Since 2014, Trading Made Easy has been dedicated to empowering traders with cutting-edge technology that simplifies the complexities of the market. Our mission is to level the playing field, making sophisticated trading accessible to everyone, from beginner day traders to experienced quants. The rise of artificial intelligence has supercharged this mission, ushering in an era where data-driven decisions replace emotional guesswork.

In this comprehensive guide, we cut through the noise to identify the best AI trading platforms available today. We provide an in-depth, side-by-side analysis of leading tools that solve a critical problem: how to execute trading strategies with greater speed, precision, and objectivity. Whether you're a busy professional needing passive trading solutions, an investor seeking user-friendly automation, or an active day trader looking to harness high-speed execution, this resource is designed for you.

You will find a detailed breakdown of each platform, including:

- Unique Features: What makes each tool stand out.

- Practical Use Cases: How to apply the software to real-world trading.

- Honest Limitations: A clear-eyed view of potential drawbacks.

We will examine solutions from industry innovators like Trade Ideas and TrendSpider to powerful automation hubs like QuantConnect and Alpaca Markets. Each review includes screenshots and direct links, giving you everything needed to make an informed decision. This guide moves beyond marketing hype to offer a practical roadmap for integrating AI into your trading workflow, helping you navigate the markets with enhanced confidence and control.

1. Trading Made Easy: Precision Automation for Futures Trading

Since 2014, Trading Made Easy has been a trusted name in the trading industry, with a mission to make sophisticated trading accessible to everyone. The platform is specifically engineered for the fast-paced futures market, providing a patented, AI-driven system that removes emotional biases and executes trades with unparalleled speed and precision. This makes it one of the best AI trading platforms for both newcomers seeking a structured entry point and seasoned traders aiming to optimize their execution strategies.

The platform operates on a foundation of pre-programmed, algorithmically defined strategies. It automates the entire trading process, from market analysis to trade execution, reportedly operating up to 1,000 times faster than a human trader. This speed is a critical advantage in futures trading, where market conditions can shift in milliseconds.

Key Features and Strategic Advantages

Trading Made Easy’s automated day trading software distinguishes itself with a robust feature set designed for performance and user security. This focus on unique, trader-centric benefits is how it empowers users to navigate the markets more effectively.

- Patented AI-Powered Automation: The platform's proprietary AI doesn't just place trades; it actively manages them based on predefined rules, ensuring disciplined execution without the influence of fear or greed. This is ideal for busy professionals who want to participate in the markets without constant monitoring.

- Integrated Risk Management: A standout feature is its sophisticated, automatic risk-management system. This safeguard is built into every trade, protecting capital by adhering to strict parameters, which gives traders significant peace of mind.

- Continuous Expert Guidance: Users gain access to free weekly live trading webinars. These sessions provide real-time market analysis and actionable insights directly from experts, offering a continuous learning opportunity that is rare in the industry.

- Dedicated U.S.-Based Support: The platform provides a personalized support experience with a dedicated team based in the United States, ensuring clear communication and effective assistance throughout a trader’s journey.

Success Stories and Proven Performance

The effectiveness of Trading Made Easy is frequently highlighted through user testimonials. For instance, John Carter, a retired Green Beret, has publicly praised the software for its remarkable consistency, citing success rates of 95%. Such stories underscore the platform's reliability and its ability to deliver tangible results for its users, transforming their trading outcomes.

Accessibility and Community Focus

A unique aspect of Trading Made Easy is its strong community and service commitment. The company offers special discounts to military personnel, veterans, first responders, and investors aged 55 and older, making advanced trading technology more accessible.

Currently, access is available through a limited-time leasing program starting at $299. While this provides an accessible entry point, prospective users should inquire directly for details on full purchase options or long-term subscription costs. Combining its advanced technology, proven success, and supportive community, Trading Made Easy empowers traders to operate with enhanced speed, intelligence, and confidence.

Best for: Novice and experienced futures traders, busy professionals, and individuals seeking a disciplined, automated approach to day trading.

