Let's cut through the noise. Put simply, algorithmic trading is just using a computer program to place your trades for you. It takes a set of rules you've defined and executes them automatically.

Since 2014, we at Trading Made Easy have been dedicated to one core mission: to democratize trading by providing powerful, accessible tools that help traders succeed. We believe that with the right technology, the discipline and precision once reserved for Wall Street can be in every trader's hands.

This whole process swaps out human decision-making for high-speed, data-driven instructions. It lets you place trades at a speed and volume that would be impossible for any person to keep up with. Think of it as teaching a computer your exact trading strategy so it can work for you, 24/7.

So, What Exactly Is Algorithmic Trading?

What was once a secret weapon for huge Wall Street firms is now within reach for individual traders. This shift is leveling the playing field in a big way.

Algorithmic trading, or "algo trading" as it's often called, is a system where computers make and execute trading decisions based on algorithms. Imagine having an incredibly fast, razor-sharp assistant who is totally unemotional and follows your trading plan perfectly. You set the rules—like price, timing, and volume—and the algorithm handles the rest.

The Power of Automation

At its core, algorithmic trading is about executing trades faster and more efficiently than any human ever could. It does this by using the sheer power of computers to sift through massive amounts of market data in the blink of an eye. An algorithm can watch thousands of stocks at once, spot tiny opportunities the moment they appear, and act on them instantly.

For instance, you could program a simple algorithm to follow these rules:

- Buy 100 shares of a stock when its 50-day moving average crosses above the 200-day moving average.

- Sell all 100 shares if the stock drops 5% below what you paid (your stop-loss).

- Sell all 100 shares if the stock climbs 10% above your purchase price (your take-profit).

This removes the emotional second-guessing that trips up so many traders. The computer just follows the logic you gave it, making sure your strategy is executed with discipline, every single time.

To give you a quick reference, here’s a simple breakdown of the key ideas.

Algorithmic Trading at a Glance

| Concept | Brief Explanation |

|---|---|

| Algorithm | A specific set of rules (like "buy if X happens") coded into a computer program. |

| Automation | The computer executes trades automatically based on the algorithm, no manual clicking required. |

| Backtesting | Testing your algorithm on historical market data to see how it would have performed. |

| Execution Speed | The ability to place trades in microseconds, far faster than a human can react. |

| Discipline | Removes emotion from trading, ensuring the strategy is followed without fear or greed. |

This table covers the basics, but the real power comes from seeing how these concepts work together in the market.

At its heart, what is algorithmic trading? It’s turning your strategy into a system that can operate with more speed, accuracy, and discipline than you can, freeing you from the emotional biases that get in the way of smart trading.

This automated approach isn't just one single strategy; it's a framework that can support countless different trading styles. As we'll see, it's completely changing how markets work, creating both new opportunities and challenges. By understanding the fundamentals, you can start to see how platforms like ours at Trading Made Easy make this powerful technology practical for your own trading.

How Algorithmic Trading Actually Works

So, how does this all work in the real world?

Think of your trading strategy as a brilliant, incredibly disciplined assistant. This assistant operates at superhuman speed, never needs a coffee break, and executes your plan perfectly without a flicker of emotion. That's the core idea behind algorithmic trading.

The whole process, from a trading idea to a live order, really boils down to three key parts. It's a bit like a self-driving car: you need a destination and rules for the road (the algorithm), sensors to see what's happening around you (data inputs), and the mechanics to actually steer, accelerate, and brake (the execution engine). When these three elements work in perfect harmony, the system can navigate the chaotic, high-speed traffic of the financial markets.

The Algorithm: The Strategic Brain

First up, and most importantly, is the algorithm. This isn't some magical, unknowable black box. At its heart, an algorithm is just a clear set of instructions you've programmed into a computer, telling it precisely what to do and when to do it. It's your personal trading strategy, coded into a language a machine can execute flawlessly.

An algorithm can be as straightforward or as complex as you need. For instance, a simple trend-following strategy might look something like this:

- Rule 1: If Asset XYZ closes above its 20-day moving average, buy 50 units.

- Rule 2: If the price drops 5% below what I paid, sell everything immediately to cut my losses (a stop-loss).

- Rule 3: If the price jumps 10% higher than what I paid, sell it all and take the profit (a take-profit).

