifying long-term, stable trends. | Use longer periods (e.g., 50, 200) to confirm the primary market direction. |

| Exponential Moving Average (EMA) | Gives more weight to recent prices. | Reacting quickly to new price action and short-term trends. | Set up crossover strategies with shorter periods (e.g., 9, 21) to catch momentum shifts. |

| Weighted Moving Average (WMA) | Similar to EMA, but with a linear weighting. | Finding a balance between SMA's smoothness and EMA's speed. | A good middle-ground for trend-following in moderately volatile markets. |

Think of this as your starting toolkit. An EMA might be your go-to for fast-moving day trades, while an SMA on a higher timeframe can keep you aligned with the bigger picture, preventing you from trading against a powerful underlying trend. The key is to match the tool to the job at hand.

Selecting the Right Time Frames for Your Strategy

Choosing the right moving average period can honestly make or break your moving averages trading strategy. Get it right, and you’ve got a powerful tool. Get it wrong, and you're in for a long series of frustrating false signals.

It's not about hunting for some magic number. It's about matching the MA's time frame to the personality of the asset you're trading and what you’re actually trying to accomplish.

Think about it like this: a speedboat is fast and nimble, reacting to every little wave. An ocean liner is slow and steady, powering through small chop and only concerned with the major underlying current. A short-term moving average is that speedboat, while a long-term MA is the ocean liner. Your job is to pick the right one for the job.

With a platform like Trading Made Easy, you can see this in action immediately. A day trader glued to a volatile tech stock might find a 20-period EMA is perfect for catching those quick intraday swings. On the other hand, a swing trader analyzing an entire index like the S&P 500 will lean on a 200-period SMA to see the bigger picture—the defining line between a bull and bear market.

Aligning MA Periods With Your Goals

The period you choose directly impacts how sensitive your automated signals are.

Shorter periods spit out more signals. This sounds great for active day trading, but it can also lead to "whipsaws"—getting chopped up in sideways, non-trending markets. Longer periods give you fewer signals, but they tend to be more reliable for identifying and riding major trends for weeks or even months.

The core principle is simple: Your moving average period must align with your intended holding period. A mismatch here is a primary reason why many automated strategies fail. You can't successfully day trade using a 200-day MA, just as you can't define a multi-year bull market with a 9-period EMA.

Don't forget to consider the asset's volatility, too. A slow-and-steady utility stock will behave very differently than a fast-moving crypto, and they'll likely require different MA settings. This is where your backtesting becomes absolutely crucial.

Standard Periods and Their Roles

You'll notice that traders, from big institutional players to folks trading from home, often gravitate toward the same set of MA periods. There's a good reason for this—they work as fantastic starting points.

As detailed in posts on the QuantInsti's blog, key periods like the 10, 20, 50, 100, and 200-day averages each serve a distinct purpose. Shorter MAs are loved for their quick reaction to price changes, while the big ones are there to confirm major trends with smoother, more dependable signals.

Here’s a quick rundown of how these are typically used in the real world:

- 10 & 20-Period MAs: These are the bread and butter of short-term trading and momentum analysis. They hug the price action closely and are great for jumping on quick moves.

- 50-Period MA: This is a classic for identifying the medium-term trend. Many traders watch the 50-period MA like a hawk, looking for pullbacks that offer a chance to enter an already established trend.

- 200-Period MA: This is the big one. It's widely seen as the definitive line in the sand between a long-term bull and bear market. If the price is consistently trading above the 200-period MA, the outlook is bullish; below it, bearish.

By testing these different periods and aligning your choice with the market's volatility and your personal goals, you start creating automated signals that are genuinely meaningful and, most importantly, actionable.