2. Trade Ideas (Holly AI)

Trade Ideas is a highly specialized platform renowned for its AI-powered stock scanner and trade signal generator, Holly. Since 2003, it has carved out a niche as one of the best AI trading platforms for active day traders focused exclusively on the US equity markets. The platform’s core mission is to level the playing field by providing retail traders with institutional-grade analytical power. Holly, the proprietary AI, runs millions of simulations overnight on over 70 unique algorithms to identify strategies with the highest statistical probability of success for the upcoming trading day.

This makes it an ideal solution for traders who want to bypass the manual work of scanning thousands of stocks and developing strategies from scratch. Holly presents a curated list of high-potential, real-time trade ideas complete with entry points, stop-loss levels, and profit targets.

Key Features and User Experience

The platform is more than just a signal service; it is a comprehensive ecosystem for active trading.

- AI-Generated Signals: Holly provides three distinct AI modes (Conservative, Moderate, Aggressive) to match different risk appetites. Each signal is backtested and presented with clear risk parameters.

- Brokerage Plus Module: Users can connect their Interactive Brokers or E*TRADE accounts to automate the execution of Holly’s signals, creating a fully automated day trading software experience.

- Oddsmaker Backtesting: This powerful tool lets you test custom strategies against historical data, providing deep insights into their potential performance before risking real capital.

- Live Trading Room: An active community and daily live trading room provide invaluable real-time education and peer support, which is excellent for beginner day traders.

Access to Holly AI requires a Premium subscription, which is a significant investment. However, for dedicated day traders seeking a robust, data-driven edge, the value is clear. Trade Ideas frequently offers discounts, making it more accessible.

Website:https://www.trade-ideas.com/

3. TrendSpider

TrendSpider is an advanced, all-in-one technical analysis platform designed to automate the manual work of charting for active traders. Since its inception, it has established itself as one of the best AI trading platforms for systematic traders who rely on data-driven decisions. The platform’s core strength lies in its AI-assisted chart analysis, which automatically detects trendlines, candlestick patterns, and key price levels like anchored VWAPs across multiple timeframes. This saves traders countless hours of manual chart preparation.

This makes TrendSpider a powerful tool for DIY swing and day traders who want to build, test, and automate their strategies without writing a single line of code. It effectively combines sophisticated charting with powerful backtesting and alert-to-order automation, creating a streamlined workflow from analysis to execution.

Key Features and User Experience

TrendSpider offers a comprehensive suite of tools that bridge the gap between manual analysis and full automation.

- Automated Chart Analysis: The platform’s algorithms automatically draw trendlines, identify support/resistance zones, and detect over 200 candlestick patterns, providing an instant analytical foundation.

- Strategy Tester & Backtesting: Users can visually build and backtest trading strategies using a no-code interface. This allows for rapid validation of ideas against historical market data.

- Trading Bots: The platform’s bots can be configured to execute trades automatically when specific alert conditions are met. They integrate with brokers and third-party services like SignalStack for seamless order routing.

- Multi-Timeframe Analysis: A standout feature that displays indicators and patterns from higher timeframes directly on a lower timeframe chart, providing crucial market context at a glance.

While the pricing tiers can be a bit complex, and the advanced automation features come with a learning curve, TrendSpider provides excellent educational resources and a supportive community to help users master its powerful toolkit.

Website:https://www.trendspider.com/

4. Tickeron

Tickeron positions itself as an AI-powered marketplace, offering a diverse ecosystem of tools for traders interested in stocks, ETFs, crypto, and forex. Instead of a single, monolithic system, it allows users to assemble a custom toolkit from various AI modules, including AI Robots, real-time pattern recognition, and predictive analytics. This modular approach makes it a flexible solution for traders who want to pick and choose specific AI capabilities without committing to a full, high-cost platform.

The platform’s core strength lies in its variety. Traders can access pre-configured AI Robots that generate signals, use the Pattern Search Engine to identify candlestick or chart patterns automatically, or leverage the AI Screener to find investment opportunities based on complex criteria. This makes it one of the best AI trading platforms for those who value customization and a broad selection of analytical tools.

Key Features and User Experience

Tickeron’s marketplace model can be both a strength and a weakness, offering immense choice but also a potentially confusing user journey.