This set of commands takes all the guesswork and "gut feelings" out of the equation. The system has one job: watch for these exact conditions and act the very second they’re met.

Data Inputs: The Eyes and Ears of the System

An algorithm is pretty useless without information. That's where data inputs come into play. These are the live data streams the algorithm constantly monitors to see if its rules are being triggered. It’s the system’s direct line to the market, feeding it the raw information it needs to make smart decisions.

Common data inputs include:

- Price Data: The absolute basics, like current bid/ask prices and historical price charts.

- Volume Data: Information on how many shares are being traded, which can signal how strong a price move really is.

- Technical Indicators: Calculated data points like Moving Averages, RSI (Relative Strength Index), or MACD.

- Fundamental Data: Things like economic news, company earnings reports, or other big announcements that can shake up the market.

The system sifts through this flood of information in milliseconds—something no human could ever do—to find opportunities that fit its pre-programmed rules. This is a huge distinction between manual trading and letting a machine do the work. For a deeper dive, check out our full guide on what is automated trading.

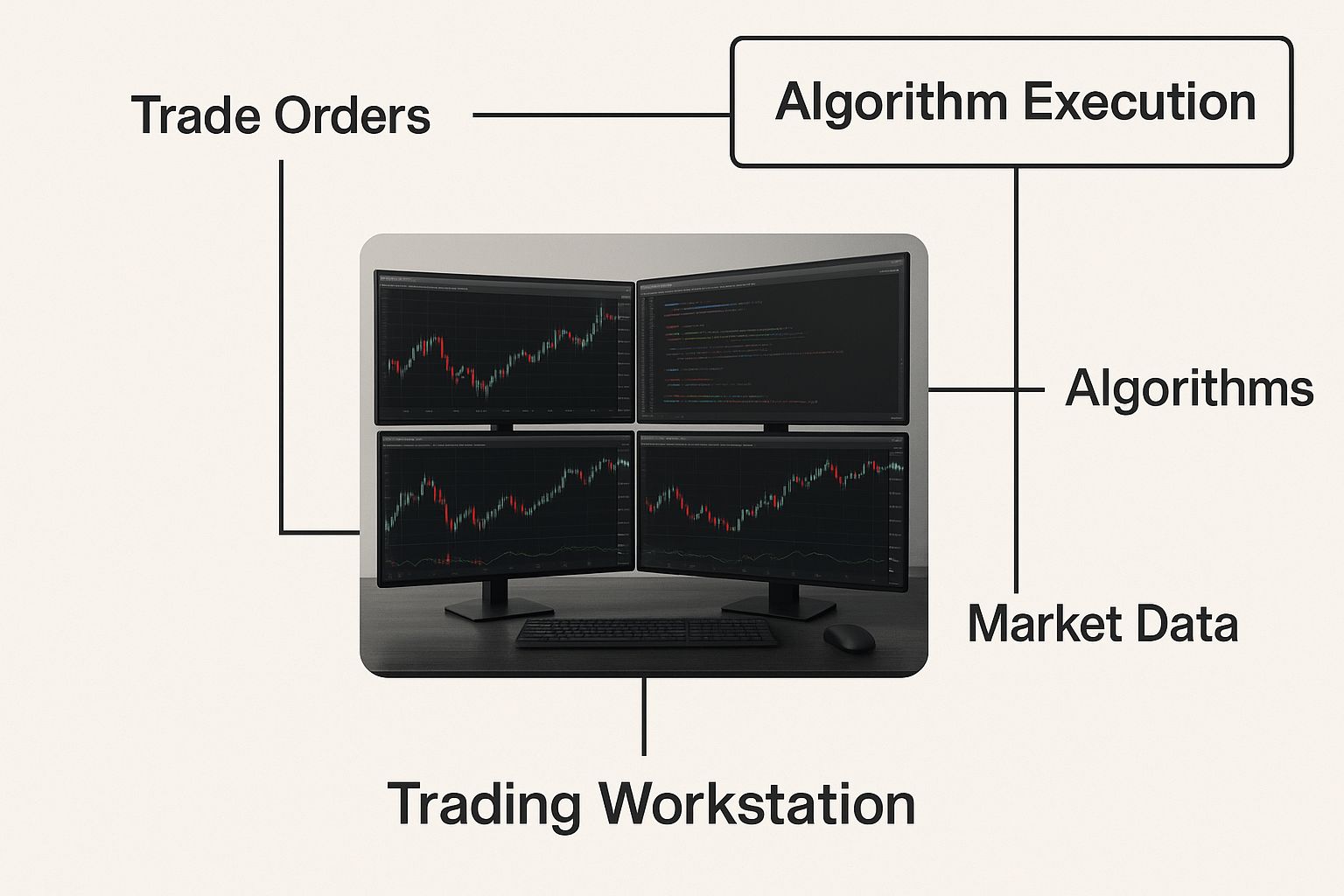

The image below gives you a glimpse of a trader's workstation, where all these moving parts—the code, the charts, and the live data—all come together.

