Welcome to Trading Made Easy. Since 2014, our mission has been to demystify the trading industry and make the financial markets accessible to everyone. We understand that the world of trading can seem complex and intimidating. That's why we're dedicated to providing powerful, user-friendly tools that empower both new and experienced traders to navigate the markets with confidence.

We can get you from zero to your first trade in just a few hours. The trick is to walk in with a plan, a basic grasp of risk, and the right tools in your corner.

Your First Steps Into the Trading World

Let's dive in. You're here because you're ready to stop watching from the sidelines and start trading. The good news? Getting started is more straightforward than you might think. It really boils down to three things: opening and funding a brokerage account, and then, the exciting part—placing your first buy or sell order.

The global market is a massive playing field. To give you some perspective, as of 2025, the total value of all listed companies on stock markets worldwide is hovering around US$51.61 trillion. That number shows you just how much opportunity is out there, but it also hints at the complexity. Things like global economic shifts and political tensions can make the markets jumpy, which is why having a steady hand is so important. If you want to dig into the numbers yourself, Statista has some great analysis on global market trends.

What It Means to Be a Trader Today

Trading isn't what it used to be. It’s no longer just about gut feelings and hot tips whispered on a trading floor. Today, it’s about having a clear strategy, being disciplined, and using technology to your advantage. The tools available now have completely opened up the world of trading, turning it from an exclusive club into something accessible to anyone with a plan.

At its core, successful trading really comes down to a few key habits:

- Building a Strategy: This is your roadmap. You need to know your financial goals, how much risk you're comfortable with, and which markets you're interested in.

- Managing Your Risk: Think of this as your safety net. Using simple tools like stop-loss orders is non-negotiable for protecting your hard-earned money.

- Always Be Learning: The markets are always moving. Staying on top of financial news and trends isn't just a good idea—it's essential to understanding why your positions are moving.

Key Features That Empower Your Trading

This is where things get really interesting. Technology has completely reshaped the trading game. Our automated day trading software is designed to put powerful analytical tools in your hands. Here are the unique features that benefit our traders:

- Automated Trade Execution: Our system executes trades up to 1,000 times faster than a human can click, ensuring you get the price you want without emotional hesitation. This speed is critical in fast-moving markets.

- AI-Powered Analytics: The software constantly scans the market for high-probability patterns, delivering data-driven signals instead of relying on guesswork. It helps you trade like a pro from day one.

- Built-In Discipline: By automating your strategy, our software removes the two biggest obstacles for new traders: fear and greed. It sticks to your rules, ensuring consistent and disciplined execution.

For a new trader, the biggest advantage you get from technology is consistency. An automated system follows the rules you set without a moment of hesitation. That’s how you start building solid, disciplined trading habits right from day one.

Our goal here is simple: to give you the foundation you need to go from a curious beginner to a confident trader. By pairing practical education with smart software, we help you take those first crucial steps with clarity and purpose.

Finding Your Focus in Today's Market

Before you even think about hitting that "buy" button, you need to know where the action is. The market isn't just one big, confusing mess; it’s broken down into different sectors, and each has its own personality and rhythm.

Figuring out which sectors are driving the market helps you put your money where the momentum is, instead of in some forgotten corner that’s going nowhere. It’s like picking a highway for a road trip. You want the one that’s actually moving, not some quiet backroad that leads to a dead end. For anyone new to this, effective trading starts by focusing on those main highways where most of the money is flowing. It just makes everything simpler.

Where the Money Moves

A handful of key areas really dictate which way the market is heading. Right now, the big players are Information Technology, Financials, and Consumer Discretionary. These aren't just random labels; they represent huge chunks of our economy, so naturally, they see the most trading volume.

Let’s look at the numbers. In 2025, Information Technology is still the undisputed king, making up a massive 33.09% of the S&P 500's total weight. Behind tech, you have the Financials sector at about 14.03% and the Consumer Discretionary sector pulling its weight at around 10.37%.

Why does this matter? It tells you that a huge slice of the daily market action is tied to how the big tech companies, major banks, and top retailers are doing. By focusing your attention here, you’re putting yourself right where the most significant trends are likely to pop up.