- AI Robots: Tickeron offers a wide catalog of AI-driven trading bots. Users can follow their signals or, in some cases, use a virtual account to see how the bot would trade on their behalf, providing a semi-automated trading experience.

- Pattern and Trend Prediction: Its AI engine scans the market in real-time to identify over 40 different chart patterns, calculating a confidence level and predicting future price movements.

- AI Screener & Time Machine: The screener helps filter assets based on AI-driven criteria, while the "Time Machine" feature allows for backtesting how AI predictions would have performed historically.

- Flexible Pricing: The platform uses a module-based pricing system with trials and a credit system. This allows users to test individual tools before purchasing, but navigating the many options can be complex.

Website:https://www.tickeron.com/

5. Composer

Composer is a unique platform that democratizes algorithmic trading by offering a no-code, visual strategy builder. Based in the US, it empowers retail investors to design, backtest, and automate trading strategies for stocks, ETFs, and select cryptocurrencies without writing a single line of code. Its mission is to make sophisticated, quantitative-style investing accessible to everyone, not just institutional players with programming expertise. By using a drag-and-drop interface, users can build logic-based rules and execute them automatically.

This makes it an excellent choice for investors who have clear ideas for automated trading strategies but lack the technical skills to implement them. Instead of manual execution, Composer lets you build a portfolio of "symphonies" (strategies) that automatically rebalance based on your predefined criteria, making it one of the best AI trading platforms for hands-off portfolio management.

Key Features and User Experience

Composer’s platform is built around an intuitive, user-friendly experience that simplifies complex processes.

- No-Code Strategy Editor: The visual, drag-and-drop builder allows you to create strategies using logical conditions (e.g., moving average crossovers, RSI levels, economic data).

- Unlimited Backtesting: Instantly test any strategy against years of historical data to understand its potential performance, risk, and drawdown before deploying it with real money.

- Pre-Built Strategies: For those seeking inspiration or a ready-to-use solution, Composer offers a library of pre-built symphonies created by its in-house quant team.

- Fully Automated Trading: Once you fund your account, you can turn your strategies live. Composer handles all the buying and selling automatically to keep your portfolio aligned with your rules.

The platform operates on a "Trading Pass" subscription model after a free trial, with a paid tier offering advanced features like IRA support. Its transparent approach and strong educational content make it an appealing option for those new to algorithmic trading. To get started with systematic investing, you can learn more about some of the best automated trading strategies available.

Website:https://www.composer.trade/

6. QuantConnect

QuantConnect is an institutional-grade, open-source algorithmic trading platform designed for quantitative developers and financial engineers. It is built on the powerful LEAN (Lean Algorithmic Trading Engine), allowing users to research, backtest, and deploy complex strategies using Python or C#. The platform distinguishes itself by offering immense flexibility and control, making it one of the best AI trading platforms for professionals who need to build sophisticated, data-intensive models from the ground up. Instead of providing pre-built signals, QuantConnect supplies the institutional-grade data and cloud infrastructure necessary for creating and testing proprietary algorithms.

This makes it an ideal solution for traders who possess strong coding skills and want to integrate advanced machine learning libraries directly into their trading logic. The platform supports a wide array of asset classes, including equities, forex, crypto, and derivatives, providing a comprehensive environment for serious quantitative analysis and live deployment. You can learn more about algorithmic trading to better understand its foundations.

Key Features and User Experience

QuantConnect provides an end-to-end ecosystem for quantitative strategy development and execution, supported by a collaborative community.

- Cloud Backtesting and Optimization: Access a vast library of institutional-grade historical data to backtest strategies in the cloud, significantly reducing local hardware requirements.

- Machine Learning Integration: Seamlessly incorporate popular libraries like TensorFlow and Scikit-learn to build predictive models directly within your trading algorithms.

- Multi-Broker Live Trading: Deploy your finished strategies across numerous supported brokers, enabling live trading in equities, options, futures, crypto, and forex.

- Open-Source LEAN Engine: The core engine is open-source, offering transparency and portability. Developers can run it on their own hardware or use QuantConnect’s cloud services.

While QuantConnect has a steep learning curve requiring programming expertise, its power is unmatched for those building custom solutions. The platform operates on a tiered subscription model, with costs scaling based on data access, computing power, and team collaboration needs.

