Since 2014, Trading Made Easy has been on a mission to demystify the trading industry. We believe that with the right education and powerful tools, anyone can learn to navigate the markets with confidence. A technical trading course is the essential first step, teaching you to analyze price charts and market data to make calculated decisions instead of just guessing. Without that foundation, you’re gambling. A good course provides the framework—chart patterns, indicators, and risk management—to trade with a clear, effective plan.

Why a Solid Trading Education Matters

Since 2014, our mission here at Trading Made Easy has been simple: cut through the noise of the financial markets and give traders tools that actually work. We’ve seen firsthand that real, lasting success is always built on a solid foundation of knowledge.

Jumping into trading without understanding technical analysis is like trying to navigate a foreign city without a map or a translator. Sure, you might get lucky and stumble upon something great, but the odds are you’ll just end up lost and frustrated.

This guide is all about why a high-quality technical trading course is the single most important first step you can take. It’s not about memorizing formulas from a textbook; it’s about building practical, real-world skills to read what the market is telling you, spot real opportunities, and protect your hard-earned capital.

Bridging Knowledge with Action

Becoming a truly proficient trader happens when you combine that education with the right tools. A course can teach you what to look for, but powerful software is what helps you act on that knowledge with speed and precision.

Think about it. The concepts you learn, like spotting support and resistance levels or recognizing when a trend is about to reverse, are the building blocks. Our automated software is designed to execute strategies based on those exact principles, but it does so without the hesitation and emotion that trip up so many human traders.

The goal of a trading education isn't to find a "crystal ball" that predicts every market move. Instead, it's about developing a repeatable process for identifying high-probability setups and managing risk with discipline.

For instance, a course will teach you to identify a classic "head and shoulders" pattern, which often signals that a market is about to turn down. But recognizing the pattern is only half the battle. In a market that moves in milliseconds, can you execute the trade at the perfect moment? That's where automation becomes your best ally.

By programming your strategy, the software executes the trade the instant your criteria are met—no second-guessing, no missed opportunities. To see how technology is changing the game, check out our guide on the best AI trading platforms. At the end of the day, your education gives you the blueprint, and technology gives you the tools to build your success.

Understanding the Language of the Market

Before you can pick the right technical trading courses, you need to get a handle on what technical analysis actually is. Staring at a price chart for the first time can feel like trying to read a foreign language—it's just a mess of lines, bars, and colors that don't make any sense. The whole point of technical analysis is to teach you how to read it fluently.

This isn't about predicting the future with a crystal ball. It’s a way to interpret what the market is doing right now so you can make smarter, probability-based decisions. This entire approach is built on a few core beliefs that have held up for a very long time.

The Three Foundational Pillars

At its core, technical analysis stands on three simple principles. Once you get these, the rest starts to fall into place.

The Market Discounts Everything: This is the idea that every piece of information out there—from a company's earnings report to global news—is already baked into the price you see on the chart. Technical traders believe the chart tells the whole story, because the collective actions of buyers and sellers have already priced everything in.

Price Moves in Trends: Prices don't just bounce around randomly. They tend to move in clear trends, whether that’s up, down, or sideways. A technical trader's main job is to figure out which way the trend is going and trade with it, not against it.

History Tends to Repeat Itself: Human psychology doesn't change much. The same emotions—fear and greed—drive market behavior today just as they did 50 years ago. By studying past chart patterns, traders can spot setups that have led to predictable moves time and time again.

These three pillars are the "why" behind every chart you'll ever look at. They're the foundation for every strategy and indicator you’ll learn.

Translating Charts into Actionable Insights

With those core ideas in your back pocket, you can start learning the actual "words" of the market's language. This is where concepts from technical trading courses start to click. For instance, think of support and resistance levels as the floor and ceiling in a room.

Support is a price level where a downtrend is likely to hit a wall and pause because buyers are stepping in. It’s the "floor" that prices struggle to break through. On the flip side, resistance is the "ceiling" where an uptrend might stall out as sellers take over.

A core tenet of technical analysis is that a broken support level often becomes a new resistance level, and a broken resistance level can become the new support. This dynamic is a constant tug-of-war between buyers and sellers.

Candlestick patterns give you an even closer look. Each "candle" on the chart tells a mini-story about the fight between buyers and sellers over a specific period. Patterns with names like the "Doji" or the "Hammer" are like visual cues, hinting at potential turning points in the market.