Bringing Crossover Logic to Life with Automation

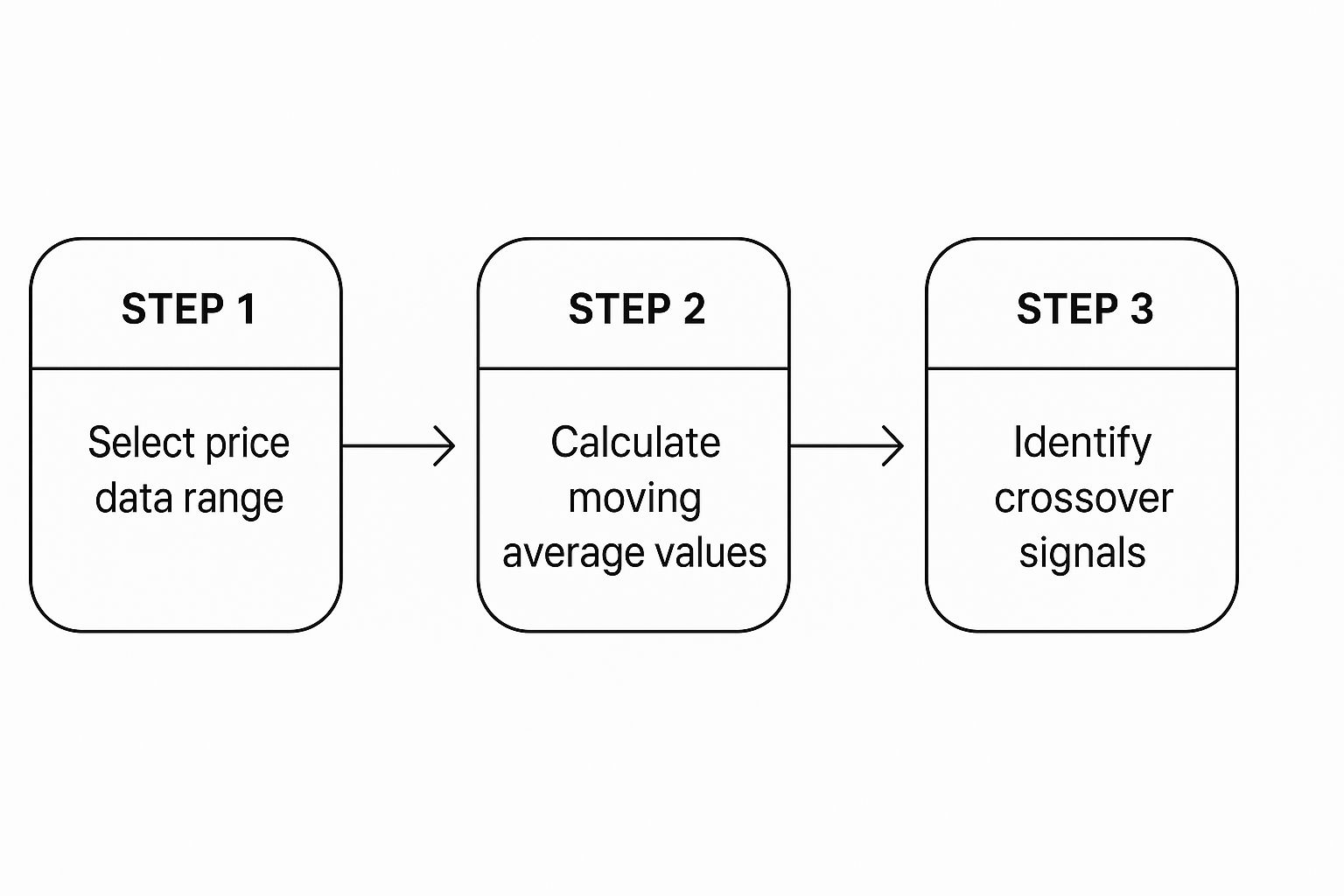

This is where the magic really happens. Setting up automated moving average crossovers is how you turn a solid trading idea into a hands-off, disciplined system. Forget being glued to your screen, waiting for that perfect moment when lines cross. With the right software, you define the rules once, and let the machine do the heavy lifting.

This isn't just about convenience; it's about removing the two biggest enemies of a day trader: emotion and hesitation. Instead of second-guessing a signal, the software acts instantly based on the precise rules you gave it. It’s the closest you can get to perfect trading discipline.

The image below breaks down how this process works, taking raw data and refining it into a clear, actionable signal.

As you can see, it’s a logical flow from data to decision. This systematic approach is the bedrock of any good automated moving average strategy, ensuring every trade is triggered by the same consistent logic.