Website:https://www.quantconnect.com/

7. TradingView

TradingView is a global powerhouse in the trading community, known for its exceptional charting tools, vast social network, and powerful analytical capabilities. While not a pure-play AI trading platform in the same vein as a dedicated signal generator, it serves as a foundational ecosystem where traders can build, test, and deploy AI-driven strategies. Its strength lies in its versatility, offering an immense library of community-built indicators and automated chart pattern recognition, making it an indispensable tool for both manual and automated traders.

The platform empowers users to harness AI through its proprietary Pine Script language. This allows for the development of custom algorithms that can be backtested rigorously against historical data. For traders seeking automation, TradingView’s alert system can be integrated with third-party services like SignalStack to execute trades automatically with a connected broker, effectively turning a custom strategy into an automated trading bot.

Key Features and User Experience

TradingView provides a comprehensive and intuitive environment that supports a trader’s entire workflow, from analysis to execution.

- Pine Script Engine: Develop, backtest, and deploy custom trading indicators and strategies. This is the core feature for creating personalized, AI-like trading logic.

- Auto Chart Patterns: The platform automatically detects a wide range of technical patterns, such as triangles, wedges, and head and shoulders, providing AI-assisted analysis without any coding.

- Massive Indicator Library: Access thousands of community-developed indicators and strategies, many of which incorporate sophisticated algorithmic logic, offering a collaborative approach to AI trading.

- Webhook & Broker Integration: Create sophisticated alerts that trigger external actions via webhooks, enabling seamless integration with automated execution services and supported brokers.

While its native AI features are focused on pattern recognition, the platform’s real power as one of the best AI trading platforms comes from its open-ended scripting and integration capabilities. Free plans are robust, but advanced features like server-side alerts and extended historical data require a paid subscription.

Website:https://www.tradingview.com/

8. Interactive Brokers (IBKR) – IBot and automation stack

Interactive Brokers (IBKR) is not a dedicated AI signal platform but rather an institutional-grade global brokerage that offers a powerful foundation for AI-driven and automated trading. Its inclusion as one of the best AI trading platforms stems from its extensive automation stack, anchored by IBot, an AI-powered natural language assistant. IBKR is designed for serious traders who want robust infrastructure, vast market access, and the flexibility to build or integrate sophisticated trading systems.

This makes it a prime choice for quantitative traders and those using third-party AI tools. The platform’s strength lies in its connectivity and native support for complex, algorithmic order types, allowing traders to execute strategies with precision. IBot simplifies navigation and order placement by allowing users to issue commands in plain English, streamlining the workflow on its feature-rich but complex platforms.

Key Features and User Experience

IBKR serves as a comprehensive ecosystem where traders can deploy their own automated strategies or connect external AI services.

- IBot AI Assistant: Available across the Trader Workstation (TWS), mobile app, and Client Portal, IBot can place orders, find market data, and answer account questions via natural language commands.

- Advanced APIs: Offers robust APIs (including TWS API and FIX/CTCI) that enable developers to build and connect custom trading applications and algorithms.

- Third-Party Integration: Seamlessly connects with leading platforms like Trade Ideas' Brokerage Plus, allowing for fully automated execution of external AI-generated signals. This flexibility is key for building an automated trading system.

- Sophisticated Order Types: Provides access to a vast library of algorithmic order types designed to achieve optimal execution prices based on specified criteria.

While the TWS platform has a steep learning curve, its power is undeniable. IBKR is less about providing AI signals and more about providing the professional-grade tools to act on them, making it a critical component for many advanced automated traders.

Website:https://www.interactivebrokers.com/

9. Capitalise.ai

Capitalise.ai democratizes algorithmic trading by transforming plain English into executable strategies, making it one of the best AI trading platforms for traders who want to automate without writing a single line of code. Its unique strength lies in its natural language processing (NLP) engine, which allows users to type out trading ideas using simple "if-then" logic. The platform then translates these commands into complex algorithmic orders, bridging the gap between a strategic idea and its automated execution.