This discipline has been a cornerstone of financial education for decades. Just look at the New York Institute of Finance (NYIF), which was set up by the New York Stock Exchange back in 1922. For nearly a century, it has been a leader in financial education, training countless bankers and traders on everything from basic chart patterns to advanced indicators. You can find out more about the legacy of technical analysis education at Bankers by Day.

Learning to spot these patterns and levels is like learning to read the market’s body language. It helps you anticipate what might happen next and manage your risk with a lot more confidence. This is exactly what a good technical trading course is designed to do—turn you from a spectator into an informed participant in the market.

Putting Your Trading Knowledge into Action

A good technical trading course provides the map, showing you the terrain and teaching you how to read the signs. But to get anywhere, you need a vehicle. That’s where the right software comes in, turning theory into real-world action. Your course teaches you to spot the perfect moment to enter or exit a trade, but in a market that moves at lightning speed, the gap between seeing a setup and placing the order is where profits are lost. That's the exact problem our Trading Made Easy software was built to solve. It’s the engine that takes the principles you’ve learned and executes them with mechanical precision.

From Manual Analysis to Automated Execution

The biggest hurdle for any trader is bridging the gap between knowing a strategy and executing it flawlessly. A course can teach you a dozen high-probability setups, but scanning multiple charts for hours is exhausting and prone to human error. You might miss a perfect entry because you looked away for a second, or hesitate on a clear signal because of a scary news headline. It happens to everyone. Our proprietary algorithms do the heavy lifting for you, constantly scanning the market and pinpointing trade setups that match the technical rules you've learned.

The real power of automation isn’t just about speed—it's about the ice-cold discipline it brings to your trading. The software executes your plan without fear, greed, or second-guessing, helping you sidestep the emotional traps that derail over 80% of manual traders.

This frees you up. You can stop being glued to your screen, hunting for the next opportunity. The system flags the setups based on your rules, so you can spend your time thinking about the bigger picture and refining your strategy.

Key Features That Empower Your Strategy

Our automated day trading software was designed to be a direct extension of your trading education, turning complex ideas into simple, actionable steps. It translates your knowledge into consistent action with unique features that benefit every trader.

Here's how it works:

- Automated Entry and Exit Signals: Forget guesswork. Our software executes trades instantly when market conditions align with your pre-defined strategy, whether it’s a moving average crossover or a specific chart pattern. This precision ensures you never miss an opportunity.

- Advanced Risk Management: This is your financial seatbelt. Before any trade is placed, you set your maximum acceptable loss. The software enforces these rules automatically, protecting your capital from unexpected market volatility and preventing emotional decisions.

- Simplified Data Interface: Staring at complex charts can be overwhelming. Our intuitive dashboard presents all the essential data in a clean, straightforward way, allowing you to monitor your strategy’s performance without getting lost in the noise.

These features work together to create a disciplined and efficient trading process. You get your time back, reduce emotional mistakes, and have confidence that your plan is being followed to the letter, every single time. By automating the mechanics, you’re free to focus on what truly matters: making smarter, more informed decisions.

Choosing the Right Technical Trading Course for You

So you're ready to dive into the world of trading education. That’s a great first step, but it doesn't take long to realize you're staring at a massive menu of options, from stuffy university programs to intense weekend bootcamps. It’s easy to get overwhelmed.

Finding the best technical trading courses isn’t about picking the “#1 rated” program. It’s about finding the one that clicks with you—your schedule, your learning style, and most importantly, your goals in the market. What works for a full-time pro trying to sharpen their edge is totally different from what a beginner needs while juggling a 9-to-5.

Your decision will likely boil down to a few key formats. Let's break down the common choices to help you figure out where you fit.

Live Webinars vs On-Demand Flexibility

One of the first forks in the road is choosing between a live, scheduled class and a course you can tackle on your own time.

- Live Webinars: These are all about real-time interaction. You can jump in, ask the instructor a question on the spot, and get instant feedback. It feels like a real classroom, and that energy and accountability help a lot of people stay on track.

- On-Demand Courses: This is the definition of flexibility. Got a spare hour at midnight? You can learn then. Need to re-watch a tricky concept five times? Go for it. This is perfect for anyone with a chaotic schedule. Many traders start here, and we even offer resources like our guide on free day trading classes to help you build a foundation at your own pace.