Getting a handle on sector weightings is your first real strategic advantage. When nearly a third of the market's value is in tech, even a small ripple in that sector can cause waves everywhere else. This is the kind of insight that helps you get ahead of the market's next move.

Here's a quick breakdown of the most active sectors in the S&P 500, which can help you narrow down where to look for opportunities.

Top Market Sectors by Trading Volume and Key Players

| Market Sector | S&P 500 Weighting | Example Companies |

|---|---|---|

| Information Technology | 33.09% | Apple, Microsoft, NVIDIA |

| Financials | 14.03% | Berkshire Hathaway, JPMorgan Chase, Visa |

| Consumer Discretionary | 10.37% | Amazon, Tesla, Home Depot |

| Health Care | 9.88% | Eli Lilly, Johnson & Johnson, UnitedHealth Group |

| Communication Services | 8.52% | Meta Platforms, Alphabet (Google), Netflix |

This table isn't just data; it's a map. It shows you exactly where the big money is concentrated and which companies are steering the ship. For a new trader, sticking to these well-traveled roads is a much smarter play than getting lost in the weeds.

Reading the Sector Trends

Spotting a trend isn't as complicated as it sounds. It’s more about paying attention to the world around you. Are people splurging on vacations and new gadgets? That's a good sign for the Consumer Discretionary sector. Are interest rates ticking up? That could create some interesting plays in the Financials sector.

For those just starting out, our guide on day trading strategies for beginners dives deep into practical ways to spot and act on these kinds of shifts. The goal is simple: line up your trading ideas with the bigger economic story that's unfolding right in front of you.

Getting Started with Trading Made Easy Software

Alright, you’ve got a handle on the different market sectors. Now it's time to get your hands dirty and actually start trading, and that means you need the right tools for the job. This is where our automated day trading software really shines.

Think of it as your secret weapon. The platform is built to cut through the noise of complex market data and give you clear, actionable insights. We’ve been at this since 2014, and our mission has always been simple: make trading less intimidating.

We do that by focusing on automation. Instead of staring at confusing charts until your eyes glaze over, our AI-powered interface does the heavy lifting for you. It spots potential opportunities based on proven strategies, helping you build good, disciplined habits right from the start.

Setting Up Your Account

First things first, let's get you set up. The process is pretty straightforward—you'll create your account, run through a quick identity verification (a standard security step), and then fund it so you’re ready to go. We've made this as painless as possible so you can get from sign-up to your first trade without any headaches.

Once you’re in, you’ll land on the main dashboard. This is your command center. Everything you need—market activity, your portfolio, and all our automated tools—is right there at your fingertips.

Here’s a peek at what you'll see. We designed it for clarity, not clutter.

As you can see, your key stats like account balance, active strategies, and real-time performance are laid out clearly. No digging around required.

Understanding Our Platform

Our software is much more than a simple "buy" and "sell" button. It’s a complete system designed to guide you. There are a ton of platforms out there, and figuring out which one is right for you can be overwhelming. To help with that, we put together a guide on understanding trading platforms that breaks down what really matters when you're comparing your options.

The features we've built all work together to drastically shorten your learning curve. Instead of spending months trying to master complex technical analysis, you can start with a structured, automated approach. It lets you gain real-world experience with a safety net, building your confidence as you see how a systematic approach works in a live market.

Ready? Let's Place Your First Trade

This is it. The moment where all the reading and planning becomes real. Making your first trade is a huge milestone, but it's not just about hitting "buy" or "sell." It's about taking that first step with a clear head and a solid plan, building the right habits from day one to protect your money for the long run.