This approach is ideal for traders who have well-defined strategies but lack the programming skills to implement them. For instance, a user could write, "If the RSI of EUR/USD crosses above 70, sell 10,000 units with a stop-loss 20 pips away." Capitalise.ai will monitor the market 24/7 and execute the trade precisely when the conditions are met, freeing the trader from constant screen-watching.

Key Features and User Experience

The platform is built around simplicity, speed, and accessibility, offering a seamless experience from strategy creation to live execution.

- No-Code Strategy Builder: The core feature allows you to type trading plans in everyday English. A library of pre-built templates and strategies helps new users get started quickly.

- Backtesting and Simulation: Before risking capital, you can backtest your plain-language strategies against historical data or run them in a simulated environment to validate their performance.

- Broker Integration: Capitalise.ai integrates directly with select brokers. US-based users can connect to FOREX.com for free to trade spot FX, while Interactive Brokers connectivity for equities and forex is also available, though it requires additional onboarding.

- Smart Notifications: Set up alerts based on your custom technical conditions to stay informed about market movements without being tied to your desk.

While its broker integrations are more limited than some competitors, the platform's free access via FOREX.com makes it an incredibly powerful and cost-effective tool for automating forex strategies.

Website:https://www.capitalise.ai/

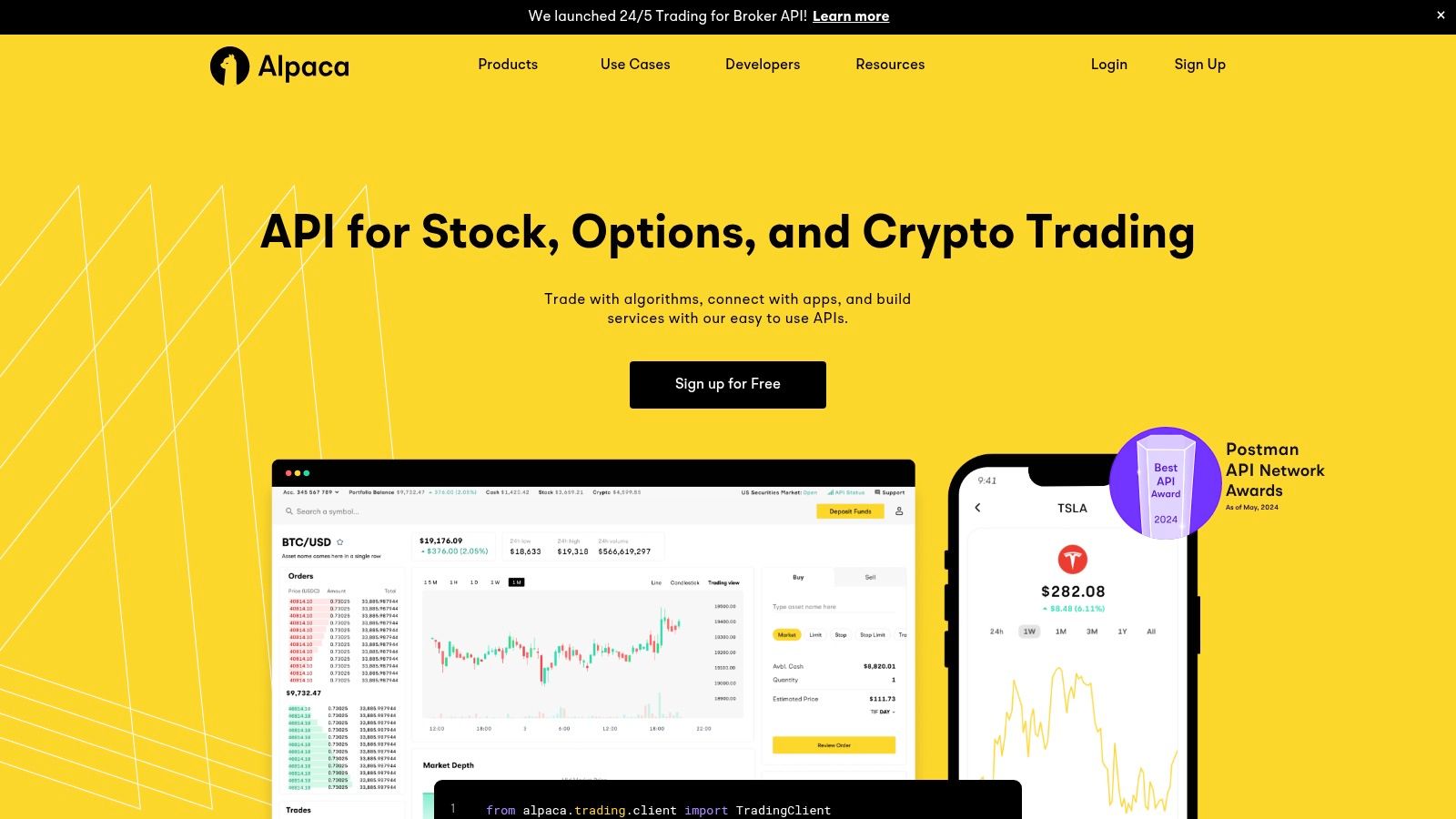

10. Alpaca Markets

Alpaca Markets is a US-based, commission-free brokerage platform uniquely designed for developers and algorithmic traders. Instead of offering a pre-built AI, it provides the essential infrastructure for users to build, backtest, and deploy their own custom AI trading platforms and strategies. The platform is built API-first, empowering traders to connect their machine learning models or third-party AI tools directly to the market for executing trades on US stocks and ETFs.

This makes Alpaca the ideal solution for coders, data scientists, and quantitative traders who want full control over their trading logic. It effectively serves as the foundational layer, or "picks and shovels," for those looking to create their own sophisticated, automated day trading software without the high costs and complexity of traditional brokerage APIs.

Key Features and User Experience

Alpaca’s ecosystem is centered on robust API access and developer support, creating a powerful sandbox for innovation.

- Trading API: The core offering includes SDKs for popular languages like Python, Go, and C#, simplifying the process of connecting algorithms to live or paper trading accounts.