It really comes down to whether you thrive with structured guidance or prefer the freedom to learn whenever—and wherever—you can.

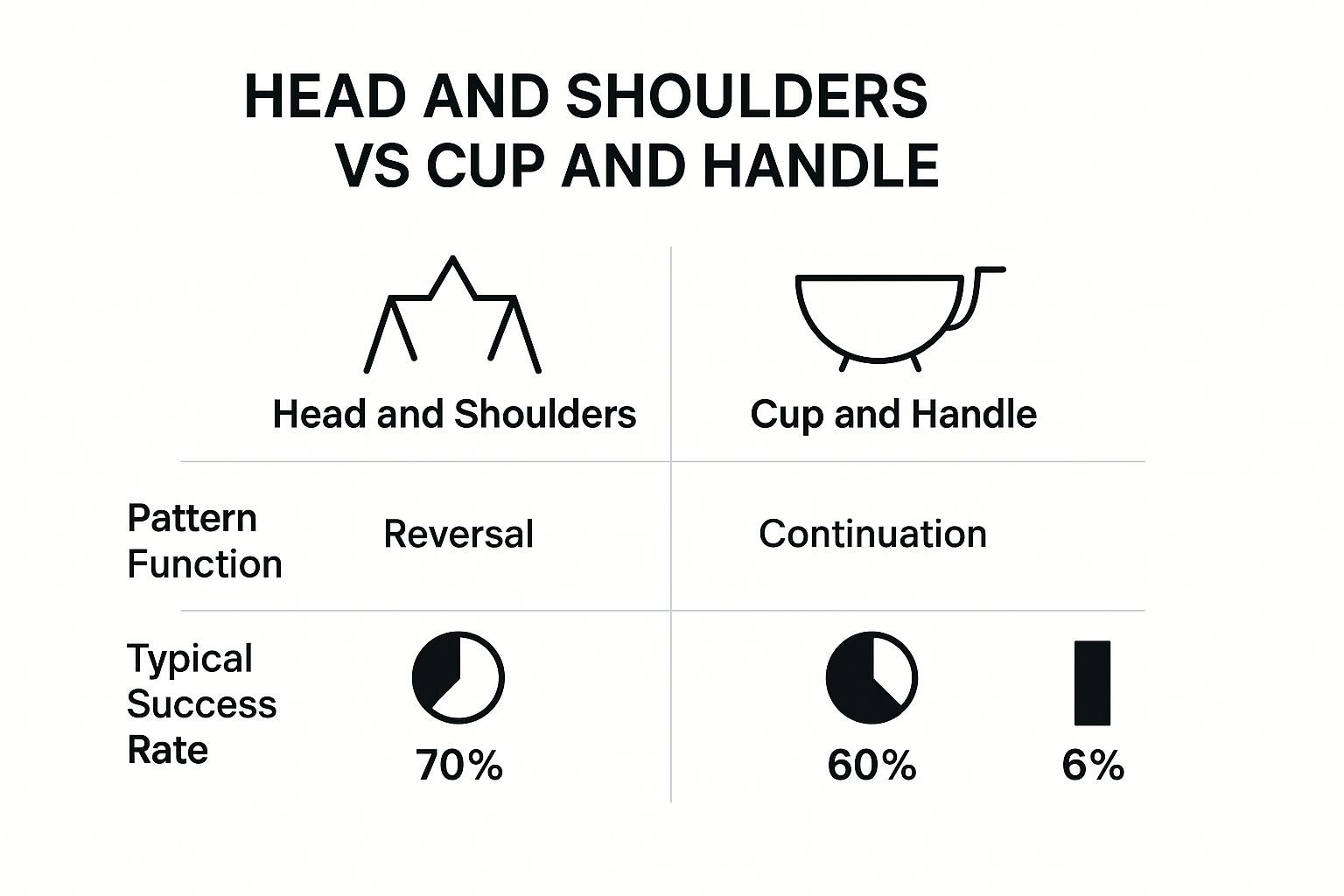

Take a look at this quick visual. It breaks down two classic chart patterns you'll meet in just about any course, showing how they signal different potential market moves.

As you can see, a Head and Shoulders pattern often signals a reversal is coming, while a Cup and Handle suggests the current trend is about to continue its run.