Setting Up a Real-World Crossover Scenario

Let's get practical and walk through a classic example: setting up a bullish entry on a major index like the NASDAQ. One of the most-watched bullish signals is the "Golden Cross," which happens when a shorter-term moving average pushes up through a longer-term one. It often signals a potential shift into a strong uptrend.

You can build this exact rule inside the Trading Made Easy platform in just a few clicks.

Pick Your Moving Averages: First, you’ll need a "fast" MA and a "slow" MA. A great combination is the 50-period EMA (for its responsiveness to recent price action) and the 200-period SMA (for a stable, long-term trend baseline).

Define the Crossover Condition: Next, you tell the software exactly what to look for. Your rule would be something like: "Execute a BUY order when the 50 EMA crosses above the 200 SMA on the daily chart."

Add Confirmation to Avoid Noise: To steer clear of false signals in choppy, sideways markets, you can add another layer of confirmation. For instance, you might add a condition that the price must close above both moving averages for two consecutive periods before the trade is placed.

That little bit of extra detail is what turns a simple idea into a truly robust automated strategy.

Don't Forget Your Automated Exit Strategy

Getting into a trade is only half the story. A winning moving averages strategy has to include automated exits. With our software, you can bake your risk management right into the initial crossover rule.

A dynamic stop-loss that trails a moving average is a game-changer. It adapts to the market's momentum and volatility, which is far more intelligent than a static price point that can get taken out by random noise.

For our NASDAQ Golden Cross example, you could program an automated stop-loss to sell your position if the price ever closes back below the 50-period EMA.

This way, the same logic that got you into the trade is the same logic that gets you out, either to lock in profit or cut a small loss. By setting these entry and exit rules ahead of time, you create a complete, closed-loop system that executes your plan perfectly, every single time.

Real-World Success with Our Automated Software

Theory is one thing, but real-world results are what truly matter. The success stories from our community are the best proof that our automated day trading software delivers. Here are a few examples of how traders are using our platform to execute their moving averages trading strategy and achieve their goals.

One of our members, a busy professional with a full-time job, wanted to day trade forex trends but couldn't watch the charts all day. Using our software, she set up an automated 20/50 EMA crossover strategy on the EUR/USD pair. The system entered trades on crossovers and managed them with a trailing stop that followed the 20 EMA. This allowed her to stay in the market and execute her plan perfectly, even while at work.

Another trader, who focuses on swing trading stocks, used our software to enforce discipline. Her biggest challenge was cutting losses. She implemented a simple but powerful rule: if any stock she held closed below its 200-day SMA, the system automatically sold the position. This "master kill switch" helped her exit weakening stocks and protect her capital during market downturns, a strategy backed by extensive market data. You can optimize your trading plan with Number Anaytics to see how such rules can be refined.

These stories highlight the true power of automation: it's not just about speed, but about instilling unwavering discipline. Our software ensures your strategy is followed to the letter, removing emotion and guesswork from the process.

By using our backtesting engine, traders can test and refine these strategies before risking capital. They can see what works, what doesn't, and build a plan based on data, not hunches.

Common Questions from Our Trading Community

Theory is great, but here at Trading Made Easy, we know real-world results are what actually count. Since we got started back in 2014, our whole mission has been to give traders the tools to turn their strategies into action. The success stories from our community are the best proof that our automated day trading software gets the job done.

These aren't just hypotheticals. These are real, anonymized examples of how traders are using our platform to hit their goals.

Automating Trends and Protecting Capital

I was talking to one of our members recently—a day trader who also has a demanding full-time job. He wanted to catch forex trends but simply couldn't stare at the screen all day.

Using our software, he set up an automated 20/50 EMA crossover strategy on the EUR/USD pair. His rules were simple: the system enters a trade when the faster EMA crosses above the slower one and exits using a trailing stop that follows the 20 EMA. This let him stay in the market and execute his plan perfectly, even while he was at work.

Another great example comes from a swing trader who focuses on stocks. Her biggest concern was protecting her capital when the market started to turn sour. She used our 200-day SMA filter as a sort of master "kill switch." If any stock she owned closed below its 200-day SMA, the system automatically sold it for her.

This one simple rule helped her get out of bad positions right as a bear market was starting, locking in her profits while so many others were watching their portfolios shrink.