- Commission-Free Trading: Users can trade US stocks and ETFs with no commissions, although minor regulatory fees still apply. This low-cost structure is highly beneficial for high-frequency strategies.

- Market Data APIs: Alpaca offers tiered data plans. A free plan provides real-time data from IEX, while paid subscriptions like "Algo Trader Plus" grant access to unlimited, real-time US stock data for more demanding applications.

- Active Community and Resources: The platform is supported by extensive documentation, tutorials, and an active developer community that shares code and strategies, making it accessible even for those new to algorithmic trading.

While its focus on US equities and API-centric model may not suit every trader, for those with the technical skills, Alpaca provides unparalleled freedom and flexibility to bring their AI trading ideas to life.

Website:https://alpaca.markets/

11. SignalStack

SignalStack is not an AI platform itself but a crucial automation layer that connects your preferred signal source to your broker. It serves as a universal, no-code bridge for traders who use sophisticated alert systems, like those from TradingView or TrendSpider, and want to convert them into live trades automatically. The platform's core function is to receive webhook alerts and instantly translate them into executable market, limit, stop, or stop-limit orders across more than 30 supported brokers.

This makes it one of the best AI trading platforms for integration, as it empowers traders to build a custom automated setup without writing a single line of code. Whether your signals come from a custom Pine Script strategy, an AI-driven scanner, or a third-party service, SignalStack ensures they are executed with precision and speed, making it an ideal solution for automating an existing, proven strategy.

Key Features and User Experience

SignalStack is designed for simplicity and powerful integration, allowing traders to focus on strategy rather than infrastructure.

- Universal Broker Integration: Connects with over 30 leading brokers and exchanges, covering stocks, options, futures, and crypto, making it highly versatile.

- Webhook-to-Order Engine: Its primary feature is converting any webhook-based alert into a precise order type, giving traders full control over their execution logic.

- No-Code Automation: Eliminates the need for complex API programming, making trade automation accessible to non-developers.

- Scalable and Reliable: The infrastructure is built to handle everything from a few signals per day to high-frequency trading volumes with low latency.

The platform offers flexible pricing, including pay-as-you-go plans and monthly subscriptions, catering to different trading frequencies. While it requires an external platform to generate signals, its power lies in its ability to quickly and reliably automate any alert-based trading system.