University Programs vs Strategy Bootcamps

Beyond just how you learn, the what you learn can be wildly different. You can go the academic route for a deep theoretical understanding or jump into a practical bootcamp that gets you trading sooner.

University-style programs, like the ones you’ll find on platforms such as Coursera, give you the "why" behind it all. They'll walk you through financial theories, quantitative models, and the complex mechanics that make the markets tick. It's a fantastic way to build a rock-solid, comprehensive knowledge base.

The rise of online learning has blown the doors off high-level financial education. It used to be locked away in ivory towers, but now anyone with an internet connection can learn from the best minds in the world.

On the other hand, independent bootcamps are all about action. They skip the heavy theory and get straight to teaching you specific, ready-to-use strategies. You'll learn exact entry and exit rules, risk management models, and setups you can start testing almost immediately.

The growth in online finance education has been massive. For example, by 2025, Coursera was hosting over 10 major trading and technical analysis courses from world-class schools like Yale and the University of Pennsylvania. These aren't just basic chart-reading classes; they cover everything from classic patterns to algorithmic trading.

Comparison of Trading Course Delivery Formats

To make the choice a little easier, here's a side-by-side comparison of the main formats. This table breaks down the key features to help you match a course type to your personal learning style and needs.

| Feature | Live Webinars | On-Demand Courses | University Programs |

|---|---|---|---|

| Pacing | Structured, fixed schedule | Self-paced, flexible | Structured, semester-based |

| Interaction | High (real-time Q&A with instructor and peers) | Low to moderate (forums, occasional Q&A) | Moderate (TA sessions, forums) |

| Accountability | High (set class times) | Low (requires self-discipline) | High (deadlines, grades) |

| Content Focus | Practical strategies, current market analysis | Specific skills or broad overviews | Theoretical foundations, quantitative models |

| Best For | Learners who need structure and immediate feedback | Busy individuals who need maximum flexibility | Those seeking a deep, academic understanding of finance |

| Typical Cost | Moderate to high | Low to moderate | High (can be very expensive) |

Ultimately, the best course is the one that fits your life and your goals. Whether you need the rigid structure of a university program or the grab-and-go convenience of an on-demand course, the right fit will feel less like a chore and more like a genuine step toward mastering the markets.

Real-World Results from Real Traders

Theory and software features are important, but the only thing that truly matters is real-world performance. The success stories we hear from our members aren't just about profits; they're about profound transformations. These traders have successfully bridged the gap between their education and the market's reality, all thanks to the power of precise automation. Their experiences highlight how our software solves the everyday struggles traders face, enabling them to achieve their goals.

Case Study: From Part-Time Trader to Consistent Earner

Time is the biggest hurdle for most aspiring traders. Take "David," a full-time IT professional who simply couldn't dedicate eight hours a day to watching charts. He had completed several technical trading courses and understood the concepts, but applying them while managing a demanding job felt impossible. David's main frustration was constantly missing key entry and exit points; he'd identify a perfect setup in the evening, only to wake up and find the opportunity had passed.

By implementing our automated software, he programmed the exact strategies he had learned. The system took over, scanning the markets and executing trades on his behalf. This allowed him to focus on his career while his trading plan worked for him in the background.

- The Problem: Not enough screen time, leading to missed trades.

- The Solution: Automating his pre-defined technical strategy.

- The Result: David finally built a consistent side income, turning his education into a real, profitable skill without having to quit his day job.

This is a perfect example of how automation empowers traders who can't be chained to their desks, ensuring their strategy is always active.

Scaling Strategies for the Experienced Pro

Even seasoned professionals hit limitations. "Maria," a veteran trader with over a decade of experience, was a master of a few specific markets. Her problem? She found it impossible to manually scale her winning strategies across new asset classes. There are only so many charts one person can effectively monitor. She knew her methods could work in other futures markets but was stretched too thin, leading to mental fatigue and capped growth.

After integrating her strategy into our platform, Maria could run her system across multiple markets simultaneously. The software handled all the mechanical entries and exits, freeing her to focus on high-level analysis and refining her edge. She was no longer the bottleneck in her own trading business.

Automation provides a powerful edge by removing human limitations. It allows a single trader to execute with the discipline and reach of a team, applying a successful strategy across diverse markets without burnout.