It really shows the blend of pure strategy (the code) and real-time market analysis (the charts) that powers these trading decisions.

The Execution Engine: The Hands of the System

Finally, once the algorithm has processed the data and flags a trade, the execution engine springs into action. This is the piece of the puzzle that actually connects to the exchange or your broker to place, manage, and eventually close the trade. It’s the part that turns a digital decision into a real-world market order.

The execution engine is built for two things: speed and reliability. Its entire purpose is to get your order filled at the best price possible with almost zero delay, which helps minimize what traders call "slippage."

In the world of high-frequency trading (HFT), a specialized corner of algorithmic trading, execution speed is measured in microseconds. For most of us, though, the goal is simply to get our orders filled reliably the moment our strategy says "go," locking in an opportunity before it vanishes. Together, these three pillars create a powerful, unified system for navigating the markets.

Key Features of Our Automated Trading Software

Alright, you get the theory behind algorithmic trading. But how does that translate into a real tool that gives you a genuine edge? That’s where our automated day trading software at Trading Made Easy comes in. We’ve built our platform to deliver on the things that actually count: precision, simplicity, and safety.

AI-Driven Algorithms for Pinpoint Accuracy

Our platform goes way beyond simple rules. We've built it with advanced, AI-driven algorithms designed to analyze what the market is really doing and pinpoint high-probability setups with incredible accuracy. This AI-powered analysis lets the software spot patterns and openings that even a seasoned human trader could easily miss. It crunches massive amounts of data in real-time to act on those blink-and-you'll-miss-it market movements, giving you a shot at opportunities that are simply impossible to catch by hand.

The whole financial world is leaning into artificial intelligence (AI), making algorithmic trading smarter than ever. The global market was pegged at USD 21.06 billion in 2024 and is expected to rocket to USD 42.99 billion by 2030—that’s a 12.9% compound annual growth rate. This boom is all thanks to tech that lets algorithms chew through data, spot trends, and adjust on the fly. You can explore the full research on algorithmic trading's growth to see just how fast this space is moving.

An Intuitive Interface—No Coding Required

Let's be honest, one of the biggest things that scares traders away from automation is the tech. We built our software specifically to bust the myth that you need to be a coding wizard. The Trading Made Easy platform has a straightforward, intuitive interface that makes launching even complex strategies feel simple. You don’t need to write a single line of code. Period.

Our goal was to make automation something any trader could use, no matter their tech skills. You bring the trading know-how; our software handles the heavy lifting.

This focus on simplicity means you can get your strategies live and running fast, without getting stuck in a technical swamp. It lets you focus on your trading plan, which is what really matters.

Rock-Solid Risk Management to Protect Your Capital

Here's the most important part: managing risk. Our software is designed to be your disciplined partner, taking emotion completely out of the equation. The platform's risk management module is built right into its core.

- Automated Stop-Losses: The system automatically closes a trade the second it hits your preset loss limit, protecting you from nasty drawdowns.

- Position Sizing: You set the rules for how much you're willing to risk on any one trade, preventing you from ever getting over-leveraged.

- Take-Profit Targets: It automatically locks in your gains when a trade hits its target, so you aren't tempted to get greedy and watch a winner turn into a loser.

By automating these vital risk controls, the software sticks to your plan with relentless discipline. If you want to dive deeper into how to set this up, our guide on building an automated trading system is a great resource.

Weighing the Promise and Peril of Automated Trading

Automated trading brings incredible power to the table, but let's be real—it’s not a magic wand. Like any serious tool, how you use it makes all the difference. To make smart, strategic moves, you have to get a feel for both its game-changing advantages and its very real downsides.