Website:https://signalstack.com/

12. eToro (Smart Portfolios and CopyTrader)

eToro is a globally recognized social trading broker that leverages data and automation in a unique way. While not an AI in the traditional sense of generating signals, its platform offers powerful tools like Smart Portfolios and CopyTrader, which use rules-based and social-driven data to automate investment strategies. This positions it as one of the best AI trading platforms for individuals who prefer a hands-off, community-driven approach to the markets rather than building their own algorithms.

The platform's strength lies in making sophisticated thematic investing and portfolio mirroring accessible. Instead of day trading after dark, users can allocate funds to portfolios managed by eToro’s experts or automatically replicate the trades of successful investors. This provides a simplified path to diversification and automated management, ideal for busy professionals or those new to active investing.

Key Features and User Experience

eToro’s ecosystem is built around social collaboration and automated portfolio management, offering a distinct user experience.

- Smart Portfolios: These are curated, thematic investment bundles that are periodically rebalanced based on predefined rules. They provide diversified exposure to market trends like tech, crypto, or renewable energy without any management fees.

- CopyTrader: The platform's flagship feature allows you to automatically mirror the portfolio and real-time trades of other, more experienced users. All performance metrics are transparent, allowing you to make data-driven decisions on who to copy.

- Social Trading Community: A built-in social feed lets investors share insights, strategies, and market analysis, creating a collaborative environment that can be especially helpful for beginners.

- Multi-Asset Platform: Depending on jurisdiction, users can access stocks, ETFs, and cryptocurrencies, all from a single, user-friendly interface available on web and mobile.

It is important to note that product availability, particularly for certain assets and features, varies significantly across different US states. Minimum investment requirements also apply for both CopyTrader and Smart Portfolios.

Website:https://www.etoro.com/en-us/

Top 12 AI Trading Platforms Feature Comparison

| Platform | Core Features/Technology | User Experience & Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Trading Made Easy 🏆 | AI-driven automated futures trading, risk management | ★★★★★ Intuitive UI, weekly live webinars | ★★★★ Leasing starts at $299 with discounts | 👥 All skill levels, military, seniors | ✨ 1000x faster trades, U.S. support, community focus |

| Trade Ideas (Holly AI) | AI-driven intraday equity scans, backtesting | ★★★★ Mature tools, active trading room | ★★★ Premium pricing for AI features | 👥 Active equity traders | ✨ Holly AI trade ideas, broker integration |

| TrendSpider | Automated charting, pattern detection, alerts, bots | ★★★★ Good onboarding, clear automation | ★★★ Varying tiers, sometimes complex | 👥 DIY swing/day traders | ✨ Multi-timeframe AI analysis, bot trading |

| Tickeron | AI robots, pattern recognition, multi-asset AI signals | ★★★ Mixed reviews, broad AI catalog | ★★★ Flexible modules, promotions | 👥 Multi-asset investors | ✨ Modular AI toolkit, broad asset class coverage |

| Composer | No-code strategy builder, automated live trading | ★★★★ Transparent pricing, free trial | ★★★ Stock/ETF focus, low barrier to entry | 👥 Retail investors, no-coders | ✨ Drag-and-drop strategy design, IRA support |

| QuantConnect | Open-source algo platform, machine learning, cloud backtest | ★★★★ Powerful but steep learning curve | ★★★ High data/computing costs | 👥 Quants, developers | ✨ Full code control, institutional data feeds |

| TradingView | Charting, Pine Script, social trading, broker integrations | ★★★★ Massive community, intuitive interface | ★★★ Paid plans for extended features | 👥 Broad traders, social community | ✨ Custom scripting, large indicator marketplace |

| Interactive Brokers (IBKR) | Broker with AI assistant, APIs, algorithmic order types | ★★★★ Institutional-grade, complex platform | ★★★ Wide connectivity, some third-party fees | 👥 Institutional & retail traders | ✨ IBot AI, extensive automation & broker tools |

| Capitalise.ai | No-code natural language strategy builder | ★★★ Quick prototyping, free FOREX.com users | ★★★ Free FOREX.com US, broker-dependent access | 👥 No-code traders, forex users | ✨ Plain English commands, multi-broker support |