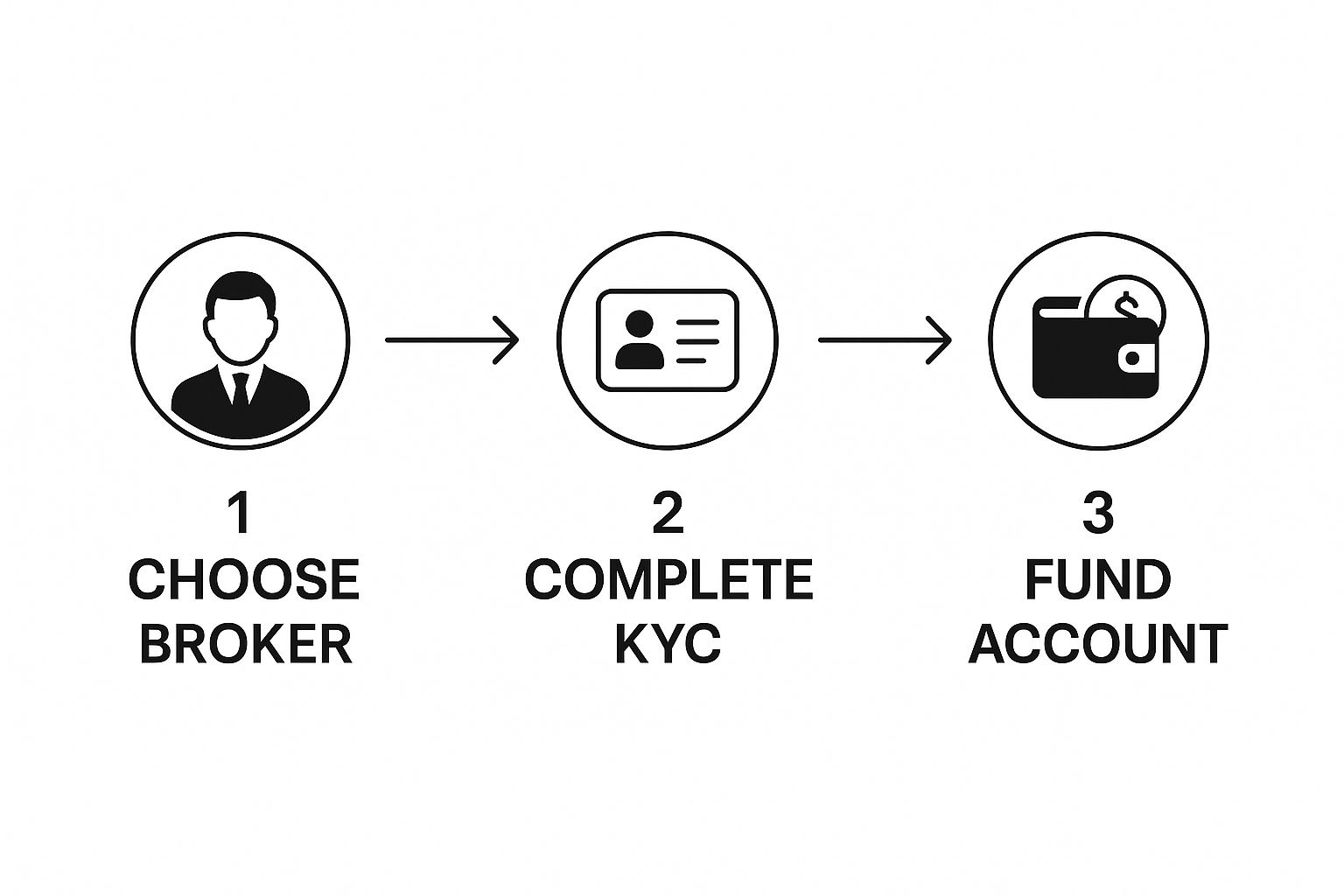

Before you can trade, you need an account. It’s a straightforward, three-part process: pick a broker that fits your style, get your identity verified, and then fund the account.

We've designed this flow to get you from sign-up to your first trade securely and without any unnecessary headaches. Think of it as building a strong foundation.

The Big Picture: What's Moving the Market

Once your account is ready, it's tempting to jump right in. But hold on. You need to understand that the markets aren't a self-contained bubble. Big-picture global events can send shockwaves through the charts, and if you're not prepared, you'll get blindsided. A good risk strategy is your only real defense against that kind of chaos.

Remember the global market crash that kicked off on April 2, 2025, after those sweeping tariffs were announced? That's a perfect, if painful, example of how quickly things can change. It’s a stark reminder for new traders to keep one eye on the news and economic policy, not just the charts. You can read up on how policy decisions rock the markets if you want to go deeper.

Risk management isn’t some optional add-on. It’s the single most important skill you will ever learn as a trader. It’s what separates the pros from the gamblers.