The draw of algorithmic trading is obvious. It’s all about logic, precision, and speed—three things that can give any trader a serious leg up. When set up right, an automated system can execute a trading plan with robotic perfection, completely sidestepping the emotional chaos that market swings often trigger. This isn’t just a passing fad; it's a fundamental shift in how the financial world works.

The numbers don't lie. The global algorithmic trading market was pegged at around USD 51.14 billion in 2024 and is expected to rocket to USD 150.36 billion by 2033. That’s a growth rate of roughly 12.73% every year, fueled by faster tech and a growing demand for smarter, more efficient trading. You can dig into these market insights to see just how big this transformation is.

The Upside: What Automation Gets Right

The biggest win with letting an algorithm handle your trades is its blazing execution speed. A system can analyze the market and place an order in microseconds—literally faster than a human can even process the thought. This speed is everything when you're trying to grab fleeting opportunities before they vanish.

But it’s not just about being fast. Automation also brings a level of consistency that’s almost impossible for a person to match.

- No More Emotional Decisions: Fear of losing and greed for more are the two biggest enemies of a solid trading plan. An algorithm doesn't feel a thing. It sticks to the logic, stopping you from making those gut-reaction mistakes that almost always cost money.

- Rock-Solid Discipline: Your rules—like stop-losses and profit targets—are followed to the letter, every single time. The system never gets nervous and sells too early or greedy and holds on too long.

- Powerful Backtesting: Before you risk even a penny of real money, you can test your strategy against years of historical data. This lets you see what works, what doesn't, and fine-tune your approach based on how it would have actually performed in the past.

- Lower Transaction Costs: By executing orders with pinpoint precision, algorithms can cut down on "slippage"—that annoying gap between the price you wanted and the price you got. Those small savings really start to add up over time.

When you take emotion out of the equation, your strategy—not your feelings—is what drives your results. That systematic approach is what separates successful long-term traders from the rest.

The Downside: A Reality Check on the Risks

As good as all that sounds, we have to be honest about the risks. Algorithmic trading isn’t some "set it and forget it" path to riches. The technology itself introduces a new set of problems you need to be ready for.

One of the scariest risks is a simple bug in the code. Even a tiny mistake in the algorithm's logic can trigger a cascade of bad trades and wipe out capital in the blink of an eye. This is exactly why meticulous testing and using a professionally built, reliable platform are non-negotiable.

Another major pitfall is over-optimization. This is what happens when a strategy is tweaked so perfectly to fit past data that it looks brilliant in backtests but completely falls apart in a live market. The market is always changing, and a strategy that can’t adapt to new conditions is a ticking time bomb.

Finally, you have to think about system-wide risks. We've all heard of "flash crashes," where automated systems get caught in a feedback loop, causing a market to nosedive in minutes. On a more personal level, your entire operation depends on technology. A power outage, a lost internet connection, or a platform glitch at just the wrong moment could be disastrous.

Knowing these risks isn't a reason to run away from automation. It's a reason to be smart about it. It highlights just how important it is to have a solid platform, a thoroughly tested strategy, and a clear-eyed understanding of the tools you’re putting to work.

Success Stories: How Our Software Helps Traders

Theory is one thing, but what really matters is seeing how this works for real traders. The stories below aren't about getting rich overnight. They're honest accounts of how traders overcame common hurdles like emotional decision-making and a lack of time—and found consistency using our software.

From Emotional Swings to Disciplined Trading

Consider "Sarah," a sharp trader who understood the markets but kept getting tripped up by fear and greed. She’d cut winning trades short or hold onto losers for way too long, hoping for a turnaround. This emotional rollercoaster was wrecking her results.

Using Trading Made Easy, Sarah set hard-and-fast stop-losses and profit targets for every trade. The software became her unemotional trading partner. If a trade hit her stop-loss, it closed instantly. When a position hit her profit target, gains were locked in—no second-guessing. By taking her own emotions out of the equation, Sarah's performance stabilized, allowing her to trade her strategy, not her feelings. This disciplined execution is a core benefit of all automated systems, from retail platforms to the sophisticated setups used in high-frequency trading explained in our detailed guide.

Finding Time to Trade with a Busy Schedule

Then there's "David," a marketing manager with a demanding day job. He loved trading and had a solid strategy, but he simply couldn't find the screen time. He was constantly missing perfect entries or exits because he was in a meeting or swamped with work.