This systematic approach to the 200-day SMA isn't just a hunch; it's backed by a ton of market data. Research has shown that buying a security when it crosses above its 200-day SMA and holding it has often produced better risk-adjusted returns than just buying and holding. Why? Because it helps you sidestep the worst of the major market drawdowns. You can dig into those trend-following findings over at OANDA.com.

Key Takeaway: The real magic of automation isn't just about placing trades faster. It’s about building a disciplined system that follows your moving average strategy to the letter, taking emotion and second-guessing completely out of the picture.

These stories really get to the heart of what our software does. It gives you a rock-solid framework for disciplined execution. By turning your moving average strategy into a set of clear, automated rules, you can manage your risk with confidence and chase your goals with data, not guesswork.

Start Trading with Confidence and Discipline

Putting a solid moving averages strategy into action requires discipline and consistency. But more than that, it requires the right tools to do the heavy lifting. We've walked through how to select and configure these strategies, but the real magic happens when you let automation take over, bridging the gap between your plan and a perfectly executed trade.

Since 2014, the entire mission behind Trading Made Easy has been to take the guesswork and emotional rollercoaster out of trading. We've seen it time and time again—even the best traders can get sidetracked by market noise. Automating your plan is how you stop reacting and start trading with confidence.

Our unique automated day trading software is built to run your specific moving average strategy with the speed and reliability you need, making sure you never miss a critical entry or exit again.

We’ve seen firsthand how our platform helps traders finally stick to their plan, trading with the discipline they always intended. The best way to understand the difference is to experience it yourself. We encourage you to explore our offerings, see how thousands of other traders in our community are using the software, and discover what it feels like to trade a data-driven, automated plan.

Ready to take the next step toward smarter trading?

Your Questions, Answered

When you're looking into automating your trading, a lot of questions naturally come up. I get it. Here are some of the most common ones we hear from traders thinking about using moving averages in our software, with some straight-to-the-point answers from our experience.

What’s the Best Moving Average for Day Trading?

For the fast-paced world of day trading, most of our users lean heavily on Exponential Moving Averages (EMAs). They just react faster. Shorter periods like the 9, 12, and 26 EMA are especially popular because they're quick to respond to the price swings that happen throughout the day. That responsiveness is what you need to catch those smaller, more frequent moves.

This is exactly where our automated day trading software shines. You can set up crossover strategies with these short-term MAs to generate plenty of signals, all without having to glue your eyes to the charts all day long.

Can I Use This Strategy for Stocks and Forex?

Absolutely. A moving averages strategy is one of the most versatile tools out there. It works across stocks, forex, commodities, and even crypto because the underlying concepts of trend and momentum apply everywhere.

The real key, though, isn't the market—it's how you tune your strategy for that market. This is where our backtesting tools become so important. They let you find the perfect MA periods for a specific instrument, because a tech stock like TSLA isn't going to move the same way as a currency pair like EUR/USD. This data-driven approach means you’re not guessing; you’re building a strategy tailored to what you’re actually trading.

The best strategies are never one-size-fits-all. Our platform gives you the power to test and prove the right MA settings for each asset you trade, shifting you from generic rules to a personalized, data-backed plan.

How Does Automation Help Me Avoid Bad Signals?

Look, no system on earth can get rid of false signals completely. It's just part of trading. But automation gives you a massive advantage in filtering them out. Our software helps in three specific ways:

- Add More Rules: You can build a strategy that’s much smarter than a simple crossover. For example, you could tell the system to only take a trade if there’s a confirming volume spike or a specific candlestick pattern alongside the MA signal.

- Be Incredibly Precise: Automation removes the gray area. You can program the system to wait for a specific trigger, like requiring two full price bars to close above the MA before entering. This helps you avoid getting shaken out by a brief price spike.

- Test It Against History: Our backtester is your single best defense. It lets you see which MA settings would have caused too many whipsaws in the past on the asset you're trading. You can then discard those weak configurations and only deploy strategies that have a solid, proven track record.

Ready to stop guessing and start building a trading plan based on discipline and data? With Trading Made Easy, you get the tools to turn your moving average ideas into a flawlessly executed system. It’s time to discover the confidence that comes with automation.

Start Your Smarter Trading Journey at tradingmadeasy.com

Article created using Outrank

Leave a Reply