Your First-Trade Safety Checklist

Let's get down to brass tacks. Before you even think about entering a trade, you need to define exactly what you're willing to risk. This boils down to two critical concepts our software helps you automate: setting a stop-loss and calculating your position size. These are your non-negotiables.

Here's how to put them to work:

- Set Your Stop-Loss First. Always. A stop-loss order is your eject button—it automatically sells your position if the price drops to a certain level. Decide the absolute maximum you're willing to lose on a trade before you place it.

- Size Your Position Correctly. A golden rule is to never risk more than 1-2% of your entire account on any single trade. If you have a $5,000 account, a 1% risk means your stop-loss should be set so you can’t lose more than $50. This one simple rule makes it impossible for a single bad trade to cripple your account.

- Take Emotion Out of It. The biggest trading mistakes are almost always driven by fear or greed. Our system is built to execute your pre-set rules without a shred of emotion, keeping you on track even when the market gets wild.

By baking these habits into your routine from the very first trade, you’re building a disciplined framework. This is how you turn trading from a game of luck into a strategic business—one that gives you the confidence to navigate the markets and protect your capital while you grow.

Success Stories: How Real Traders Succeed with Our Software

Theory is great, but seeing real-world results is what matters. Since 2014, we've helped countless traders navigate the markets. The common thread in their success is how automation builds the discipline needed to thrive.

From Beginner's Fear to Confident Trading

Take Sarah, a new trader who was completely overwhelmed by market volatility. She was terrified of making a costly mistake. By using our software, she let automated strategies handle the execution. This removed the emotional pressure and allowed her to learn by watching data-driven decisions in action. Within months, she went from fearful to confident, understanding the "why" behind each trade.

Sharpening the Edge for a Seasoned Pro

Then there’s Mark, a veteran trader who struggled with consistency. He knew his strategy worked but often deviated from his own rules during choppy markets. Mark programmed his exact strategy into our platform. The software became his "discipline partner," executing his plan flawlessly every time. His results stabilized, and his profitability increased because the small, emotion-driven errors were eliminated.

These stories show that whether you're starting out or have years of experience, success hinges on discipline. Our software provides that, allowing traders to execute their strategies with machine-like consistency.

These aren't just one-off examples. They represent the core benefit our users experience: the power to trade strategically and without emotion, which is the key to long-term success.

Where Do You Go From Here?

You’ve made it through the basics—from spotting market sectors to placing that first trade with a proper risk plan. But here’s the thing: learning to trade isn’t a one-and-done deal. It's a constant process of learning, refining your approach, and staying disciplined. What you've learned so far is the foundation, but what you do next is what really counts.

This is exactly why we started Trading Made Easy back in 2014. Our whole mission was to simplify this journey. Our automated trading software is designed to be your partner, handling lightning-fast execution and data analysis so you can focus on strategy. By removing emotion and enforcing discipline, our platform helps you build the habits that separate profitable traders from the rest.

Letting Automation Enforce Your Discipline

Every success story in trading comes back to one key concept: discipline. Automation is what makes consistent execution possible. Our software ensures your strategy is followed perfectly every time, translating your plan into real results.

- AI-Driven Insights: Get an edge with data-backed opportunities flagged by our system.

- Speed and Precision: Execute trades faster than humanly possible to capture quick market moves.

- Built-In Risk Management: Protect your capital from day one with automated stop-losses and position sizing.

The most valuable asset you have as a trader isn't your money—it's your discipline. Automation doesn't just make trading easier; it forces you to be a more disciplined trader.

Your Next Steps

Don't stop learning now. The markets are always evolving, and the traders who succeed are the ones who stay curious and informed.

Understanding risk, in particular, is a topic you can never know too much about. It underpins everything you do. To take your knowledge further, I highly recommend digging into our guide on day trading risk management. It's packed with more advanced insights for protecting your account while you grow it.

To summarize, starting your trading journey requires a solid foundation of knowledge, the right tools, and a commitment to disciplined execution. With a clear plan and our technology to back you up, you can face the markets with confidence. We encourage you to explore Trading Made Easy’s offerings and see how our automated software can help you achieve your financial goals.

Ready to take control of your trading? See how Trading Made Easy can help you trade smarter, not harder.

Leave a Reply