| Alpaca Markets | API-first US stock/ETF broker | ★★★ Developer-friendly, paper trading | ★★★ Commission-free US equities, paid data | 👥 Developers, algo traders | ✨ Easy automation SDKs, commission-free trading |

| SignalStack | No-code webhook-to-order automation relay | ★★★★ Broker-agnostic, pay-as-you-go pricing | ★★★ Requires existing signal platform | 👥 Traders with existing alerts | ✨ Supports 30+ brokers, multi-asset automation |

| eToro (Smart Portfolios & CopyTrader) | Social trading, automated portfolio rebalancing | ★★★★ Large community, simple UI | ★★★ No fees on portfolios, minimum investment | 👥 Passive/social traders | ✨ Copy trading, thematic Smart Portfolios |

Ready to Elevate Your Trading with AI?

Navigating the world of AI-powered trading can feel overwhelming, but as we've detailed, the right tools can fundamentally change your approach to the markets. From the powerful algorithmic backtesting of QuantConnect to the code-free automation of Capitalise.ai and the social trading innovations of eToro, it's clear there is no one-size-fits-all solution. The modern trading landscape offers a specialized tool for nearly every type of investor, whether you're a hands-on technical analyst, a passive investor, or an institutional-grade quant.

The journey to finding the best AI trading platforms requires a deep look at your own trading style, goals, and technical comfort level. What works for a high-frequency Python developer using Alpaca Markets will not be the right fit for a busy professional who prefers the pre-built, AI-vetted strategies found on Tickeron. The key takeaway is that the "best" platform is the one that aligns with your individual needs and empowers you to execute your strategy more effectively.

Your Roadmap to Choosing the Right Platform

Selecting your ideal platform involves more than just comparing features. It’s about building a sustainable and effective trading workflow.

Here’s a simplified decision-making framework based on what we've covered:

- For the Hands-On Analyst: If you live in charts and thrive on technical analysis, platforms like TrendSpider and TradingView offer unparalleled charting capabilities augmented by AI pattern recognition and alert systems. They serve as a powerful analytical co-pilot.

- For the Aspiring Quant: If you want to build, test, and deploy custom algorithms from scratch, QuantConnect and Alpaca Markets provide the robust infrastructure and data access you need. These are for traders who want complete control and are comfortable with coding.

- For the Delegator & Passive Investor: If your goal is to leverage sophisticated strategies without building them yourself, Composer, Trade Ideas, and the Smart Portfolios from eToro offer excellent, ready-to-deploy solutions. These platforms focus on making advanced strategies accessible.

- For the Automation-Focused Trader: If you want to turn your existing strategies into automated systems without writing code, Capitalise.ai and SignalStack are your go-to options. They bridge the gap between manual trading ideas and automated execution.

Beyond the Features: Implementation and Mindset

Remember that integrating AI into your trading is a strategic shift, not just a software installation. Success depends on a disciplined approach. Start by thoroughly backtesting any AI-driven strategy to understand its performance in various market conditions. Define your risk parameters clearly before letting any algorithm trade with real capital. Most importantly, avoid the temptation to constantly tweak or override the system based on emotion. The primary benefit of AI is its ability to execute a proven strategy with unwavering discipline, removing human biases like fear and greed from the equation.

Ultimately, the rise of AI in finance is democratizing access to tools once reserved for elite hedge funds. The platforms we've reviewed represent the forefront of this evolution, each offering a unique pathway to more systematic, data-driven, and potentially profitable trading. The power is now in your hands to leverage this technology, automate your edge, and elevate your performance in the market.

If you are looking for a comprehensive, done-for-you solution that combines a decade of market experience with patented AI technology, explore what Trading Made Easy has to offer. By summarizing the key benefits of our platform—including patented technology, automated risk management, and dedicated support—we hope you see a clear path to enhancing your trading. We encourage you to explore Trading Made Easy’s offerings and discover how our automated day trading software can help you achieve your financial goals. Visit us at Trading Made Easy to see how we are making automated trading simple and accessible for everyone.

Leave a Reply