The way traders are learning is changing, too. The best modern technical trading courses are blending different analytical styles to build more resilient strategies. You'll see workshops introducing proprietary tools like the Rohit Momentum Indicator (RMI) right alongside valuation metrics, helping traders spot undervalued assets before they take off. This global shift toward combining technical signals with fundamental insights is creating a new generation of more well-rounded traders. You can find out more about these hybrid educational offerings on The Economic Times.

Time to Take Your First Step

Building a successful trading career comes down to two things: a solid education from a great technical trading course and the right tools to apply that knowledge consistently, without emotion. These two elements are deeply connected. Learning chart patterns is just theory until you can apply it when real money is at stake. That’s why we created Trading Made Easy—to close the gap between knowing and doing. Our goal is to empower you with automated software and a commitment to education, helping you trade with clarity and confidence.

Your Path Forward

You now understand the fundamentals of technical analysis, how to choose the right course, and the transformative power of automation. The next move is yours. The journey to becoming a confident, disciplined trader begins with a single decision. It’s time to move from theory to practice and see what our platform can do for you. With the right guide and tools, the path ahead becomes much clearer. We’re here to support you every step of the way, whether you're a beginner or a seasoned pro.

A trading plan without a reliable execution tool is just a wish. The key to long-term success is creating a system where your strategy and your execution work in perfect harmony, free from emotion and hesitation.

Ready to see how it all clicks together? Here are a few ways to get started:

- Explore a Demo of Our Software: See for yourself how our automated system can execute the strategies you’ve learned with incredible speed and precision.

- Dive Into Our Educational Articles: Keep learning with our huge library of free trading guides and market analysis.

- Contact Our Team: Got questions? Our U.S.-based support team is here to give you real, personalized guidance and help you figure out how our tools fit your goals.

The path to disciplined, confident trading starts today. Explore Trading Made Easy’s offerings and let us help you achieve your trading potential.

Common Questions We Hear About Technical Trading

Jumping into the world of technical analysis, trading courses, and automated software brings up a lot of questions. It's totally normal. Whether you're just starting to look at technical trading courses or you're a seasoned trader trying to sharpen your edge, getting good answers is crucial.

Let's tackle some of the most frequent questions we get from traders of all stripes.

Is Technical Analysis All I Need to Succeed as a Trader?

While technical analysis is a fantastic tool for nailing your entries and exits, the best traders I know don't rely on just one thing. Think of it like a mechanic's toolbox—you wouldn't just use a single wrench for every job. Many pros layer in fundamental analysis (getting a feel for a company's real-world health) and even sentiment analysis (reading the overall mood of the market).

Our software is built to execute technical strategies flawlessly, but that broader market understanding can give you a serious advantage. The real secret sauce is finding a system that clicks with your personality and then sticking to it with unshakable discipline.

Can Trading Software Really Take My Emotions Out of the Equation?

Absolutely. This is honestly one of the biggest game-changers automation brings to the table. Quality automated software is designed from the ground up to follow a set strategy without the fear or greed that trips up so many human traders. It becomes your personal enforcer, making sure you stick to the rules you laid out, no matter how wild the market gets.

You're still the brains behind the operation—creating and testing the strategy—but the software is the perfect soldier executing your orders. It stops you from panic-selling during a dip or jumping on a hype train. If you're looking to understand different markets where this applies, our article on what is futures trading provides some great background.

How Long Until I "Get" Technical Trading?

You can get the basics down from a solid course in just a few weeks. Understanding what a head-and-shoulders pattern is or how an RSI indicator works isn't rocket science. But becoming a master? That’s a lifelong journey.

The real skill comes from building the experience and discipline to be consistently profitable, and that just takes time and practice.

The goal isn't to get rich overnight; it's about getting a little better every single day. Every trade, win or lose, is a lesson that sharpens your skills over time.

This is where automated software can seriously speed things up. By taking over the mechanical side of placing trades, it frees you up to focus on the big picture—developing your strategy and analyzing the market. It lets you hone your skills much more efficiently, putting you on the fast track to becoming a more confident, disciplined trader.

Ready to stop letting theory get in the way of execution? See how the automated, AI-driven platform from Trading Made Easy can help you trade with the precision and discipline you've been looking for. Check out our tools today at https://tradingmadeasy.com and start building a more consistent trading future.

Leave a Reply