Frustrated, David turned to our software. He programmed his strategy into the platform and let the algorithm take over. The system watched the market and executed his plan perfectly, whether he was on a conference call or out to lunch. The difference was night and day. He could focus on his career, knowing his trading was in good hands, and his strategy finally got the precise execution it needed to work.

These stories show that success often boils down to overcoming our human limits. Our software bridges the gap between a good idea and consistent, real-world execution.

These traders didn't find a magic button. They found a tool that let them apply what they already knew, but systematically and without fail.

Conclusion: Take the Next Step in Your Trading Journey

We’ve covered what algorithmic trading is, how it works, and how our software at Trading Made Easy puts its power in your hands. The direction of trading is clear: it’s automated, disciplined, and driven by data. In a nutshell, algorithmic trading gives you:

- Speed: Execute trades in a fraction of a second.

- Discipline: Remove emotion to ensure your strategy is followed perfectly.

- Advanced Strategies: Deploy and test complex ideas impossible to manage manually.

Getting a handle on what is algorithmic trading is a key piece of the puzzle for any serious trader. The algorithmic trading market is expected to grow from USD 3.28 billion to around USD 6.05 billion by 2032. This is happening because traders everywhere are demanding faster, more reliable execution. You can read more about these market growth drivers and see how things are changing.

Since 2014, our mission at Trading Made Easy has been to put powerful, AI-driven tools directly into your hands. We believe that with the right technology, any trader can execute their strategy with more precision and less stress.

The tools for smarter, more disciplined trading are right here, ready for you to use. We encourage you to explore Trading Made Easy’s offerings and see how our automated day trading software can fit your personal approach to the markets.

Still Have Questions About Algorithmic Trading?

It’s completely normal to have a few questions as you get into the world of automated trading. It’s a big topic. We’ve pulled together some of the most common ones we hear from traders just like you, with real-world answers to cut through the noise.

Do I Really Need to Be a Programmer?

This is probably the biggest question people have, and I get why. The good news is, the answer is a firm no. While the systems themselves are built on complex code, modern platforms—like what we've built here at Trading Made Easy—are designed so you never have to touch a single line of it.

You bring the strategy. You decide what to trade, your entry points, your exit signals, and how you want to manage your risk. Our software takes your rules and does all the heavy lifting. The whole point is to give any trader with a solid game plan the power of automation, no computer science degree required.

Is This Just for the Stock Market?

Absolutely not. While algorithmic trading got its start on Wall Street, the principles work just about anywhere you can trade electronically. Speed, discipline, and data-driven decisions are valuable in every market.

Today, you’ll find traders running automated strategies in:

- Forex: To react to currency moves 24 hours a day.

- Cryptocurrencies: A must-have for the wild, always-on crypto markets.

- Futures and Commodities: For everything from crude oil and gold to corn and soybeans.

If a market has electronic trading and good data, you can build an algorithm for it. For instance, our platform was specifically built to give traders an edge in the futures market, which shows just how far this technology has come from its stock market roots.

What Kind of Money Do I Need to Start?

There's no single magic number here. A lot of it comes down to your broker’s minimums and the specific market you’re trading. But you definitely don't need a Wall Street-sized bankroll to get started. Many traders begin with a much more modest amount.

What’s more important than the starting dollar amount is having enough capital to manage your risk correctly. You need to be able to take a few losses without blowing up your account. That’s what gives your strategy the time it needs to let its edge work out.

So instead of fixating on a minimum, think about what you can truly afford to put at risk. Test your strategies on a smaller scale, get comfortable, and then you can think about adding more capital. That kind of discipline is the foundation for staying in the game long-term.

Is Algorithmic Trading a Guarantee I'll Make Money?

Let's be crystal clear on this one: No, algorithmic trading cannot guarantee profits. If anyone ever promises you guaranteed returns from trading, you should run the other way. Every form of trading carries significant risk, and losing money is always a possibility.

What an algorithm does give you is flawless discipline and speed. It executes your plan without fear or greed getting in the way. It’s a tool—a powerful one—for executing a strategy and managing risk, but it’s not a magic money machine. The success or failure of your trading still comes down to the quality of your strategy. The algorithm just makes sure your plan is followed to the letter.

Ready to see how a more disciplined, precise approach could fit your trading style? Take a look at the Trading Made Easy platform and see what our AI-driven software can do. Learn more and get started today.

Leave a Reply